Delaware LLC franchise taxes are due by June 1 of each year. Franchise Tax for Limited Liability Partnerships (LP) is also due in June per person each year. If the tax is not normally paid by June 3, the state imposes a $200 late fee plus a 1.5% monthly interest fee.

Click Here To Pay Your Tax File/annual Return

This application can be accessed daily from 8:00 AM to 11:45 PM EST. When entering data, use only characters from the English version, as this may also lead to inaccurate data in the annual report.

How do you pay Delaware franchise tax?

The Delaware franchise tax is due March 1, 2022.

Delaware Franchise Tax

Tax our own state of Delaware. The tax allows you to control a corporation in Delaware. Its purpose has always been to ensure that your business has a very good reputation.

Corporate Franchise Tax

All Delaware corporations are required to file an annual franchise tax return. and an effective franchise tax. Religious associations with non-profit non-state corporations are currently exempt from taxes, but are required to file an annual tax return.Fees and annual returns must be received by March 1 of each year. The minimum tax is $175 and the maximum is $200,000. Taxpayers with more than $5,000 in debt pay taxes quarterly: 40% by June 6, 20% by September 1, 20% by December 1, and the remainder by March 1.

Delaware Annual Report Information

Businesses and non-profit organizations are required to submit annual reports to maintain their good reputation. with a government administrator. Annual returns are required in most states. Repayment terms and commissions vary by state and enter the associated object.

What Is The Delaware Franchise Tax?

The franchise “tax” is often misunderstood to mean that the commission is calculated based on payment or capitalization, but this is not the case for Delaware Franchise Tax LLC. This can best be understood as a smaller “service fee” for the privilege of seeking legal protection from a Delaware LLC. The State of Delaware requires thatWe each LLC registered with Assert paid a flat fee of approximately $300 per year to maintain a good reputation, regardless of business activity.

Delaware Franchise Tax Department Contact Information

H2>If You Have Questions About LLC Annual Franchise Taxes, Please Contact The Franchise Tax Department At 302-739-3073 (option 3). Their Hours Of Operation Are 8:00 AM To 4:30 PM ET, Monday Through Friday.

Franchise Tax And Delaware Annual Tax

Franchise Tax is a state tax, which , traders have the right to conduct business and trade legally in this scale. This is a determining factor in the privilege of having your organization registered legally and maintaining a good reputation in Delaware. Your franchise tax is determined by the nature of your business, not by business income.

Delaware Annual Return And Franchise Tax And Fee Due Dates

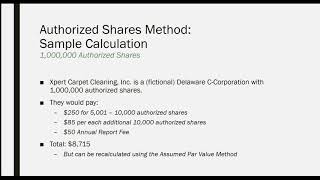

* All local Delaware businesses are required to file an annual report AND pay an annual franchise fee. The state offers two ?Method for calculating your total series tax and recommends that you use the method that yields the lowest total debt. It will never be much less than $175 or more than $200,000. Below is a breakdown of the two processes for calculating the franchise tax.

What Is The Franchise Tax?

Is the franchise tax what the LLC charges the state? s, partnerships and corporations for the opportunity to do business or start a business in this state. They have the same conductors, which they are taxed annually, and with them the tax evasion in the state of Delaware or other late payment of taxes. This will likely deter the company from doing business or operating in that state.

Franchise Tax Annual Report:

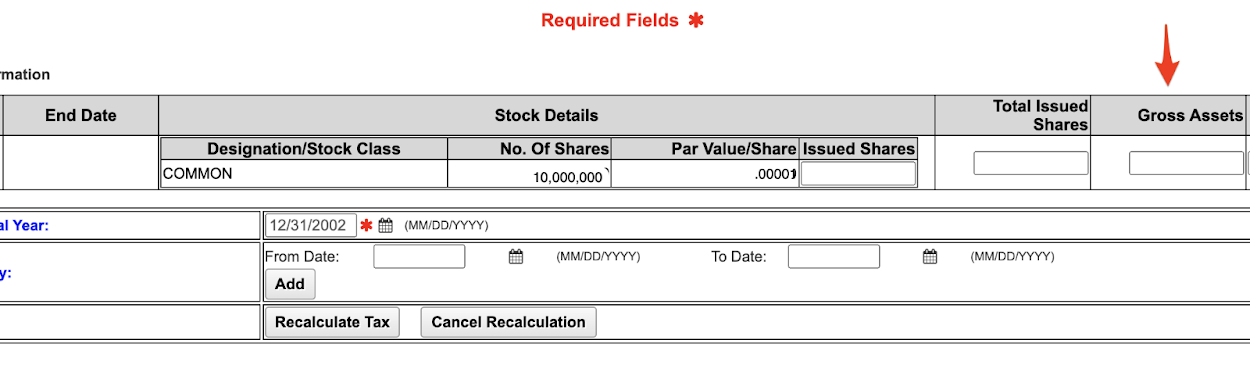

In addition to paying the fine, the national company (see registered business) must pay Delaware franchise tax by March each year. There are two methods for calculating tax on individuals: 1) share method; and 2) the primary notional cost method. Businesses have a choice of which method to use. Delaware provides correct calculation ?For each taxpayer using the allowable share method, but each taxpayer may calculate their franchise operating tax using the notional nominal value method (and use that method if it results in a lower tax). ).

Is there a franchise tax in Delaware?

Corporations incorporated throughout Delaware but not doing business in Delaware are not subject to corporate income tax [30 Del.C, Section 1902(b)(6)], but must pay taxper franchise established by any State Department administered by Delaware. .

Are Delaware franchise taxes paid in arrears?

If you are a startup that has chosen Delaware as its growth state, you probably know that you are subject to the Delaware franchise tax. While this excellent article provides an overview of the Delaware franchise tax, startups based in other states or doing business in other states should be aware that they may also be subject to franchise tax in those states. While a simple franchise tax is based on the net worth or equity of an entity, the tax can also be based on other criteria such as income or gross receipts.