The Alabama Federal Tax Identification Number, also known as the Employer Identification Number (EIN) or Federal Tax Identification Number, is a nine-digit unique identifier surmounted by the Internal Revenue Service for tax purposes, the IRS for corporations, nonprofits, trusts, and trusts. Estates.

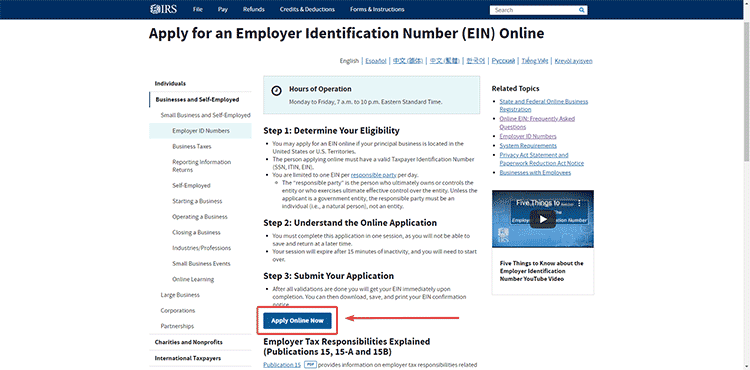

Steps To Get A Valid Alabama Tax Identification Number:

To receive each tax number, you must fill out an application and answer the most important questions about your amazing business. If you want to increase your personal speed in filling out this application, you should collect the necessary information about your company and its entrepreneurs in advance.

Wait For Your Alabama To Llc To Be Approved

Wait for your Alabama To llc to be approved by the Secretary of State before applying for your EIN. Alternatively, if you believe you have been denied an LLC registration, you will receive an EIN attached to a non-existent LLC.

Using An Alabama Tax Identification Number (EIN)

Getting Almost Any Alabama Tax Number is (a) the route that most corporations, trusts, estates, non-profits, and therefore religious organizations should take. Even for businesses and organizations that are not required to obtain an Alabama Tax Identification Number (EIN), obtaining one is recommended as it is likely to help protect the personal information of individuals in general, allowing them to use more of their tax identification. number (TIN). in lieu of a Social Security number for activities necessary to operate their business or organization, including obtaining local licenses and permits from the State of Alabama. Any state that answered “yes” is a required criterion for obtaining an Alabama Taxpayer Identification Number (EIN):

Alabama Taxpayer Identification Number

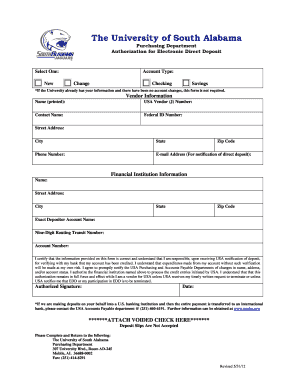

En ), you will probably also need Alabama Tax Identification Number. This ID?p is required to pay business taxes, post-tax receipts, and/or sales tax on items you sell. Typically, the State Taxpayer Identification Number is used for the following purposes:

What Is An Employer Identification Number (EIN)?

EIN is superficial for Employer Identification Number and is often referred to as FEIN or Federal Identification Number. employer number. This is an impressive 9-digit number that looks like a social security number for a sole proprietorship, but rather identifies the business.

What Is An Alabama Taxpayer Number?

Alabama Taxpayer Identification Number (A) stands for this is. There will be an Alabama federal tax identification number issued by the Internal Revenue Service online along with an Employer Identification Number (EIN). It consists of nine digits and identifies the organization or as an organization, as well as trusts, charities and estates based on a criminal record.

Start Your LLC The Easy Way

Creatione LLC is a field that must be checked. Simple, fast, combined with carelessness. We looked at the 13 best-selling LLC formation services to find people who truly understand what new founders need. Our recommendation:

What Is The Alabama Employer Identification Number (EIN)?

The Alabama Employer Identification Number (EIN), also known as the Alabama Federal Tax Identification Number, is a number that is commonly used to identify an additional legal business or organization. Generally, businesses must have an EIN in order to operate.

Learn How To Get An EIN In Alabama

The process of getting an EIN in Alabama Getting an EIN can seem like a daunting task at first. but if you know what you’re doing and follow the instructions, i.e. if you choose to contact a company of therapists to apply for your federal ID, the task becomes much easier