In Brief

Be aware of specific requirements when preparing for deployment to allow them entry into Connecticut.

Choose A Company Name

It is important that your company name is distinct from other good business entities already registered with the Secretary of State of Connecticut. . In fact, name availability can be checked by doing a computer search of the Connecticut Secretary of State.

Open A Commercial Bank Account

Use special commercial banks and loans and credit accounts business. When your financial and business accounts are mixed, your consumer assets (your home, car, and similar valuables) are at risk if your LLC is sued.

Kato Order A Copy Of The Certificate Of Articles Of Association Or A Certified True Copy Of The Articles Of Association Of Connecticut

A certified copy of your Articles of Association or Articles of Incorporation with Articles of Association may be ordered by fax, letter, email, or in person, but we recommend fax. Normal processing takes up to 1 business day plus additional shipping time and costs $55 for certification. Expedited Center is available for an additional $105 and also takes less than 24 hours, not including shipping time.

How much does it cost to incorporate in CT?

The founder must complete and sign a “Founder’s Declaration” detailing the names and addresses of the executive directors. The declaration does not need to be submitted to the state. – keep it in the book of the organization. For an example declaration of incorporation, see Anthony Mancuso (Nolo)’s “Incorporate Your Business.”

Incorporating An Interesting Business In Connecticut?

Note. Instructions are on the next page. are advocating the creation of a new Connecticut LLC (also known as an Inland LLC). They are not intended to form a foreign LLC in Connecticut, but the steps will be similar.

Company Name

The company name must contain the following words: “Corporation”, “Company”, “Incorporated”, “Limited” and an abbreviation plus that. The name does not necessarily imply that the company was incorporated for any reason, but? specified in its charter or memorandum of association.

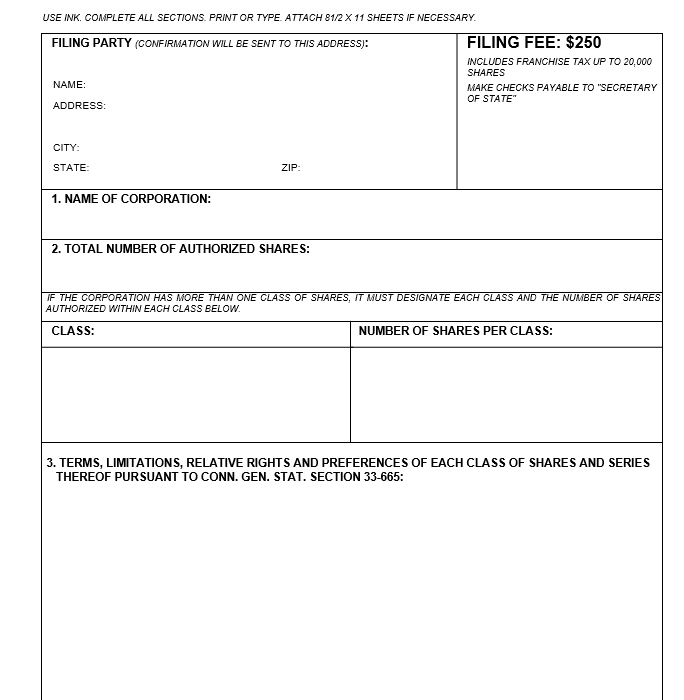

Submit Articles Of Association In Connecticut Today

COI in Connecticut, articles of incorporation in other states present, I would say, facts about the business. This is a specific basis for declaring the fund and your activities to the Secretary of State (SOS). The certificate allows your company to choose the company as a joint stock company. We focus on commercial business.

BENEFITS OF CONNECTICUT LLC

Power and prestigeCorporations have always been the oldest business in the United States and are subject to stricter rules than LLCs in addition to the regulations. While this results in a few extra tasks on your overall to-do list, it sounds like a good investment. Unlike LLCs, they can issue shares and are usually required to provide information to shareholders at the annual shareholders’ meeting.

Creating A Connecticut Corporation Is Easy

Creating a Connecticut corporation is easy. as a rule, this is a simple process, consisting in the simple filing of the memorandum of association of the statemy secretary. In this guide, we will show you step by step how to create a corporation in Connecticut. Instead

CT LLC. CT Corporations Now that we’ve covered all the key characteristics between LLCs and corporations, it’s time to look at the specifics of why a Connecticut Corporation or a Connecticut LLC might be better for your business. Each iteration has its own statutes and therefore tax laws governing its suppliers, and these unique details should be considered when choosing an individual business entity. The information in this article contains this data for Connecticut LLC and Connecticut Corporation.