Who Must File Delaware franchise tax?

Corporations incorporated in Delaware but not doing business in Delaware are not subject to corporate income tax [30 Del.C, Section 1902(b)(6)], but are able to pay franchise taxes, which are often imposed by Delaware. – administered by the State Department.

Click Here To Pay Your Taxes Or File Your Annual Return

This application is likely to be available?? 8:00 am to 11:45 am EST every day. When entering data, use only the English version of the characters, as this may result in inaccuracies in the annual report.

Delaware Annual Report And Due Dates

*All Delaware Domestic Corporations must file an annual tax AND pay an annual franchise tax. The proposals detail two methods for calculating your household’s total excess tax and suggest that you use the method that results in our lowest debt amount. which in no case shall be less than $175 and more than $200,000. Below is a breakdown of the decisions for calculating franchise tax.

What Is The Delaware Franchise Tax?

The Delaware Franchise Tax is levied by the State of Delaware on the ownership of a corporation in Delaware. The tax does not affect the profits or operations of the company. The tax is certainly necessary to maintain the good reputation of the Delaware corporation and the privilege of owning the Delaware corporation. The tax does not affect the seller’s business or income; it is only requiredto the State of Delaware to maintain the good standing of your company.

Contact Information For The Delaware Department Of Tax Benefits

If you have any questions about your LLC’s annual tax credit, you can contact with the Tax Deductions Department at 302-739-3073 (option 3). Their hours of operation are 8:00 AM to 4:30 PM ET, Monday through Friday.

Franchise Annual Tax Report:

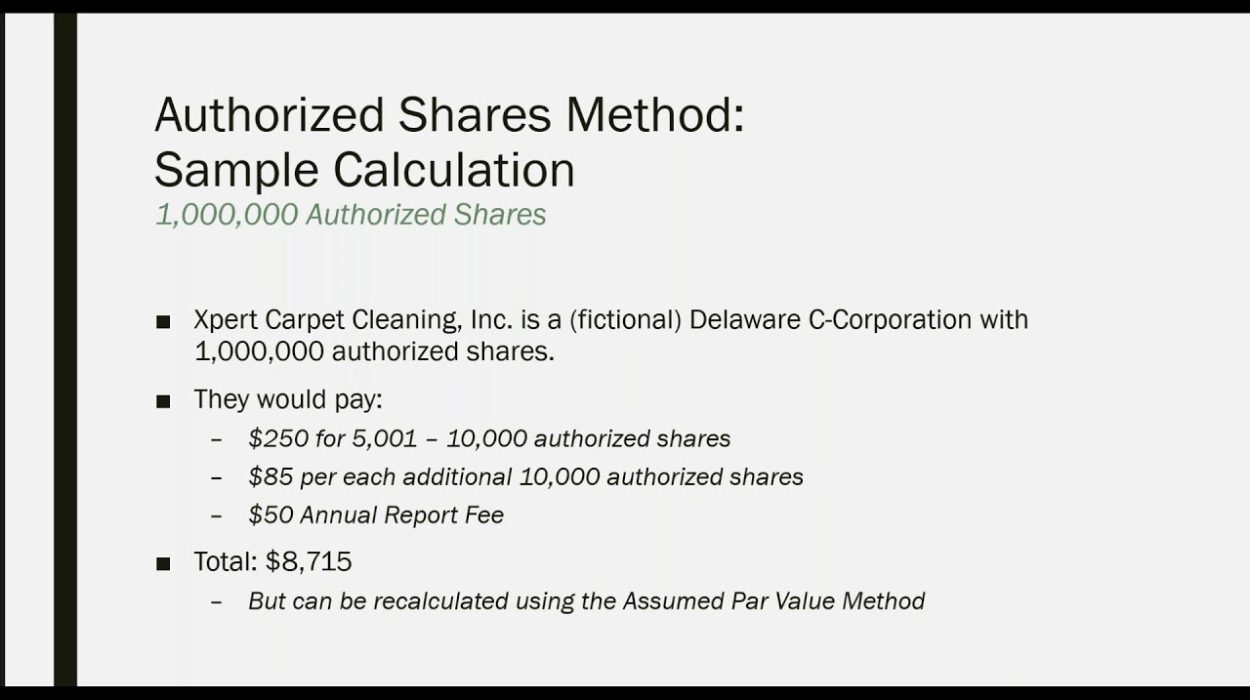

In addition to the registration fee, a local corporation ( applies to a Delaware absolute corporation) must pay its own Delaware franchise tax by March 8 of each year. There are two methods for calculating tax: 1) the method of permitted shares and; 2) the method of conditional nominal value of capital. The company has a choice of method to be used. Delaware offers each taxpayer a calculation that uses the strictly permitted shares method, but each taxpayer may also calculate their franchise tax using the notional nominal value method (and use that method if itleading to tax cuts). ).

Annual Tax

Assembly Bill 85 provides for an annual tax exemption of $800.00 during the first year for limited close relationships, limited partnership corporations, and limited partnership services. liability, organization, or registration in California. who appoint the Secretary of State on or after January 1, 2021, and before January 1, 2024

How are Delaware franchise taxes calculated?

All Delaware businesses are required to pay an annual franchise tax to the state. If you’ve received a notice from the State of Delaware that your small startup must pay tens of thousands of dollars in corporate taxes, don’t panic. Delaware defaults to one that is usually much more expensive than the other. Note. This information is current as of April 19, 2022.

How do I avoid franchise tax in Delaware?

The Delaware Franchise Fee is a tax levied by the State of Delaware on the right to do business there, which is necessary to maintain the good reputation of the business.

Do I owe Delaware franchise tax?

If you are ready to file and pay your Delaware franchise tax now, see our Net Franchise Tax Form. BUT