Companies that are actually incorporated in another state usually cite a certificate of authority from the state of California. This registers the company as a global organization and eliminates the need to register a new organization. Working without ID can result in fines and even fines.

Do I need a Certificate of Authority in California?

To operate in California, all insurers must obtain a license simply by obtaining a certificate of authority.

What Is A California Power Of Attorney?

Ultimately, companies must register with the California Secretary of State before doing business in California. Out-of-state companies usually require a California incorporation certificate. It’s registrarEstablishes the company as a foreign entity and eliminates the need to create a new legal entity.

Apply Now

The application you need to apply for a California government certification depends on the type of organization you have registered with the other state government. For example, the equivalent California Certificate of Authority for a Limited Liability Company (LLC) is the Statement of Incorporation of a New California Foreign Limited Company (LLC) (Form LLC-5). For a Limited Liability Partnership (LP), an Application for Registration of a Foreign Limited Liability Partnership (LP) (Form LP-5) must be filed.

Proof Of Ownership A Power Of Attorney Is A Document That Contains All The Necessary Information About A Company Other Than The One In Which Your Company Is Permanently Registered, Including The Legal Name, The Names Of The Owners, And The Legal Location (limited Liability Company)partnership, General Partnership, Limited Liability Partnership, Etc.). .). Another Name For A Certificate Of Authority Is “Foreign”. In This Case, Any Term “foreign” Refers To Any Intended Business Outside The State, And Not Necessarily International Institutions. A Certificate Of Authority Is Common To Any Type Of Business, Whether It Is A Partnership, Corporation, Or LLC (Limited Liability Company).

Free Guide To Registering A Foreign Corporation In California

California Currently Charges A Standard $0 Filing Fee For Signing An Out-of-state Commercial (foreign) Corporation (this Will Likely Act As A $100 Temporary Price Reduction Until June 30, 2023). ), But In Any Case There Are Additional Costs. To Make A Purchase In California, File The Foreign Company Application And Directive (Form S&DC-S/N) With The California Secretary Of State. State Still Requires Foreign Corporations To File Returnsinitial Information Within 90 Days Of Registration, Which Is Subject To A $25 Multiple Entry Fee ($20 Per Report Plus A $5 Disclosure Fee).

Business In California

Under California LLC law, you are required to help register your foreign corporation in California if you are “doing business” in California. What does it mean ______________ ? Well, like most states, California LLC law certainly does not specifically define the term “business” in relation to foreign registrations.

What Defines Your California Business As Foreign?

Social media is increasingly becoming the preferred way for companies to communicate with their employees, colleagues and customers. We are committed to sharing useful information and tools to help you grow your business.

Certificate Of Conformity. Frequently Asked Questions

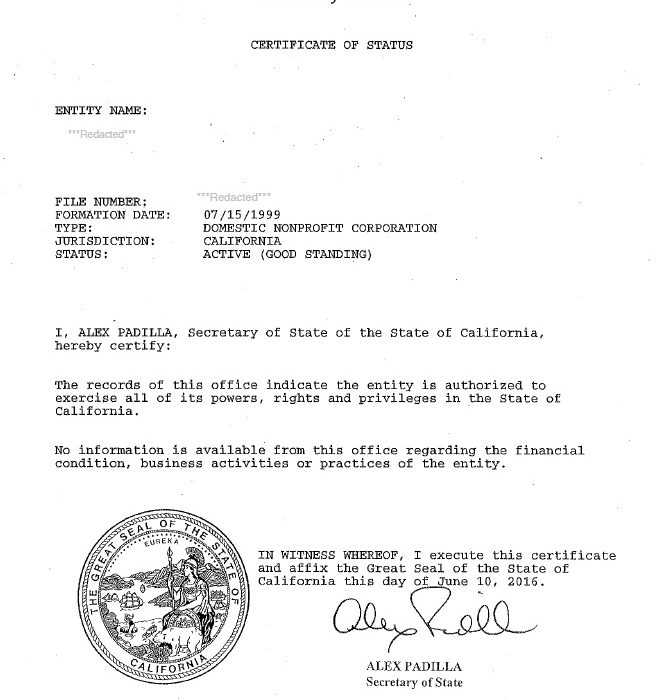

The certificate of conformity must be a government document issued by the State Secretcertifying that you are in good standing and that you meet all repetitive requirements, such as filing annual returns and simply paying franchise taxes. In some states, this document is called a “Certificate of Existence” or “Certificate of Compliance.” or country:

If you have already obtained or are in the process of obtaining a Manufacturer’s State of Origin Certificate of Conformity that is less than one month old (less than 30 ft-days in some states), please skip this single step. If you need help obtaining a Certificate of Good Conduct in your home country of California, we can help for an additional fee. If the legal entity is a non-profit, you must submit a certificate of existence/certificate of good standing of a government entity as a non-profit or to the Minister of State against each other as a non-profit. must be filed, and many other registration fees are required.

Application For A Certificate OfAuthorizations In Alabama

To register as a business in Alabama through an LLC or non-state corporation, you will need most of the following: legal name reservation fee, $150 registration fee, 3 copies of the Foreign Corporation Doing Business Certification Application in Alabama, a certified synopsis of your articles of incorporation (articles of association or articles of incorporation) and a registered agent in Alabama. .

Doing Business In Another State

Certificate of Compliance is notoriously a dangerous qualification when dealing with an entity that has a business license in a different repetition than the one in which it is indicated. originals of the founding documents of the submitted case.

How do I get a letter of Authority in California?

Are you ready to do business in California? Here’s how to get a reputable certification to help you succeed.

Do you need a California Certificate of status for my LLC?

The California Certificate of Incorporation indicates that the Limited Liability Company (LLC) plus corporation is legally incorporated and appears to be properly managed.