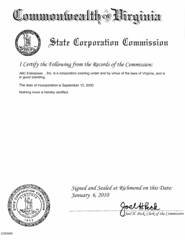

Companies incorporated in a particular state usually require a Virginia Certificate of Authority. This will register the entire company as a foreign company and eliminate the need to set up a future company.

What is a Certificate of authority for?

In many states, the first step for your LLC or foreign company to be legally allowed to operate on another express is to apply for a certificate relating to the agency.

What Is A Certificate Issued By The Government Of Virginia?

Corporations must register with the Virginia Corporation Commission before doing business in Virginia. Out-of-state corporations usually request a power of attorney from the state of Virginia. This registers the company as a foreign entity and eliminates the need to register a new legal entity.

How To Get A Certificate Of Authority In Virginia

If you own an out-of-state corporation and want to do business in Virginia, you will definitely need a CA in Virginia. Virginia. This is achieved by registering a large foreign1st Virginia Corporation to the Virginia Corporation Commission. A foreign company in Virginia can hardly be confused with an out-of-state agency. Any company that is not actually registered (incorporated) in Virginia is called an unknown company. Guide

Free Guide To Registering A Foreign Company Anywhere In Virginia

Minimum fee of $75 ($25 for incorporation plus $50 for every 25,000 shares or smaller shares) shares for normal processing). $75 for nonprofits ($50 Charter/Admission Fee + $25 Entry Fee). Speed ??up costs an additional $100.

Do I Need To Register My Business In Virginia?

Generally if you have a business in the Commonwealth of Virginia or need to register your business with the Virginia tax . So what just counts as doing business in Virginia? The general rule is that when a foreign company carries out a substantial part of its secondary business,business in a state, she sells, liquidates, continues, or acquires an interest in a company within the meaning of that state’s good name law: Meaning

In Virginia, a certificate of good conduct is also commonly referred to as a certificate of well-being or certificate of existence. In other states, this may be a certificate of fact, power of attorney, or power of attorney along with a “letter of good character”. A certificate in good standing is said to form a corporation in Virginia, while a similar license for an LLC is called a certificate fact. Ready to

Qualify Your Virginia Business Overseas?

Social media is expected to become the preferred way for businesses to communicate with customers, colleagues and individuals. We are committed to sharing information and tools to help you grow your business as a whole.

Business, Business And Profession Licensing (BPOL)

New companies must apply for a business license within 75 days of the start of the main business day. Businesses can apply for floorteaching a small business license by mail, email, fax, or possibly in person. Applications are available on the Department of Tax Administration (DTA) website with our contact information.

Entry Requirements

If all businesses do not meet the requirements of another, the business entity must complete and complete received an initial application for a certificate to an agency specific to his line of business in the NC department of the assistant secretary in the department of registration of state enterprises.

Foreign Corporation Registration In Virginia With Company Formation Lawyers

States require corporations to register as foreign corporations to ensure they “comply with tax and regulatory requirements. If you are unsure or uncertain about your business dealings in Virginia, please contact our main office at (800) 603-3900 to speak to someone who can assist buyers immediately. Registration of a foreign company and obtaininge certificates of authority – this is a legal process, like the process of registering a company; Avoid the potential hassle associated with this by contacting a non-professional organization service or agency.