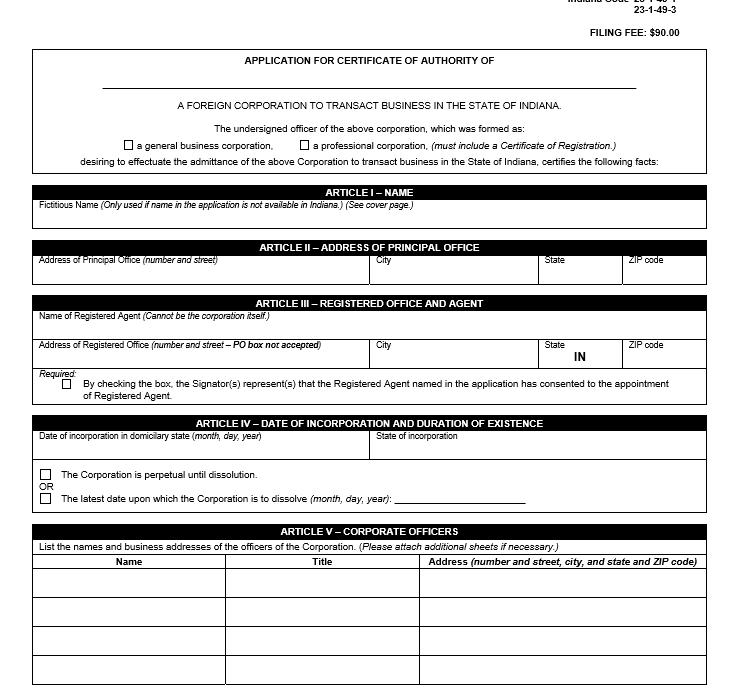

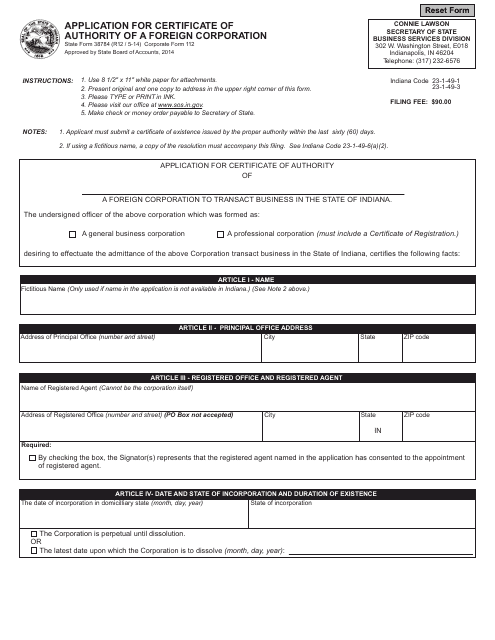

The Indiana Certificate of Trust is required by corporations incorporated in certain other states that wish to conduct business related to the state of Indiana. By completing the excellent Indiana government certification, you can be registered as a foreign company in the state of Indiana and not necessarily register a new company in any state.

What is a certificate of Authority?

In many US states, the first step for an LLC or foreign corporation to obtain legal authority to operate in another state is to file an authority certificate.

What Should Be The Certificate Authority In Indiana?

businesses must register with the Indiana Secretary of State before doing business in Indiana. Company In order to register in another state, an Indiana state agency certificate is usually required. Included registers the company as a foreign company, as there is no need to set up a company.

Do I Need An Indiana-registered Agency For My Business?

Yes, if you hire Northwest as a registered agent, it’s a fat-free annual fee of $125/year or so. an online account in whichReporting deadlines are set for the year of enrollment, when your annual service plan expired, and all documents I receive for you on the spot are immediately uploaded to your account for full review. If or when you are facing a major litigation, we may send an email to others and your lawyer to get a complete real-time view of the litigation at the same time. You will receive annual reminders. It’s the same price every year and there are no weird fees or cancellation fees.

Indiana Foreign Corporation

If you are a non-Indiana corporation and want to do business in Indiana, you are considered a foreign corporation in Indiana and need a Certificate of Eligibility to conduct business in Indiana. You can get one by filing with the Indiana Secretary of State, Corporations Division, as a foreign corporation. Once filed, the State of Indiana may return the filed power of attorney to you if necessary. A foreign company in Indiana should not be confused with a foreignstrange company. Any corporation that is not actually registered (incorporated) in Indiana is a foreign corporation.

How To Get Another Indiana Certificate Of Authority From Indiana:

The secretary of state makes these things done simply, because the same form (Foreign State Registration Form, Government Form 56369) is currently required to be filed regardless of the type of legal entity. In addition, most LLCs and corporations must pay the same fee for this tax return: $125. Nonprofits pay a $75 commission.

Want To Get Your Business Eligible In Indiana?

Social media is increasingly becoming the preferred method for companies seeking to connect with customers, colleagues and potential customers. We are committed to sharing information and therefore useful tools to help you grow your own business.

Indiana Code Search

(b) – Any corporation with a trustee must notifyof that particular commissioner for the election or appointment of each new director or officer within 33 (30) days thereafter. . a?? If such a new officer or possibly a director in the Marine Commissioner’s Office does not meet the standards set out in this article, the Commissioner may require the company to remove such persons. “If the removal is not made as promptly as possible under the circumstances and the officer’s diagnosis, then notice must be given to both the Company and such officer or director and must be done promptly after a hearing and a right of appeal in accordance with IC. 4-21.5, and upon determining that such person is incompetent or unreliable, or of a known bad character, the Commissioner may order the suspension of that person up to the present time and may do so, if this dismissal is not to be carried out promptly, suspend company certificate with authority pending compliance with this order.

What Is A Foreign Degree?

Foreign degreeThis degree allows your GmbH to conduct business in the state of Indiana. It doesn’t matter which state you originally established your business in – or in other words, the state in which your domestic LLC is located counts. how?? because the qualifying step to register a foreign LLC in Indiana is the same regardless of where your current domestic LLC is located. the secretary of state in which the client has decided to register the company. Once a corporation is actually incorporated, it becomes a separate government agency and is subject to the rules of the state and corporation of the Crown in accordance with its constitution. What is

Indiana Certificate Of Authority?

The Indiana State Compliance Certificate is an e-book form that anyone can complete, view, or edit online. PDF (Portable Document Format) is a file format that captures all the elements of pA distributable document in the form of an electronic image that individuals can view, view, print, or share to help others. PDF files are created using Adobe Acrobat or PDFSimpli. PDF files will be larger than image documents. Portable Document Format (PDF) is a file format designed to reliably represent and exchange documents regardless of software, hardware, operating system, or system. Invented by Adobe, PDF is now an accessible standard maintained by the International Organization for Standardization (ISO).

What is an Indiana certificate of good standing?

A company operating in a country maintains its good reputation by complying with legal requirements. Before expanding your industry to another state or getting funding for your business, you may be wondering if you need to file a certificate of existence for the state of Indiana, ?Also known as Certificate of Good Condition (CGS) in other states. But what will be the evidence of existence and how to get it? Our guide explains exactly what it means to get a Certificate of Existence, why you might need one, and how to get one in Indiana.

How do I register as a foreign entity in Indiana?

Indiana business corporations have a Biennial Indiana Statement that must be filed on a non-business day of the month in which it is due.Indiana nonprofits are required to contribute each year.

How much does it cost to start an LLC in Indiana?

The main cost of forming an LLC is the $95 fee for filing the Articles of Association of the LLC online with the Secretary of State of Indiana.