An authority-related certificate shows that you are eligible to do business in a state other than your home state of incorporation. A certificate from the authorities is required in most US states. It is important to note that the document label may vary by country.

How do I get a Certificate of Authority in Indiana?

Corporations are required to register with the Indiana Secretary of State before doing business in Indiana. Company Registered in another state, they usually require a good Indiana agency certification. Included registers the company as a good foreign organization and eliminates the need for successful registration of a new organization.

Types Of Certificates Issued By Most Agencies

The IRS issues two types of Tax Sales Incentive Certificates according to an agency certificate: regular and provisional. The type of certification you need depends on the expected length of your business games. Both types of certificates often use the same application form and process. However, a temporary certificate is issued with a start and end date.

Certificate Of Eligibility: Definition

Certificate of Eligibility indicates that people have the right to carry out activities in another region and act as a transfer your original form?ii. A Certificate of Authority is required in most states.

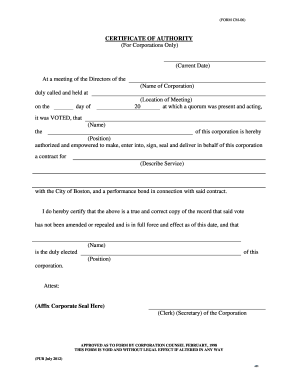

Certificate Of Authority Overview

A Certificate of Authority is a document that can be issued by states other than those in which the company is incorporated. all basic information about the company, including the official name, the names of the owners, up to the legal status (limited liability company, joint stock company, limited liability partnership, etc.). Another name for a certificate of authority is a foreign qualification: in this case, the term “foreign” refers to a business organized outside the state – not necessarily – to international companies. A certificate of authority can be described in the same way for any type of company, be it a partnership, a corporation, or an LLC (limited liability company).

How do I get a Certificate of Authority in New York?

If you make sales in New York State that are subject to sales tax, you must shop with the IRS and obtain a Certificate of Authority. The Certificate of Eligibility entitles you to levy IRS on your taxable sales and to apply for and accept most New York State Personnel Tax Exemption certificates. Typically, the seller collects the tax from the buyer and then remits it to New York State. If your entire family wants to make taxable sales in upstate New York, you must register with certain tax authorities at least 20 days before starting business. New York State will then most likely send you a Certificate of Authority, which must be shown at all times for use.niya in your business. This bulletin explains: