Failure to pay franchise tax on time will result in a $200 fine and interest charges that are estimated by the state and Delaware at 1.5% on the correct month. It will also prevent the institution from obtaining a certificate of good ascension and may result in the state declaring your company invalid.

Click Here To Pay Your Taxes Or File Your Annual Return

This app is available daily from 8:00 am to 11:45 am EST. When entering data, use only the English version of the characters, otherwise you may get an incorrect entry in the annual report. Step:

How do you pay Delaware franchise tax?

The Delaware franchise tax is due March 1, 2022.

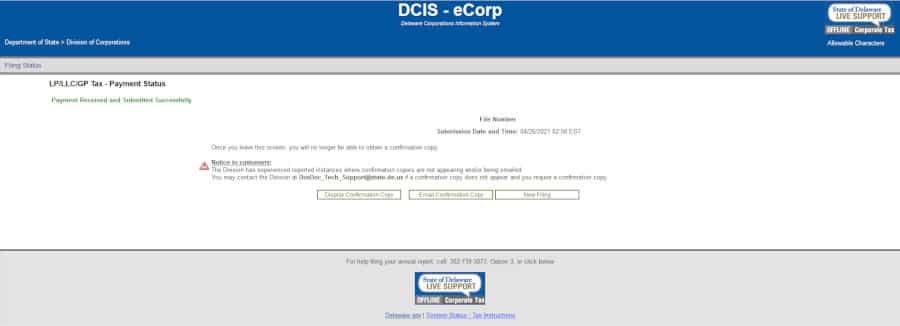

4. Paying Delaware Annual Tax

You can pay by “credit card” or “credit card”. Debit frequency response?. The debit card payment system is the simplest. Please note that we are unable to assist with payment in Delaware via PayPal, check, wire or bank transfer, or Western Union.

How Can I Accurately Register An LLC In Delaware?

H2> Creating An LLC Can Bea Difficult Task. But With The Right Resources, You Can Be Sure To Master The Process. Below Is A Step By Step Guide To Setting Up An LLC In Delaware.

Delaware Franchise Department Tax Department Contact Information

If you have any questions about the LLC’s annual franchise tax, you can contact the Franchise Tax Department at 302-739- 3073 (option 3). ). Your business hours are 8:00 am to 4:30 pm EST, Monday through Friday.

File Delaware Annual Return And Franchise Tax

While you are registered in the state Delaware, ask Vector to do all the work for you, you might be wasting your money because your organization can easily do the job by entering your information on the Delaware affiliates website.

>

Your LLC/LP/GP Must Pay Their Gross Taxes By June 1, 2022.

CT Tip: LLCs, LPs, and GPs do not have time to file their annual return for a specific tax. However, both domestic and foreign limited liability companies must submit a report of choice and also pay a fee to the r?$200 each (up to a maximum of $120,000), often due by June 1st.

Corporate Franchise Tax

All Delaware corporations are required to file an annual franchise tax return and pay corporation tax. Non-state religious and charitable organizations are admittedly exempt from paying taxes, but are required to file an annual return. Taxes and annual tax returns must be received by March 1 of each year. The extra low tax is $175 and the maximum tax is $200,000. More taxpayers due to $5,000 paying taxes quarterly: 40% on June 1st, 20% on September 1st, 20% on December 1st, and even the rest on March 1st.

Delaware Annual Return And Due Dates For Franchise Taxes And National Fees

* All Delaware corporations are required to file an annual return and pay company tax annually. The State offers two methods for calculating total franchise tax and recommends that you use the method that gives you the mostsmaller amount of debt. which type will never be less than $175 more than $200,000. Below is a breakdown of the two series tax calculation processes.

What Is The Delaware Franchise Tax?

Franchise “tax” is often misunderstood as to why fees are based on profit or capitalization , but this is far from the case with Delaware LLC franchise taxes. This can best be understood as the ultimate one-time “support fee” for the privilege of having the legal protection of an LLC in Delaware. The State of Delaware requires a flat fee of $300 per year from any LLC, normally incorporated in the State, to maintain a good reputation regardless of business activity.

Preparing to form your LLC in Delaware?< /h2>Whenever you think about taking the plunge, it’s important to know how much it will cost. Delaware has many favorable business and tax laws that allow corporations to form and register their limited liability companies (LLCs).