Key Steps After Starting An LLC

If your personal and business accounts are mixed, your assets (your home, car, and other valuables) are at risk if your Colorado LLC is sued. In commercial law, this process is known as lifting the head office veil.

Does an LLC need to file a tax return in Colorado?

1. Establishment of Colorado LLC2. Requirements for annual reporting3. Colorado state business tax4. State employer taxes

Preparing And Filing In Colorado

In order to form your LLC in Colorado, you must register with the Clerk at the Repository. for state articles related to society. Colorado does not allow paper registration with your articles of incorporation. The Colorado Secretary of State will only accept articles related to ?? organization and submitted electronically. For syndication, the documents must be printed/printed. All handwritten documents are no longer accepted.

Reserve Your LLC Name With The Secretary Of State

Once you have chosen a name for your LLC, you can reserve it with the Minister of State of Colorado. states. First, check the availability of the name using the US Department of State’s Colorado Company Name Database. Once you are satisfied that most of the name is available, apply for a name reservation with the Secretary of State of Colorado to reserve the name for up to 120 days. Submission can be done online and the registration fee is always $25.

Single Member LLC Application Requirements And Benefits In Colorado

Incorporating as a corporation in Colorado gives you control over the level required to operate the society. The owner of an LLC is also exempt from personal liability if he or she strictly adheres to the laws of the LLC in the state of Colorado.

Paper Documents May Not Be Available

. We’re for itnoted that the Secretary of State (SOS) is requiring many organizations and businesses to submit forms electronically. Keep this important fact in mind as you may need to create a full account and handle various types of online processes including payments.

Do I Need Any New Lawyer To Set Up An LLC? Colorado?

No, the law does not require you to help an attorney form an LLC. Setting up an LLC in Colorado is very easy. You can read our free guides that will guide you through all the steps.

Can I Reserve Any Colorado Company Name?

Yes. If someone is not yet ready to register your limited company, you may reserve your company name for up to 120 days by filing each Name Reservation Application with the Secretary of State of Colorado (online only) and thereby pay a registration fee of $25.

Colorado Form 106

If any of the shareholders of S Corp is not a Colorado resident, please also complete the form.We have DR 0107 and DR 0108 to guarantee all shareholders their unique tax liability in Colorado. The nonresident investor must sign DR 0107 and agree to file a Colorado tax return. S Corp will sign type DR 0107 with its annual tax return. An S Corp incorporated in 2012 must withhold 4.63% from the source of income of each non-resident shareholder and deposit this payment using this form DR 0108. A separate form DR 0108 must be filed for each non-resident shareholder considered, and each form should preferably be included on Form 106.

Organization Articles File

Colorado has a simple electronic tool that can be used to create organizational illustrated articles for a new LLC. This is a poll-style question and answer form. Also answer the questions to complete these special screens and send the document to the organization for submission to the Secretary of State of Colorado. The person(s) forming the organization must be over 18 years of age. However, LLC members cannot be restricted by ?Age or place of residence. Members of Colorado LLC are not required to show that they are listed in the articles of the organization.

Do LLC pay taxes in Colorado?

Colorado LLC tax tracking will help you with this. Take advantage of every opportunity that comes your way, not to mention avoid them. lesser-known negative aspects and common misconceptions associated with them LLC Colorado. Tax law,the governing LLC changes regularly. Learn about these changes and how these people can impact your business. help you identify these classifications and practices for implementation, and when you may also need the advice of a tax expert on the law Tips.

Where do I file an LLC in Colorado?

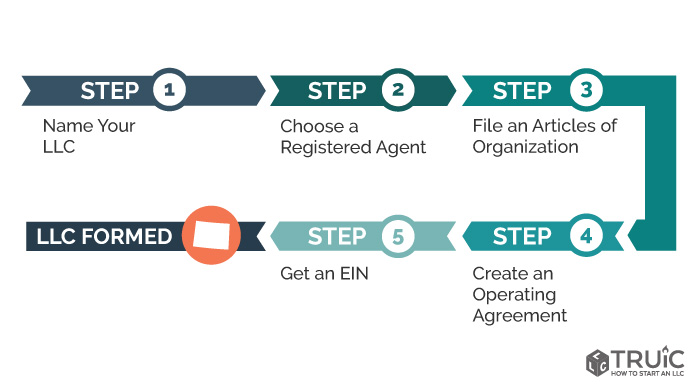

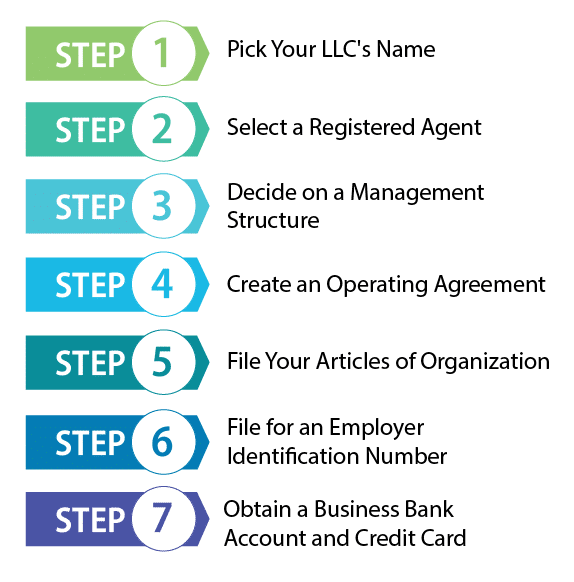

Here are the likely steps you need to follow to successfully register an LLC in Colorado. For more information on starting an LLC in any state, see Nolo’s How to Start an LLC article.

Do I have to file a Colorado business tax return?

Any corporation, association, joint venture, trust, limited partnership, labor collective or agreement, limited liability manufacturer, or other combination of persons that may have interests necessary to file a final federal tax return must file the entire Colorado tax return. . An organization is certainly considered a resident of Colorado if it is engaged in any activity in Colorado that is outside its protection under Public Law 86-272.