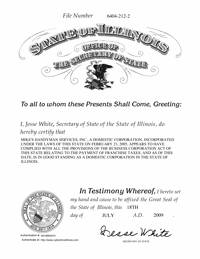

The certificate of incorporation or license is your authorization and may indicate that you are incorporated or licensed to legally operate the business identified on our certificate in the state of Illinois. The law spells out which types of taxes receive a certificate of registration, and which, in turn, receive a license.

How do I get a certificate of authority in Illinois?

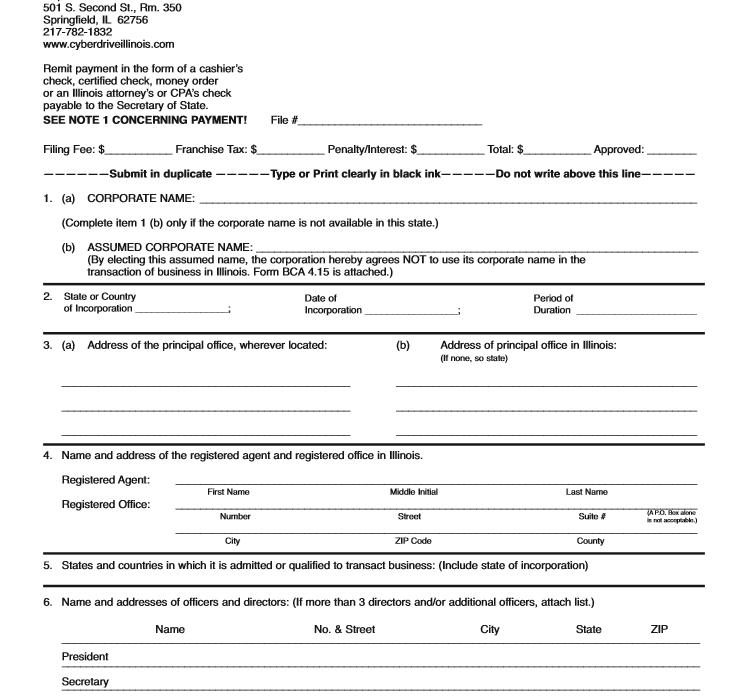

Corporations must provide proof of incorporation with the Minister of State of Illinois before doing business in Illinois. Out-of-state corporations generally require an Illinois Certificate of Authority. Thus, the company registers the existence of a foreign legal entity and eliminates the desire to create a new legal entity.

What Is A Powerful Illinois Center Certificate?

Corporations must register with our Illinois Secretary of State before doing business in Illinois. Out-of-state businesses often request an Illinois certificate from the agency. This will subscribe the company to the company as a foreign company and eliminate the need to create a modern company.

Illinois Annual Requirements

After you have completed your foreign education inIllinois, Illinois requires LLCs, corporations (commercial and non-commercial), and LPs to share directory records. These reports must be submitted to the Secretary of State of Illinois within the first four weeks of the anniversary of your company’s Illinois incorporation by users. (Example: If you started your business on Nov. 15, you must file a return 12 months before Nov. 1.)

Free Management And Foreign Company Registration In Illinois Minimum

$175 . due. Upon receipt, they will send your request and tell you the exact amount. Any additional fees will be charged and must be paid prior to filing.

Foreign Company Registration In Illinois With Company Formation Lawyers

States require corporations to register as a foreign corporation to ensure they comply with tax and regulatory requirements. If you are not sure if your travel agency in Illinois is required in connection with the registration of a foreign company, please call our main office at (800) 603-3900 to inquire.Fight with someone who can help you immediately. Obtaining a foreign company registration and certificate of authority is a legal and business process; Avoid potential pitfalls when dealing with a non-lawyer service or training agency – a public limited liability company or corporation, what you practically need: $28 face value, $150 registration fee, two copies of an application for a foreign corporation certificate of right to conduct business in Alabama, a certified copy of your Articles of Association (Memorandum and Articles of Association) and a Disclosed Representative in Alabama.

Ready To Qualify Your Illinois Business Overseas?

Companies are increasingly using social media to communicate with their customers, colleagues and patients. We are committed to sharing useful information and tools to help you grow your small business.

Registration Conditions

If the legal entity is not eligible for an exemption, the web business entity must complete and submitAn original computer program designed to obtain a Certificate of Authority specific to its type of business at the North Carolina Division of the Department of Business Registration of the Secretary of State.

What Corresponds To The Period Of “doing Business”? In Illinois Generally, You Must Form A Foreign LLC In Illinois If Your Corporation Does Any Of The Following In That State: Has A Warehouse In The State Does Business With Customers In Illinois Purpose Is To Sell Goods Or Services Obtained From Sources In This State Related Or Even Related To

Certificate Of Authorization: Definition

The Certificate of Authorization shows that “a person is allowed to conduct business in a good solid state, which is different from his initial stage of registration. A certificate of authority is important in most states.

What is the certificate of authority?

In many states, the first step in considering starting an LLC or foreign corporation legally to operate in a surviving state is to obtain a certificate from the agency.

Do I need a certificate of status for my LLC in Illinois?

WARNING! A non-government company called the IL Certificate Service contacts offices in Illinois to collect a useful $87 fee for a form entitled a sort of “certificate of status.” Please note that Corps, LLC and other Illinois business entities are NOT required by law to obtain this “Certificate of Status”. THIS IS A FRAUD! Illinois nonprofits are encouraged to ignore this request and NOT receive a response. If the business in question requires a Name Certificate, also known as a Certificate of Beneficial Ownership, it can be obtained from this website for a fee of $25 for supporting businesses and LLCs and $5 for non-profits.corporations.