If anyone has any questions about obtaining an EIN for your Delaware corporation or requesting a 147C letter from the IRS, please feel free to contact us at 800-345-2677 or email [email protected] with your questions.

How do I find my Delaware EIN number?

To find your Delaware tax identification number, you must participate in a state search.Search Site: https://icis.corp.delaware.gov/Ecorp/EntitySearch/NameSearch.aspx.

Steps To Obtain A Delaware Tax Identification Number (EIN):

Most potential or new business owners want their business up and running as soon as possible, but before you can do that, you need a VAT number. Therefore, in your intheresies to get this identity tax as easy as possible.

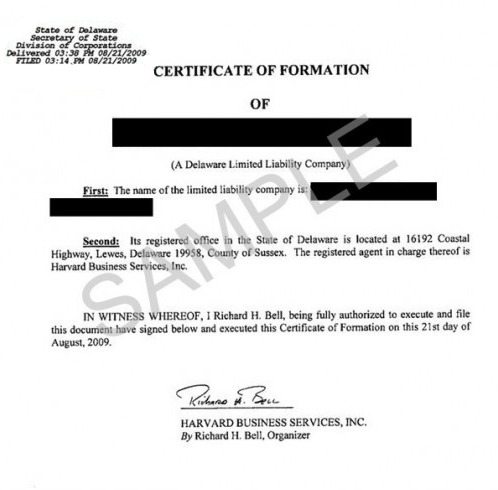

Wait For Your Delaware Limited Liability Company To Be Approved.

Wait for your Delaware Limited Liability Company to be approved by the Secretary of State before applying for your EIN. Otherwise, just as your LLC application will be rejected, you will have an amazing EIN attached to a non-existent LLC.

(USA) Delaware Employment Identification Number (EIN)

Identifier The Employer Number is also known as the Federal Tax Identification Number and is used to permanently identify an entity in Delaware. An Employer Identification Number is a nine-digit telephone number that is assigned for filing corporate income tax returns.

What Is An EIN?

An Employer Identification Number (EIN), also referred to as a federal tax identification number, is the main true identification number of a business organizationtion. An EIN is not the same as the specific registration number that the subsidiary state of Delaware assigns to each new legal entity. EIN must be filed separately based on documents filed in Delaware and directly with you, the IRS.

How To Get An EIN

Offshore an Company Corp offers the service at a low cost. the cost of helping one person to obtain a tax identification number for our business from the IRS. This quick yet simple service avoids the often confusing IRS forms and processes and includes professional customer support.

Delaware Taxpayer ID

In addition to obtaining a Delaware Federal Taxpayer Identification Number. (EIN), you will probably also need a Delaware tax ID. This is necessary to pay financial, state income tax, and/or sales tax on the items you sell. Typically, a state tax identification number is commonly used to:

Use A State Tax Identification NumberThe Delaware Exceptional Taxpayer Identification Number (EIN) Receivable Is A Complex Corporate Transaction. , Trusts, Estates, Non-profit Organizations, I.e. Organizations To Staff The Church. In Addition, Businesses And Organizations That Are Not Required To Obtain A Delaware Taxpayer Identification Number (EIN) Are Encouraged To Obtain One As It Will Certainly Help Protect The Personal Information Of Certain Individuals While Allowing Them To Use An Personal Taxpayer Identification Number (EIN) Allows You To Use His Social Security Number In Various Activities Required For The Operation Of His Business Or Organization, Including Experience With Local Licenses And Permits From The State Of Delaware. Anyone Answering “yes” Is One Of The Criteria Required To Obtain A Delaware Tax Identification Number (EIN):

Start Your LLC Easily

Creating an LLC is a checkbox that just needs to be ticked. Simple, fast and hassle-free. We willLet’s go behind the scenes on 13 of the most popular GmbH incorporation service providers to find out who really needs something to recognize new founders. Our recommendation:

Register Your Delaware Nonprofit Corporation

To register a Delaware Nonprofit Corporation, you must first register as a Delaware Nonprofit Corporation. Unlike the states, there is no broken law for non-profit corporations. Instead, the Delaware General Law Corporation (DGCL) applies to for-profit and non-profit organizations. Under the DGCL, nonprofit corporations are organized in the same way as any unincorporated corporation, known as an “exempt corporation.”

The Benefits Of Incorporating In Delaware

Deciding to Register Your Corporation in Delaware offers several benefits. For starters, Delaware offers a selection of the nation’s most modern and business-friendly laws. These by-laws describe the incorporation and operation of corporationsMuch faster than other states, so you’d better study the Delaware Constitution carefully.

What is the state of Delaware EIN number?

Apply for a Delaware Tax Identification Number (EIN)? Learn more about filing online in this quick guide to applying for a Delaware tax ID. You may be required to provide personal information to each of your affiliates, even if you are a non-profit organization, corporation, joint venture, trust, partnership or LLC with multiple members. Get more control when applying for a Delaware Official Tax Identification Number (EIN).

Do I need an EIN in Delaware?

You may be wondering, “Do I need an effective EIN for my LLC?” An individual member of an LLC can either use a Social Security Number (SSN) to conduct business or be assigned an Employer Identification Number (EIN). An EIN is required for LLCs with multiple members or in cases where you plan to have employees. An EIN can be your group identification number, much like a social security number for a department.great person.

How do I find a company’s EIN number?

Most people know their Internet Identification Number by heart, but entrepreneurs do not fully know their Taxpayer Identification Number. Your EIN is not something that a person uses on a daily basis, so remembering this number is not as easy as remembering your work phone number or just your business address.

How to get an EIN number in Delaware?

How do I verify my Ein number?

How to find Ein numbers for free?

Where can you find a college’s Ein number?