Doing Business In New Jersey

Any individual, entity, or organization doing business in New Jersey must file a Business Registration Application (NJ-REG) with the New Jersey State Department of Revenue and obtain service contracts. (DORES). This includes people who run unscheduled sales (flea markets, shops, and fairs) as well as non-profit organizations.

What Is NYC Government Certification? Jersey?

Corporations must register with the New Jersey Department of Revenue before doing business in New Jersey. Out-of-state businesses generally must apply for a marriage license in New Jersey. If you do this, the company will be registered as a foreign company and the need to register almost every new legal entity will be eliminated.

Who Needs A New Jersey State Authority Certificate?

New Jersey policy requires that you obtain a certificate from the Sales Tax Department if you are operating a business in the state of New Jersey and receive income from any of the following:General activities: advertising, renting or using housing or tangible personal property; retail dealing with the acquisition, manufacture, processing, installation, maintenance, repair and maintenance of tangible, digital or private personal property; long-term maintenance or repair of real estate; absolutely secure direct mail services; tattoo, solarium and massage; assessment and security services; information Services; car service with a driver; sale of restaurant dishes and food in stock; Rental of hotel and motel rooms; various entrance tickets; certain membership fees; Parking Fee; warehouse services; distribution of magazines, as well as periodicals; Send; and telecommunications services, except as otherwise provided by the Sales and Use Tax Act.

Free Guide To Registering Foreign Companies In New Jersey

$125 for regular and online processing; Additional $50 for Same Day Expedited Processing; $15 extrabut for expedited processing within 8.5 business hours; Fax returns require $1 per page. If you also apply online, there is a $3.50 credit card service fee.

DO I NEED A NEW JERSEY SALES TAX AUTHORIZATION?

You must obtain any type of sales Tax Compliance and Sales Permit related to tax laws if you have any connection, even connection with the State of New Jersey. Nexus can be caused by physical or economic presence.

Foreign Business In New Jersey

If you want to own a business that is headquartered in a good location other than New Jersey, conduct business in New Jersey, everyone needs a certificate associated with a New Jersey agency in order to work in New Jersey. This is accomplished by filing documents, such as any foreign corporation, to the Crown Corporation Segment with the New Jersey Secretary of State. After you submit your forms, the State of New Jersey will mail your completed marriage certificate to you. ?A foreign corporation in New Jersey should not be confused with a foreign corporation. Any company that is not merely registered (incorporated) in the state of New Jersey is considered a separate foreign company.

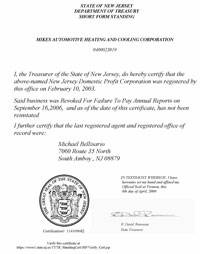

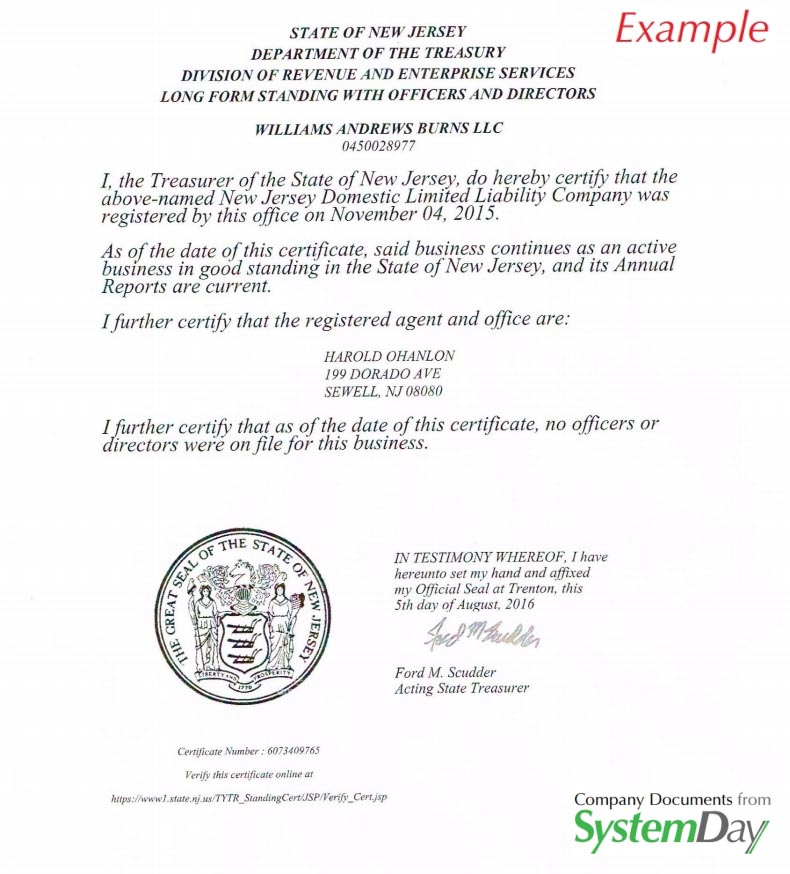

How Do I Get A New Jersey Certification Authority?

To obtain a certificate, complete an application for a public records repository to find new business objects. For a copy of the application, call (609) or 292-1730 Journal at www.nj.gov/njbgs. a?? A copy of the usually most recent annual return, which is often filed with the tax authorities, must be submitted with each application.

Employer Identification (EIN)

Leave the number on this line blank. You will receive an EIN to obtain NJ Later LLC. First, you want to register your Wait LLC company, submit it for approval, and then use it for your EIN.