The EIN stands for Employer Identification Number and is issued by the IRS in connection with your Connecticut LLC. The EIN refers to your LLC in Connecticut, which is the social security number for an individual. This allows the IRS to identify your business for encumbrance and registration purposes.

Steps To Obtain A Connecticut Taxpayer Identification Number (EIN):

Your first step should be to collect all the messages you need to complete the tax identification task. It won’t take long to apply, but the problem will be solved much faster (and stressful) if you have all the information in front of you, rather than researching it as needed.

How do I find my CT EIN number?

Connecticut Tax Registration Number: Your Connecticut tax registration number can be 10 or 11 digits long.

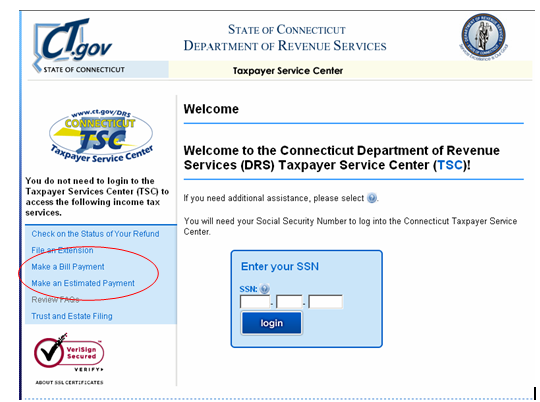

Connecticut Taxpayer Identification Number

In addition to your Taxpayer Identification Number,For the state of Connecticut (EIN), you will most likely also need a Connecticut tax identification number. This ID is required in order to pay corporate taxes, receive government taxes, and/or collect sales taxes on the equipment you sell. Typically, a State Tax Identification Number is used to:

Using A Connecticut Taxpayer Identification Number (EIN)

Getting a Connecticut Taxpayer Identification Number (EIN) is a process that many companies trust . real estate, non-profit organizations and religious groups must be completed. Even businesses and organizations that are not required to obtain a Connecticut taxpayer identification number (EIN) are encouraged to attempt to obtain individuals’ personal information by simply allowing them to use their taxpayer identification number (EIN) instead of their own. number in various activities required for the operation of your business or organization, including receivedNo local licenses or permits from Connecticut. Any business that meets any of the following criteria must obtain a Connecticut Taxpayer Identification Number (EIN): name. It’s always a good idea to choose a name that probably doesn’t look like any other registered business due to federal and state privacy laws. To verify that your financial name is available, search one of the following government databases:

Select Company Name

If you are self-employed, you can also select a region in Connecticut. create under your own arrest name or a fictitious company name. If you choose a fictitious name for your business, it must be different from the names of other merged companies and common government signs.

How To Read A Company Name In CT?

In Connecticut, the search name is included.You can be contacted at (860) 509-6200. With that in mind, how do you check if a company name goes through Connecticut? Just go to the free company name search tool and enter your display company name. You can also do any type of Connecticut business search on the state PC, which will tell you if there are any other duplicate corporations or LLCs in the state.

Creating a Connecticut LLC is very easy

Creating a Connecticut LLC is very easy

p> h2>To form an LLC in Connecticut, you must then file a Certificate of Organization with the Secretary of State of Connecticut, which costs $120. You can apply online, by mail, or in person. The entity associated with the certificate is the legal document you previously registered the LLC in Connecticut with.

How do I get a tax ID number for an LLC in CT?

Want to choose your Connecticut Taxpayer Identification Number (EIN)? This Quick Guide to Applying for a Connecticut Taxpayer Identification Number will walk you through the basic steps you need to follow to apply for a Connecticut Taxpayer Identification Number.Get a Connecticut Taxpayer Identification Number (EIN). Whether you’re a true partnership, a multi-member LLC, a corporation, a non-profit organization, or a trust, this guide will help you understand what you need to know to get an official IRS tax identification number in minutes. apply.

How do I find a company’s EIN number?

Most people already know their Social Security number by heart, but not all entrepreneurs already know their tax number. Your EIN is not something you use on a daily basis, so remembering this number is not as easy as remembering the phone number or address of the best company.

Do I need a CT Tax Registration Number?

Use this app when a person starts a new business and needs to receive a tax filing amount in Connecticut. See Reason for Inclusion for more information.