Annual Return

The State of Connecticut requires you to file an annual return for your LLC. The annual return is accepted locally, or notices are automatically sent to your LLC mailing address. You can submit any annual return online at the SOTS Store. The annual return must be submitted at the end of the anniversary month of incorporation for all of your LLCs. Currently, the application fee is often $20.

How long does it take for an LLC to be approved in CT?

You can get a great Connecticut LLC in 4 stores if you apply online (or 5-6 days if you apply by mail). When people need your Connecticut LLC faster, pay for faster processing.

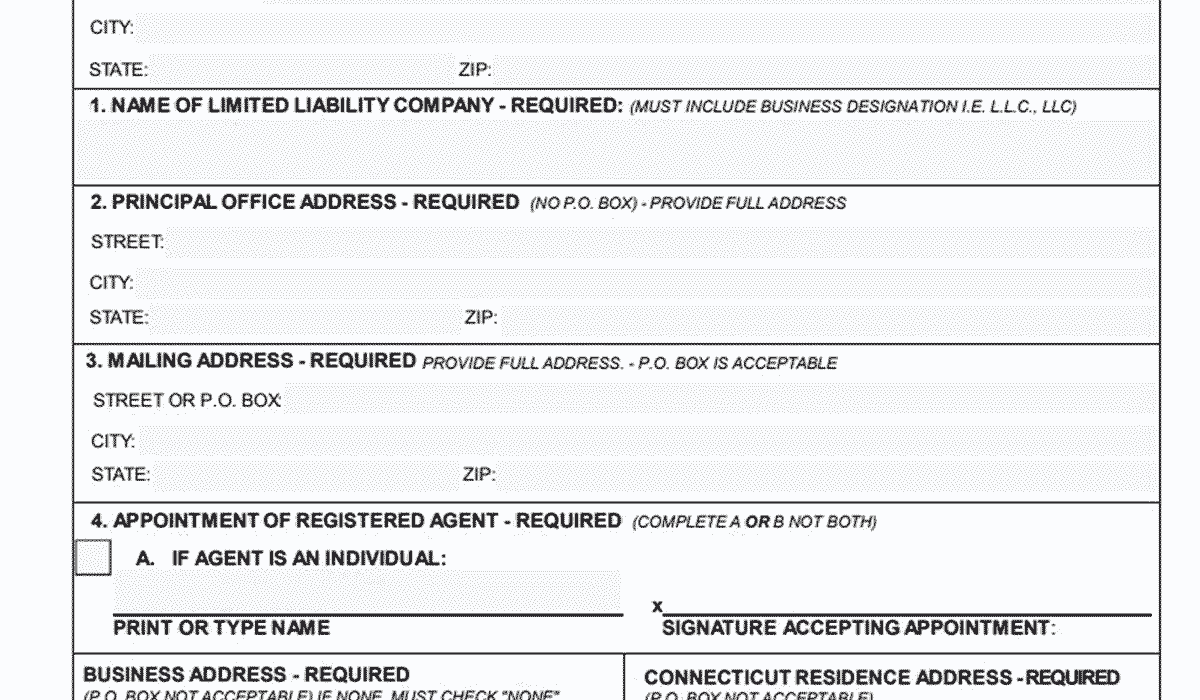

Choose A Name For Your LLC

According to Connecticut law, the name of an LLC must include my words “Limited Liability Corporation”, acronyms “LLC” or “L.L.C.” The words “Limited” can be abbreviated as “Ltd” and the entire word “Company” as “Co.”

LLC Forms And Fees

To register an LLC, your family needs willDo not fill out detailed forms, which must be sent along with other registration fees required to form it, to the Secretary of State’s office to guarantee most day-to-day expenses.

It Is Very Easy To Form An LLC In Connecticut

To form an LLC in Connecticut, you must meet with the Secretary of State of Connecticut and request a Certificate of Organization, which costs $120, by mail or in the Certificate of Organization, which is the legal document that formally incorporates most of the Connecticut Limited Burst Company.

Can I Reserve A Business Name In Connecticut?

Yes. If you’re not yet ready to formally register your favorite LLC, you can reserve your business name for up to 120 days by submitting a Company Name Reservation Request to the Secretary of State of Connecticut for $60 in filing fees.

Connecticut Annual Return Deadlines And Fees

Connecticut Annual Return Deadlines and Fees vary by business type. Com?Denmark, Connecticut nonprofits, LPs, and even LLPs will announce their birthdays on this day. Can’t remember when you recorded your sales? You can easily find it by searching the Connecticut Business Database. Limited Liability Companies in Connecticut must file by March 31 of each year.

Fast Facts: Budget And Timetable

Here’s an overview of all required paperwork, expenses, and business hours. for this Connecticut LLC. Be sure to read the last paragraph Guide – “Current Views” – to be able to understand your current expenses to track nice Connecticut LLC.

Before Forming An LLC In Connecticut

In the early stages of registering an LLC anywhere in Connecticut, there are some very important things you need to manage. The following sections explain what buyers need to consider before proceeding with their incorporation business.

Filing The Articles Of Incorporation

You can now file the Articles of Incorporation with the SecretaryConnecticut’s assistant to legally register your LLC near the state. You have the option to submit the certificate online or by mail, and the filing fee is definitely $120. Payment of fees must be made by credit card upon completion. you need to decide why a Connecticut LLC or a Connecticut Corporation would be more attractive to your business. Each state has its own laws and taxes that determine the success of their business, and these unique details should be considered when choosing a business. The information in this section contains this data for Connecticut LLC and Connecticut Corporation.

Do you have to renew LLC Every year CT?

Every LLC in Connecticut is required to file a large annual return every year.