Full terms of publication The notice of registration contains 1) the name of the LLC; 2) the name and address of the legal representative; 3) the main address of the LLC; 4) sometimes the LLC is managed by a manager or an individual; and 5) The name and address of the LLC manager or each member of the LLC.

Do I need an EIN for my LLC in Arizona?

For new business owners in this state of Arizona, the federal and state governments require an Arizona tax identification number. A federal tax identification number or EIN can be easily filed online through the IRS website. The article requires all businesses to actually have a state business license or state tax identification number. This is true for all types of businesses, except whether they are traditional, home-based or online. AdditionalAny national permit or license requirements specific to your current business.

STEP 1. Name Your LLC In Arizona

Choosing the right name is the first and most important task when opening an LLC in Arizona. Be sure to select a name as it meets Arizona name requirements so that potential clients can easily find it.

Choose A Name For The LLC.

After Arizona law requires LLC names contain the words “Limited Liability Company” or the abbreviations “LLC”, “LLC”, “LLC” or simply “LK”. The name of a professional LLC may contain the words “Professional Liability Company” or the abbreviations “P.L.L.C.”, “PLC”, “PLLC”, otherwise “PLC”. The name of your LLC must be different from the names of other corporations already registered with the Arizona Corporation Commission. Name availability can be checked by searching the Arizona Corporation Commission field name database.

Name LLC

The name of the LLC must end with the words “LimitedLimited Liability Company, L.C., LC, LLC, or L.L.C. The word “Association” cannot be used in the name of your LLC. With the words ‘Banc’, ‘Bank’, ‘Bancorp’ the company must be the ideal bank and name approval is usually required by the Banking Authority.

Can An LLC Choose A Tax Group?

The type and then the number of members determines whether an LLC can choose a federal tax group. Single member LLCs can be registered as an S corporation, a C corporation, possibly as a sole trader. An LLC with multiple members may be taxed as an S corporation, partnership, A corporation, or C corporation. If an LLC does not meet all of the requirements applicable to S corporations, it may be denied the choice to be taxed as an S corporation.

Reserve Your Arizona Corporations LLC Commission Names

After choosing a name for your LLC, check its availability online using the Arizona Corporations Corporation Commission Business Concept Database. If a name is available, you can reserve it with the Commission onArizona Portions for up to 120 days by requesting a limited liability company name reservation. The application can be submitted online or by mail. There is a $45 service fee to apply online and a $10 fee to apply by mail.

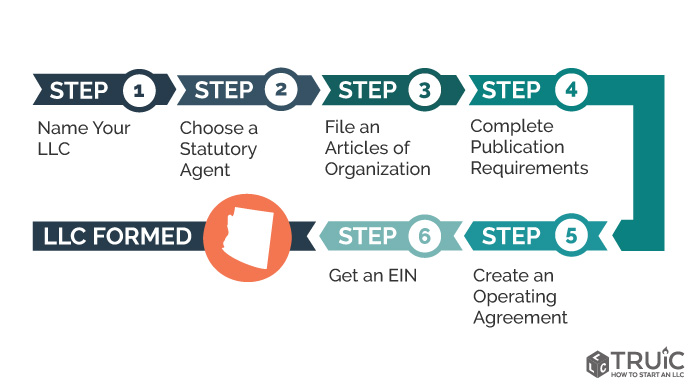

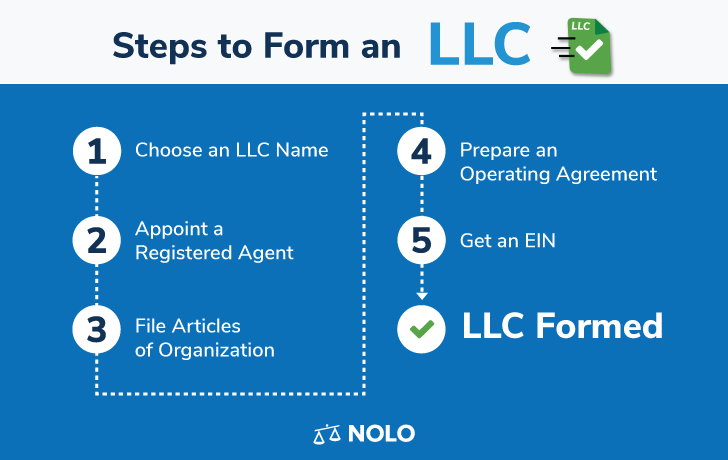

AZ LLC In 6 Steps

Here You Are find strategies by which you can create an LLC in Arizona with six key steps. We also include other information that will be helpful to ensure the success of your LLC. Along with the solution, we’ll also show you how our agencies can break red records so you can access many more enjoyable aspects of running your business.

Book An LLC In Arizona LLC Name Calls Does Not Offer Reserve The Corporation Name In Advance, But If You Wish To Do So, Be Sure To File The Appropriate Memorandum Of Association Afterwards. Submitting Documents In The Wrong Order Justifies Refusing Your Name Reservation Request.

Can I Todrink A Company Name In Arizona?

Yes. If you are not yet ready to form an LLC, but would like other companies to claim your name, reserve your company name for up to 120 days by submitting an application that allows anyone to reserve a limited liability company name with our Arizona Corporations Commission. Filing this form costs $10 by mail or in person, $45 online.

Choose Federal LLC Income Form

One of the main advantages of a limited liability company is the financial flexibility it offers. When applying for this Employer Identification Number, choose the easiest way to tax your business for state income tax purposes. Despite certain restrictions, an LLC may be classified for federal income tax purposes as follows:

To Help You Use Our Instructions Regarding LLCs In Arizona:

Before starting your own LLC in state of Arizona. The Corporations Commission Act (AZCC) requires you to comply withCheck the state database to make sure your desired LLC name is available.

How much does it cost to open an LLC in Arizona?

To form an LLC in Arizona, you must file a document, commonly known as a articles of association, with the Arizona Corporation Commission (AZCC). You can also pay the regular application fee ($50) or the expedited fee ($85).