Arkansas LLC. To register an LLC in Arkansas, you must present your organization-related certificate to the Secretary of State of Arkansas. You can apply online, by mail, or in person for $50. The organization certificate is a legal document that truly includes your Arkansas LLC.

Franchise Annual Tax Return

The requested state of Arkansas will help you file your LLC’s annual tax return. The report relates to state tax laws applicable to most LLCs. The fee payable to the Secretary of State is $150. You can file your franchise tax annual return online or download the return form from the SOS website. The Franchise Tax Return, consisting of a $150 tax payment, must be submitted by May 1 of each year. Are there any legal consequences for late reporting.

Do you have to file an annual report for an LLC in Arkansas?

If you want to register and purchase a limited liability company (LLC) in the state of Arkansas, you must prepare and file various forms.Debt documents to the state. This article discusses our main current filing and tax obligations for limited liability companies in Arkansas.

Choose A Name For Your LLC In Arkansas

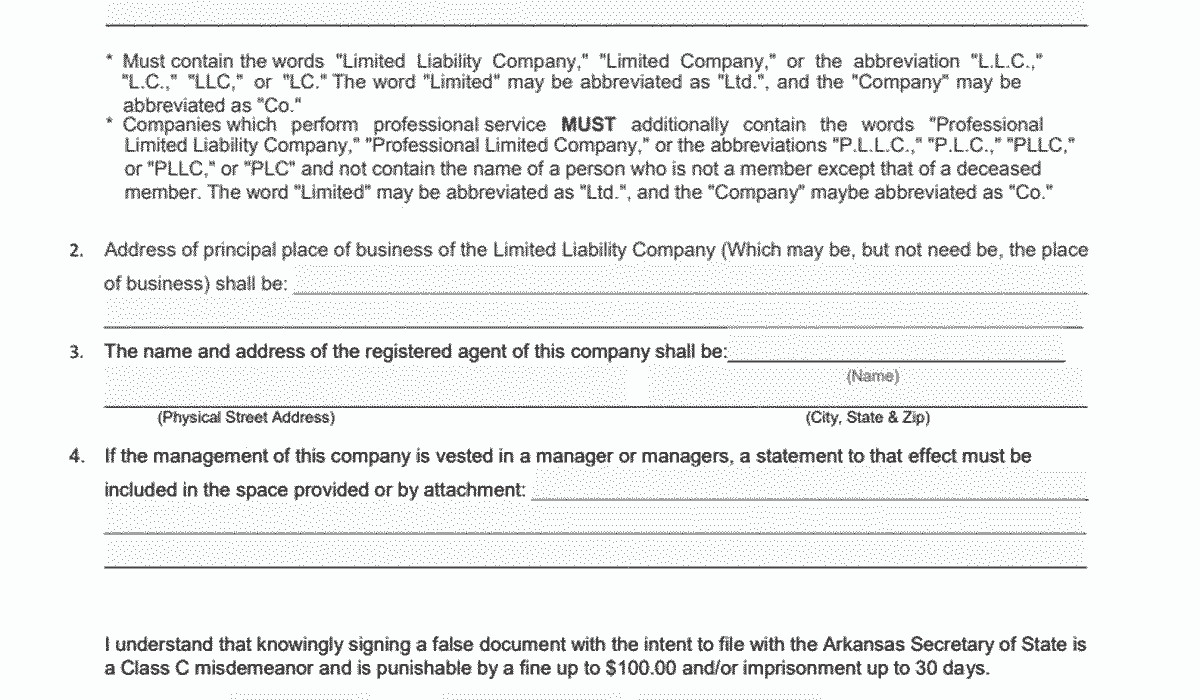

, LLC must use the words “Limited Liability Company”, “Limited Liability Company or the abbreviation “L.L.C.”, “L.C.”, “LLC”, and/or possibly “LC”. The word “Limited” can be abbreviated to “Ltd.”, and “Company” to«Co as».

Creating An LLC In Arkansas Is Very Easy

LLC Arkansas. To form an LLC in Arkansas, you must file a Certificate of Organization with the Arkansas Secretary of State. You can apply online, by mail, in person, or in person for $50. The Certificate of Organization has become the legal document that officially registers your LLC in Arkansas.

Our Best LLC Services

Corporation registration requires state-approved documents, which can always be confusing for new owners business. Northwest offers business services to help entrepreneurs find the right paperwork, complete it, and submit it to the most appropriate government agency on time. In addition to helping you set up an LLC, Northwest offers a range of additional services, such as professional property registration services, that new homeowners will also find very helpful.

Before Forming An LLC In Arkansas

In the early stages of setting up your business, a person must first take care of a few important details. Read the following? sections to learn what you need to take care of in advance when forming an LLC.

Annual Franchise Tax

All LLCs operating in Arkansas must manually file an annual return and pay a lump sum of taxes $150 each per year. The $150 tax return and the annual return together are commonly referred to as the LLC Franchise Annual Tax Return.

What Are The Rules For Naming An LLC In Arkansas?

Limited Liability Company, Limited Liability Company, LLC, LLC, LLC, or LLC Task. The word “Limited” can be shortened to “Ltd.” and the word “Company” can be shortened to “Co.”

Can I Reserve A Company Name In Arkansas?

Yes. If you really don’t want anyone to demand your LLC information while you prepare to register your business, you can ask the Arkansas State Minister to reserve the company name and pay the $25 bill ($22.50 online).< /p>

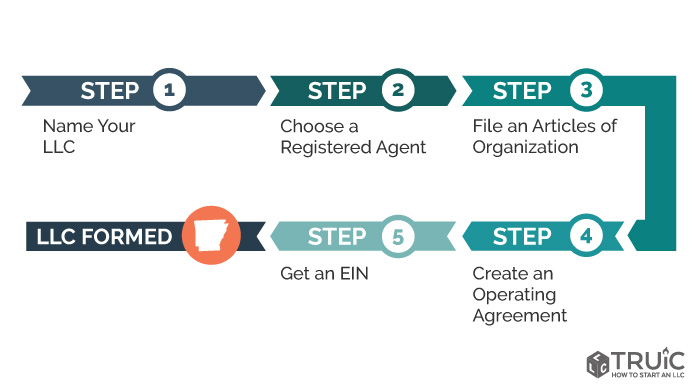

Steps Of Creating A TOEAbout In Arkansas

Creating an LLC in Arkansas on your own doesn’t have to be difficult. Just follow these simple steps below and your new business will be up and running in no time!

The Benefits Of An LLC:

With all this, you have made the decision to register an LLC in Arkansas. You have members, your own business plan, and a small start-up income, and you’re on your way.

How should I file my single member LLC?

The first thing an entrepreneur needs to do is decide on the structure of their business. If an individual wants to protect the liability of an LLC, but with ease of filing using individual ownership, then a sole proprietorship LLC may be the right structure for you.

What taxes does an LLC pay in Arkansas?

Individual tax returnLimited liability companies must file a partnership tax return with the Arkansas Department of Finance and Administration. Members must submit this relevant form of income tax and pay income tax ranging from 2.4% to 7%.