An LLC in Massachusetts is similar to a corporation, but less formal. Owners are sent as “members” and owners coming from all companies are their “shareholders”. LLC members are taxed as a corporation, partnership, or S Corp, with salaries flowing from the LLC to our LLC members.

Incorporation

In Massachusetts, there is a slightly more complex form of corporation. First, one or more persons (the “Founder”) must prepare, complete and sign articles (“Articles”) about the bodycompany ization. See M.G.L. Celsius. 156D sec 2.01. The articles are the typical founding document for any corporation and consist of eight (8) articles:

LLC Or S Corp: Which Is Better In Massachusetts?

S Corp refers to a corporation that appears to be taxed under subsection S of the Internal Revenue Code (IRC). When comparing the pros and cons of choosing an S Corp, consider tax laws, your company’s income, and the rules that no doubt apply to business structures in your country. As a business owner, you might see tax reserves on your personal tax return if you file for an S corporation instead of an LLC in Massachusetts.

Best Choice For Small Businesses

Usually an LLC is best choice for small businesses like S Corp. Indeed, for small businesses, corporate formalities, such as the adoption of a charter and the holding of general meetings, are onerous. An LLC must follow certain social standards, such as membership and issuance of shares in all major corporate decisions, but these rules are less strict than those of a good, solid corporation.

Afterdiscussion, you will see that, in general, the characteristics of all SARLs and companies then apply. Next, we will look at some of the features that distinguish Massachusetts LLC or Massachusetts Corporation from other provinces, which brings us to the answer to the question of which corporation is best for your business. Each state has its own laws and tax laws that govern the performance of their business, and these unique details should be considered when choosing your business. The guidance in this section describes these aspects for Massachusetts LLC and Massachusetts Corporation.

What is the difference between an LLC and C Corp?

LLCs avoid the double taxation that C corporations also have to pay because they transfer all of the company’s income to the financial income of the individual owners. A C-Corporation (or C-Corp) is a legal entity for a corporation in which you or your shareholders are taxed separately from the current legal entity.

The Steps Of Forming An LLC And Choosing S Corp Status In Massachusetts

Creating your own Massachusetts LLC and choosing S Corp tax status is easy . You can use our journals to register an LLC with S corp status yourself, or you can contact a service provider like ZenBusiness to help you through the process.

Benefit #2: Incentives – Massachusetts Business Support Programs

Once you register a new marketplace in Massachusetts, you can allow it to participate in variouspersonal business incentive programs established by additional federal, state and local governments. Check out some of the best programs to help your business:

Corporation Ownership Vs. LLC

The owners of corporations are called shareholders. The company issues shares, and each individual shareholder owns a number of shares corresponding to his share, most often associated with ownership. So if a company issues 1,000 shares and owns shares, you own half of the online business, then you have 500 shares.

Massachusetts Articles Of Incorporation

In Massachusetts, you can relatively recently, a simple process by which you can convert a personal business from a corporation to an LLC by first completing some basic Commonwealth Secretary (SOC) forms. This process, technically known as “statutory conversion”, automatically transfers the assets and liabilities of your business to this new LLC. Unlike other conversion types, it involves only one business entity and you do not need to createseparate LLC before a change can occur. Also, by the same symbol, there is no need to dissolve your current corporation as it is considered to be incorporated in a new form through an LLC. The conversion procedure is still largely codified in chapter 156D, sections 9.50 through 9.56 of the Massachusetts General Laws (MGL).

Prior To Registering Your Limited Company In Massachusetts

in Face In the early stages of filing an LLC in Massachusetts, there are a few important things to look out for. Please review the specific sections below to learn what you need to do before starting your own LLC.

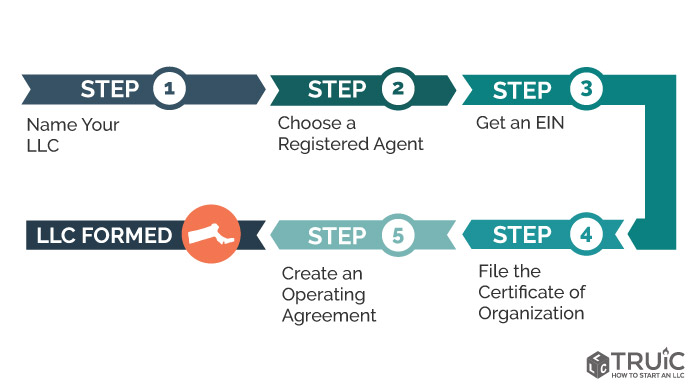

How To Start An LLC In Massachusetts

Starting a new LLC company comes with an absolute variety of challenges. Below are some of the important steps you need to take to ensure your business is eligible if you choose to form an LLC in Massachusetts. For more information on setting up an LLC for your business, check out our webinar “What You Need to Know When Making a Decision”I’m talking about registering a small business.”

Is an LLC a corporation in Massachusetts?

Like corporations, LLCs are created:

Is it better to be as corp or LLC?

LLCs are popular because they can offer similar responsibilities to your own business, but they are easier to grow and have fewer regulatory requirements than some other types of businesses. LLC allows special liability protection, which means thatReditors cannot access the owner’s personal assets. An LLC also allows for direct taxation, meaning business income or loss is recorded and taxed based on the owner’s personal tax return. LLCs are undoubtedly beneficial for individual entrepreneurs and partnerships. An LLC with multiple owners will be taxed as a partnership, which means that each owner will be required to report profits and losses on their emergency tax return.

Why would I want a corporation vs an LLC?

Remember that if a corporation has fewer than 100 shareholders, it can apply to select an S corporation. This is a fee status that allows the corporation to be treated as a through entity, albeit larger than an LLC. This can be a professional option for companies wishing to remain taxed as an LLC, but also some of the extra paperwork that a partnership offers. The S Corporation designation now allows for taxation (no corporate tax), but there are currently certain requirements for any type of S Corp qualification, which may limit their software to a single company.

Is an an LLP or LLC a corporation for Massachusetts tax purposes?

LLP or LLC consideredTreated as corporations for Massachusetts income tax purposes if they are classified as such for federal sales tax purposes.

What is the difference between a corporation and a limited liability company?

The business is also permanent from the perspective of the owners, which means that the business will continue to exist even if the individual leaves or separates from the business. A limited liability company (LLC) has the ability to distribute its share among its members, regardless of the member’s debt contributions to the LLC.

Should I form a corporation or LLC for my business?

As a rule, most entrepreneurs prefer to register a corporation or a limited liability company (LLC). The main difference between an LLC and a corporation is that a powerful LLC is owned by one or more men and women, while a corporation is owned by shareholders. Whichever organization you create, both organizations offer great benefits for certain businesses.