Businesses incorporated in the following state usually require a California Certificate of Incorporation. This will register your business as a foreign entity and eliminate the need to create a new organization. Working without an authorization certificate can easily lead to sanctions or fines.

Do I need a Certificate of Authority in California?

To operate in California, all insurers must obtain a license by obtaining a certificate of authority.

Filing By Mail Or In Person

All trade documents themselves may be filed by mail or in person. Find the form you want to submit and follow the instructions. For more information on personal addresses and opening hours, please visit the Company Contact Information web page.

What Could It Be? Authority CertificateWho Are The States Of California?

Businesses must register with the California Secretary of State before doing business in California. Out-of-state businesses typically apply for a California state certification agency. Registration of a company as a foreign legal entity eliminates the need to create a single legal entity.

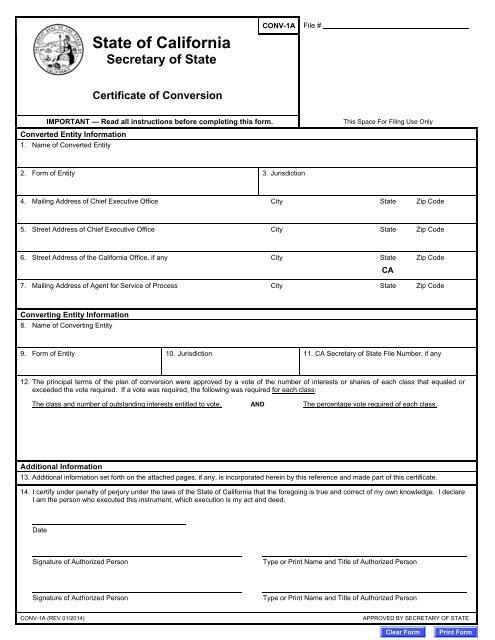

Complete The Application

The application you must submit to obtain a California state certification in a public institution depends on the type of organization you registered in another state. For example, the correct California Limited Liability Company (LLC) Certificate of Authority is California Foreign Limited Company (LLC) Form Form LLC-5. You must file a new Foreign Limited Partnership (LP) Application (Form LP-5) for the specific Limited Partnership (LP). liberties of states?Your secretary of state who, in turn, decides on registration. Once registered, a corporation becomes a separate legal entity and is subject to the requirements of a public corporation.

California Free Guide To Incorporating A Foreign Corporation

California currently charges a standard registration fee of $0 . to register a commercial (foreign) corporation out of state (this is a temporary fee reduction of $100, which will last until June 30, 2023). but there are other undeniable costs. Register to file your California Declaration and Foreign Company Determination (Form S&DC-S/N) with the California Secretary of State. The State also requires foreign companies to file an initial information statement within 90 days of incorporation, for which there is an additional $25 fee ($20 report plus $5 disclosure fee).

California Secretary Of State State Papers

BeCertainly, the Sacramento office is the only place where you can request documents. Diversified Solutions is located in Sacramento. We make daily trips to the Secretary of State. We can get regular or certified copies. We can get a certificate of admission in 1 first job. All other registrations take 3 to 10 business days.

LLC-12 Reporting Information

All newly registered LLCs must provide initial reporting information associated with the use of the LLC-12 Form. It is imperative that registration be filed within 90 days of incorporation for most LLCs and every two years thereafter. The form is used whenever the information has changed since it was last submitted. If the information has not changed at all since the last tax return, the LLC files are submitted in the LLC-12NC form. These forms are submitted to the Secretary of State and are subject to a $20 filing fee. The following information about these LLCs must be indicated on a special form:

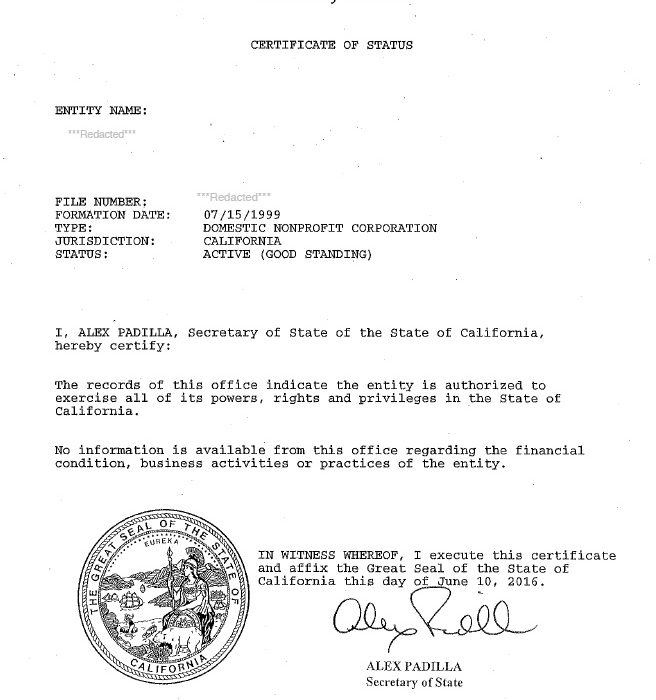

Obtaining A Certificate Of Status

In California,Honorary Certificate of Status comes from the Secretary of State. Download the form, print the software, fill it out, then mail it in with the required payment. Here is the understanding you need to provide:

Certificate Of Good Conduct – Frequently Asked Questions

Certificate of Good Conduct is a special government document issued by the Secretary of State that certifies that your business exists and is supported and meets all government requirements, such as filing financial statements and paying transaction taxes. In some states, this data file is called a “certificate of existence” or “certificate of authorization.” h2> You may need actual security clearance if you are involved in a merger or acquisition yourself, or if you are buying a business or raising money for your business. Good Standing certification documents are part of your business’ current legal documentation.

How do I get a letter of Authority in California?

Are you ready to do business in California? This is how you actually get your Certificate of Authority to start your path to success.

What is a Certificate of Authority?

In many states, the first step for an LLC or foreign corporation to legally operate in another state is to successfully apply for a certificate of authority.