(c) The Certificate of Authorization must identify all New Jersey licensees responsible for my professional engineering and/or professional surveying assignments and LLC solutions.

Copies Of Company Documents, Including Copies Of Annual Reports

You may have photocopies of company documents and company business documents. This includes original and modified records as well as registered bureaus/exchangers. You may also receive copies of the unit’s annual returns that have been filed.

How do I get a certificate of Authority in NJ?

Many businesses actually have an individual or physical address in the new state. SEO matches our dialed address registered locally in your certification programs the requirements of your state. Plus, you get true daily document scanning from our local office in all 50 states and the District of Columbia?. Our agent services are charged at a flat rate of $99. per year and you can easily order our service with any impact certificate.

Who Needs A New Jersey State Authority Certificate?

New Jersey law requires that you obtain a valid legal document to collect sales if your New Jersey business generates income from any of the following activities: retail sale, rental, or use of certain personal or proprietary digital data; retail stores for the manufacture, manufacture, processing, installation, maintenance, loading and maintenance of tangible personal property or digitized property; maintenance, maintenance or repair of specific?an asset; some direct mail services; tattoo, solarium and therapeutic services; investigative and security services; manual services; limousine service; Sale of restaurant dishes and ready meals; hotel and bed and breakfast rentals; certain entry fees; certain group fees; Parking Fee; warehouse services; sale of brochures and magazines; Send; and telecommunications service providers unless otherwise required by sales and use tax laws.

DO I NEED A NEW JERSEY SALES TAX PERMIT?

They need a sales tax permit and therefore must comply with tax laws. state of New Jersey. Nexus will certainly be activated by a physical or global financial presence.

What Is A New Jersey Certificate Authority?

must be affiliated with companies that help register with the New Jersey Department of Revenue before doing business in New Jersey. Out-of-State Businesses Usually Request Agency CertificationNew Jersey. This will register the industry as a foreign company and eliminate the need to create a new company.

Get A New Jersey Resale License

If your company orders discontinued products and then sells them to others, you can avoid paying taxes on the products you purchase by getting licensed Certificate of Resale in New Jersey. The most important tip for reselling your certificate is organizing your business, which must be done by the New Jersey Internal Revenue Service.

Certificate Verification

You can view any certificate issued by any part of the department that contains a clarification Numbers stamped with their state of New Jersey. To validate a certificate Authorization may be required to use the document’s tracking number. This application is not available suitable for certificates containing a gold embossed seal.

If You Need To Collect Sales Tax In The State Of New Jersey

In New Jersey sales taxeslevied on the sale of tangible goods and certain services. The tax is considered collected by the seller and remitted to the state tax authorities. The seller acts knowing they are the de facto tax collector.

Registration Information

Starting a new business in Connecticut?In addition to the DRS-related information below, visit Connecticut’s new online checklist tool, which sometimes includes information from various government agencies, creating a personalized checklist to help clients get started. From

Example Copies

Although the term is no longer used at the comptroller’s headquarters, it is sometimes used to refer to a certificate issued by the Comptroller of the State of Texas Public Accounts in respect of a franchise tax account balance. The Comptroller’s Home Office now refers to these certificates as “Certificates of Payment”. Certificate information similar to account status is available from our own controller. You can also ask for help from the controller on ?Phone (800) 252-1381.

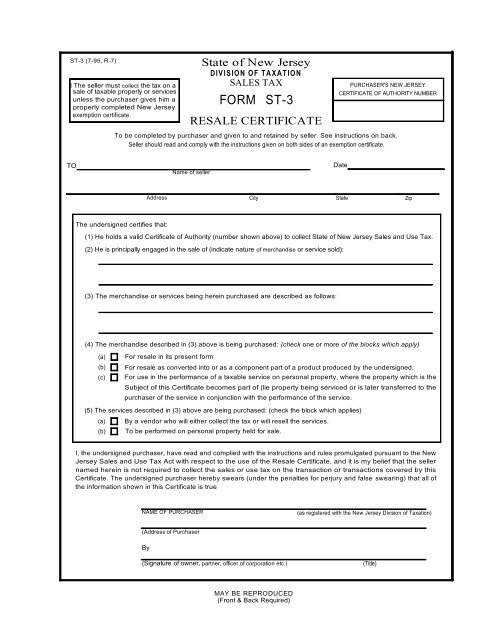

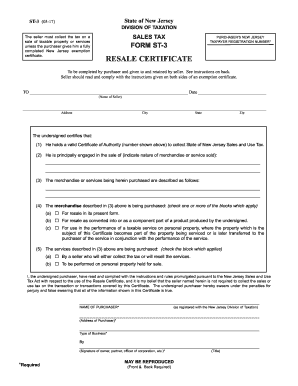

Do you need a resale certificate in NJ?

If your business buys items for resale or buys items that include items such as items for resale, you must complete a Certificate of Resale and provide it to your supplier. Resale certificates allow your business to purchase used goods without paying sales tax. Sales tax, of course, should only be levied if the goods were sold at retail. Registered businesses can access the resale certificate online.

How do I get a NJ Sales Tax ID?

Do I need a New Jersey VAT number? If yes, how can I get it?Anyone who retails in this state is doing business in New Jersey and must comply with applicable tax laws. In the State of New Jersey, all truckers, including seasonal businesses and one-time suppliers, must register with the State for tax returns at least 15 business days prior to commencement of work and collect New Jersey sales tax on all sales of taxable fixed personal goods or services. There are no special provisions for temporary suppliers. After the disclosure of informationand you must file all required returns until you terminate your registration as a tax officer in the State of New Jersey.

What is a New Jersey sales tax certificate of authority?

New Jersey law generally requires that you obtain a sales tax eligibility certificate if your New Jersey business model generates income from activities such as: retailing, renting, or using tangible digital personal property. property; Retail trade with production, manufacture,

How do I obtain a New Jersey Certificate of authority?

You can easily obtain your New Jersey certificate, which is most often associated with an agency, online through the New Jersey Online Business Registration Service website. If you have questions about applying for a permit online, you can contact the Ministry of Finance by phone.Call (609) 292-9292 for sales tax help or visit the Make it Possible website.

How do I get a sales tax license in NJ?

To obtain a New Jersey Certificate of Eligibility: You can obtain a Certificate of Authorization for Sales Tax by completing Form NJ-REG or by using the New Jersey Tax/Employer Registration Online Interface. Before you begin, you must have a registered business organization and a valid federal EIN.

How to complete the ST-3 resale certificate form in New Jersey?

Therefore, you can fill out the ST-3 Resale License Form with your New Jersey tax clearance number. ? STEP 1: Complete the New Jersey Sale and Use the Tax Registration