Although limited partnerships, limited partnerships, and full partnerships formed in Delaware do not file any annual returns, they must pay an annual fee of $300. Registration taxes for these companies must be paid no later than June 1 of each year. The penalty for non-payment or late payment is $200.

Click Here To Pay Your Taxes Or File Your Annual Return

This app will likely be available between 8:00 AM and 11:45 AM EST every day. Use only the English version of the characters when entering dates, as this can result in an inaccurate entry on your amazing annual return.

Delaware Annual And Due Dates And Fees For Delaware Statement And Franchise Taxes

* All Local Delaware Corporations ?Must File An Annual Return And Pay An Annual Franchise Tax. The Ad Offers Two Methods For Calculating The Best Total Franchise Tax And Encourages You To Use The Method That Results In The Most Debt. Which Will Never Be Less Than $175 And More Than $200,000. Below Is A Breakdown Of The Two Events For Calculating Franchise Tax.Delaware Annual Franchise Tax

The Delaware Annual Franchise Tax is a tax levied under Delaware law. The duty authorizes the ownership of a corporation in Delaware. Its purpose is to maintain a good reputation for your business.

Delaware Annual Report Information

Businesses and non-profit organizations are required to file annual returns in order to maintain a good reputation in society. Foreign Secretary. Annual returns are required in most states. Deadlines and fees vary by state and, in addition, the type of the entity.

How do I calculate Delaware franchise tax?

Corporate Franchise Tax

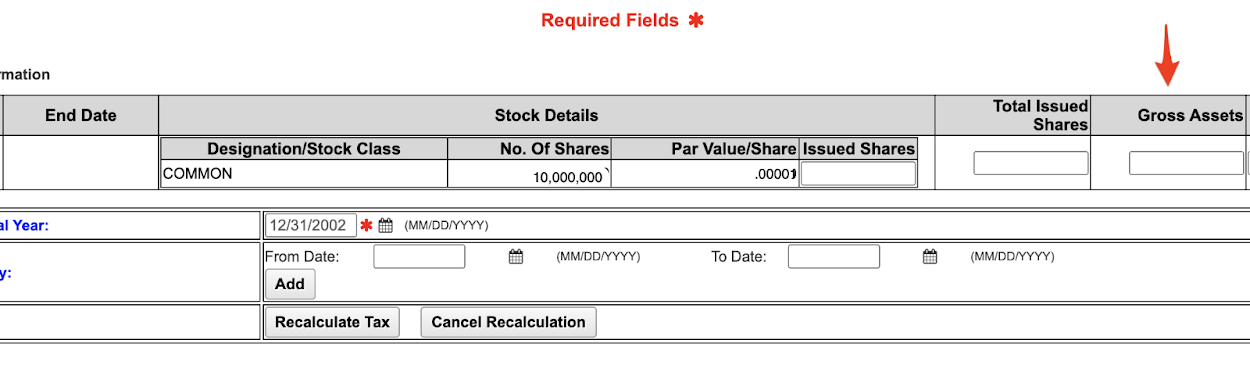

All corporations registered inDelaware are required to file an annual franchise tax return and pay the tax deductible. Religious and non-government non-profit corporations are generally exempt from taxes, but must file an annual balance sheet. Taxes and annual returns must be received by March 1 of each year. The minimum property tax is $175 and the maximum is $200,000. Taxpayers owing more than $5,000 pay taxes quarterly at rates of 40% by September 1, 20% by September 1, 20% by December 1, and the rest by March 1.

Annual Report:

In addition to registration fees, a local corporation (meaning a Delaware corporation) must pay a Delaware franchise tax every twelve months until March 1st. There are two methods for calculating taxes: 1) permitted proportions and method; 2) the method of the estimated nominal value of capital. The company seems to have a choice of which method to consider. Delaware provides a per-person calculation using the allowed method.shares, but each taxpayer must actually calculate their tax benefit using the notional nominal value method (and use the Weil method if that results in a less expensive tax).

What Is The Delaware Franchise Tax?

Franchise “tax” is often misunderstood to mean that the fee is based on income or capitalization, but this is not the case for a Delaware LLC. Franchise Tax Bill. This can best be understood as a reasonable one-time “service fee” to provide legal protection for an LLC in Delaware. The State of Delaware requires any LLC registered in the state to pay a flat fee of approximately $300 per year to remain in good standing, regardless of its business activities.

The Delaware Franchise Is A Redefinition Calculator

H2> Don’t Worry If The Methods Above Seem A Little Complicated. Delaware Offers A Handy Spreadsheet Calculator That You Can Download Here. (To Get Started, Right-click This Webaddress, Then Select Save As, Open The .xls File, And Use A Spreadsheet Application On Your Netbook Such As Excel Or Numbers.)

Delaware Franchise Tax Department Contact Information

If you have questions about your LLC’s annual franchise tax, you can contact the Franchise Tax Department at 302-739-3073 (option 3). Their hours of operation are Monday through Friday, 8:00 am to 4:30 pm ET.

Is there an annual fee for an LLC in Delaware?

Foreign corporations must file an annual return with the Delaware Secretary of State by June 30 every twelve months. A registration fee of $125.00 is required if you wish to be paid. Failure to receive the annual return by the due date will result in a $125 fine plus filing fees.

How do I avoid franchise tax in Delaware?

The Delaware Franchise Tax is a tax levied by the State of Delaware on those who own a business there and is generally necessary to keep the business in good standing. 8 minutes of reading.

What is the minimum franchise tax in Delaware?

Beginning January 1, 2018, a local corporation incorporated in Delaware or a nonprofit corporation incorporated solely as incorporated will be required to file franchise tax once a year. The minimum tax is typically $175 for corporations using a permitted share structure and a minimum of $400 for corporations using the notional nominal value method. All corporations using either method have a maximum tax of $200,000. Businesses that owe $5,000.00 or more earn settlement media?You, with 40% due on June 1st, 20% on September 1st, 20% on December 1st and the remainder on March 1st.

Are Delaware corporations subject to franchise tax?

How much does it cost to open a franchise in Delaware?

How much does it cost to file Delaware business taxes?