What is a California Tax Identifier (EIN)? The California Federal Tax Identification Number, also known as the Good Employer Identification Number (EIN) or Federal Tax Identification Number, is a unique nine-digit identifier assigned by the Internal Revenue Service for personal tax purposes, including businesses owned by non-profit organizations. , trusts and estates.

Does California require a state EIN?

1. California Identification Number Overview2. Obtaining a California State Identification Number3. Getting BE or ONE from another company or yours

Do You Need An EIN To Do Business In California?Huh?

The IRS has specific criteria for determining which businesses sometimes require an EIN and which do not. The following criteria are provided by the IRS itself. If your business is in one of the following categories, you must have an EIN to be eligible for an EIN.

California Identification Number Overview

A California Identification Number belongs to the group assigned to your California entity to identify your entity for tax purposes. Also highly regarded as a State Employer Identification Number, or possibly a SEIN, it works the same way as an EIN or National Employer Identification Number, identifying your business to the IRS in the same way that a Social Security number definitely does for a person. Unlike the EIN, which is issued by the IRS, the California SEIN is issued by the California Employment Department (EDD), which is also a special department that collects payroll taxes in California.

Wait. For Your California LLC To Receive An AdditionalAdditional Approval

Wait for your California LLC to be approved by the Secretary of State before posting your EIN. Otherwise, if you are denied LLC registration, you have attached an EIN to a non-existent LLC.

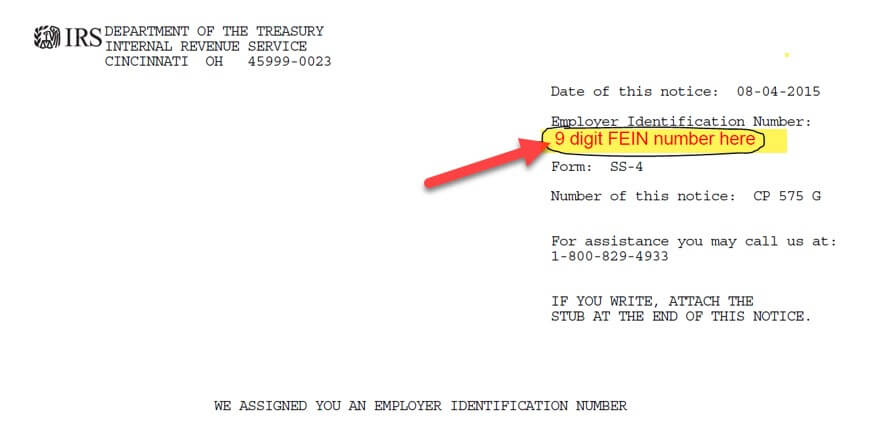

Finding California EINs

The Easiest Way to Register Your Great Company An EIN is used to find the right tax return previously filed for your unit. All tax returns filed on behalf of your company will show your EIN.

Get A Federal Taxpayer Identification Number (EIN)

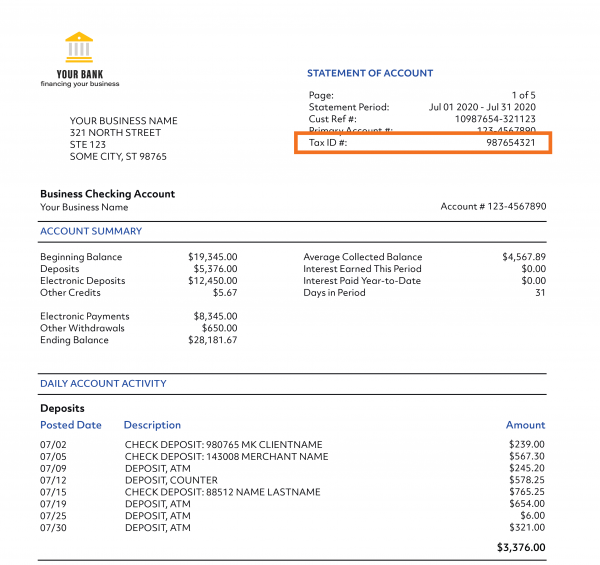

When you are ready to make your business official, it will take time to register with the federal government and obtain a federal tax identification number. Also known as the CEO Identification Number (EIN), this number serves as a unique signature for your favorite company. This is what you will use to control your income and taxes. You will also need this if you are planning to hire an outdoorstaff, open a business bank account, perhaps create some kind of business loan.

California Taxpayer Identification Number

The State Taxpayer Identification Number is effectively the same as the State Taxpayer Identification Number in that it identifies the company to the tax authorities, but the California Taxpayer Identification Number is reserved for government tax officials and withholding requirements. Most businesses require state and federal tax identification numbers to apply in California.

What Is An Employer Identification Number (EIN)?

EIN is a temporary employer identification number. it is sometimes referred to as the Federal Employer Identification Number, FEIN, Federal Tax Identification Number, or Federal Tax Identification Number. It is actually a unique nine-digit number, similar to an individual social security number, but instead identifies the business.

California Tax Identification Number

In addition to determining your tax, you will need a California Federal Identification Card (EIN). You probably also have a California tax ID. This ID is required to pay corporation tax, state income tax, and/or sales tax on items that you can easily sell. Typically, a state tax identification number is provided for the following purposes:

Choose A Company Name

In California, a company may use any name that is not the same as or closely related to the name. its registered trade name. When counting, the name should not mislead people. To make sure your organization’s name is available, it’s important to search the following government databases:

Does an LLC need an EIN in California?

The beginning of a completely new business is accompanied by a large number of conditions. Following are some of the important steps required to maintain your business certification while becoming a California Limited Liability Company (LLC). For more information about registering a business, visit our webinar “Things to Know When Deciding to Register a Small Business.”