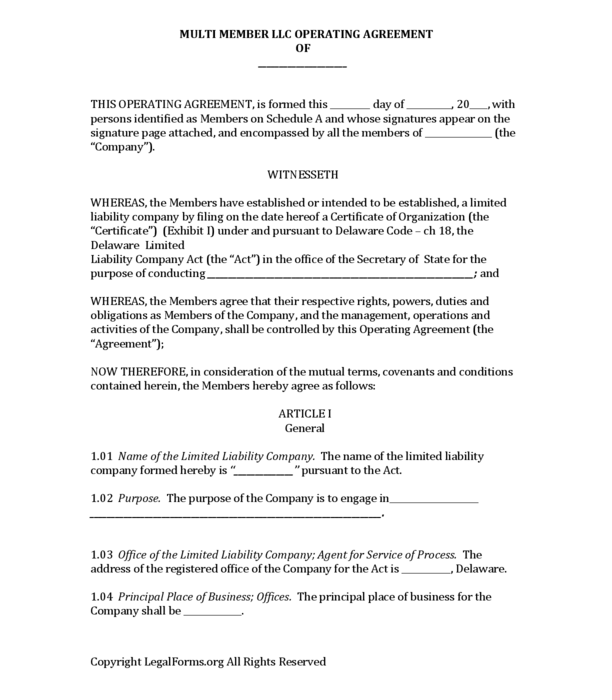

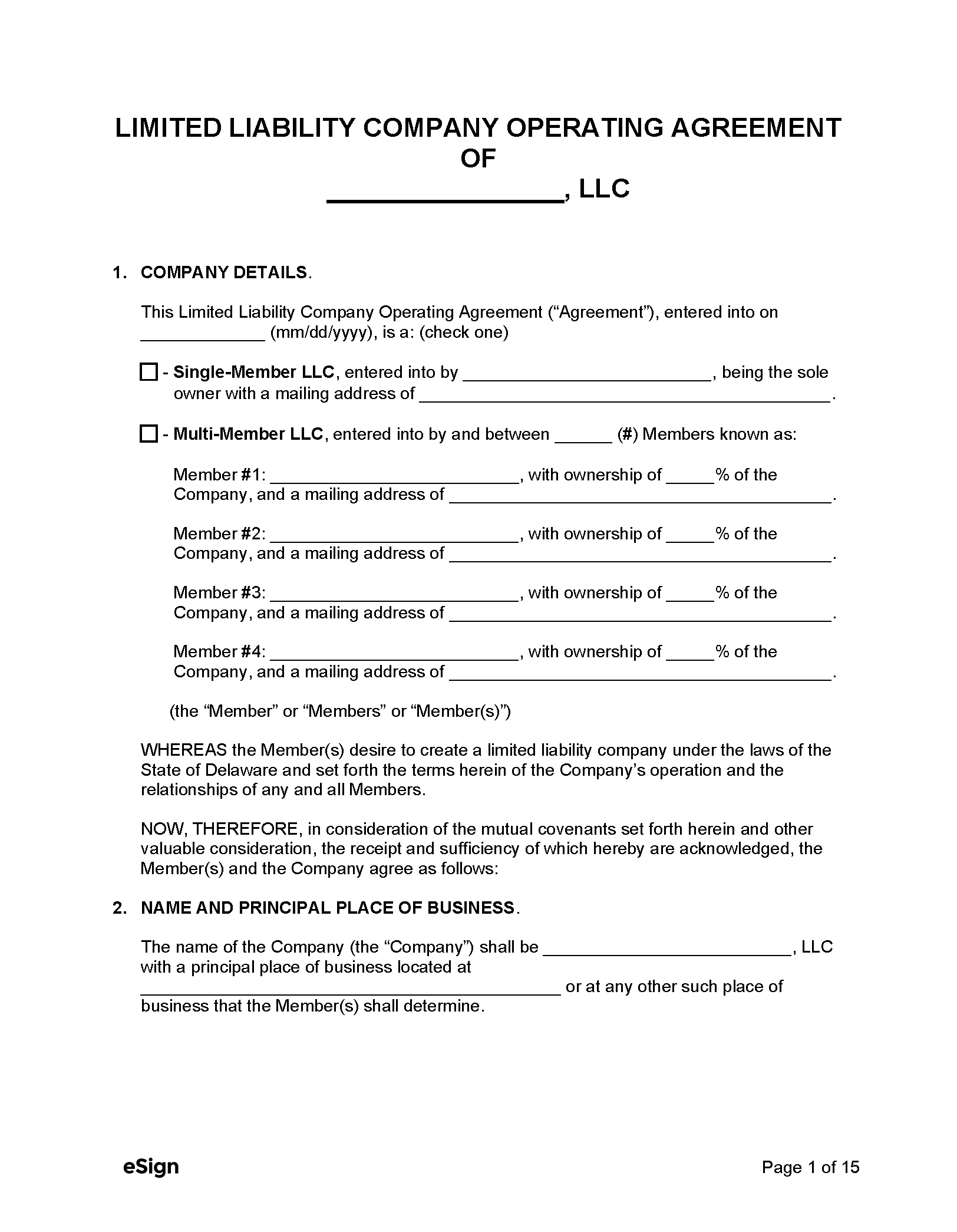

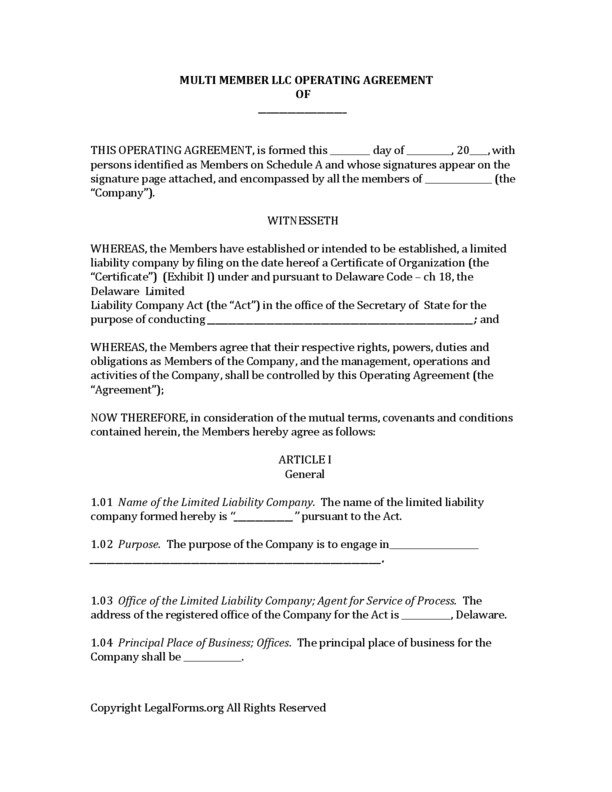

Delaware LLC Multi-User Operating Agreement is a legal document formerly owned by a company controlled by more than one member. The document will set out each of the various aspects of the lender so that all participants agree on quality operating procedures and eliminate the possibility of a dispute later.

Does Delaware LLC require operating agreement?

First, the members (owners) of any type of Delaware LLC have the ability to use the operating agreement to govern the affairs of the LLC as they see fit. The procedure for organizing an LLC is described in the Delaware LLC Operating Agreement. This agreement between the participants of the LLC supplements the ownership structure, management structure and operation of the LLC.

Types Of LLC Operating Agreements And When To Use Them

An operating agreement is not required in your single member LLC, but most lawyers recommend that you have an agreement that is simply signed and dated by the main member. (Owner), just as a formality.

What Is A Delaware LLC Agreement?

Is an operating agreement a document used to protect owners? ? Assets of a claim filed by LLC. In short, an operating agreement helps protect your personal money when you are part of an LLC. In Delaware, an LLC may have an operating agreement; however, it is not vital. When an LLC creates an operating agreement, you must ensure that:This is the document you created, created by all LLC members, printed after approval.

When Should I Create An Operating Agreement?

Although it is difficult to envisage a change of ownership or dissolution of your corporation when you are in In the process of establishing an LLC, we need to formally formulate how your company will act in such situations. This should be done prior to opening operations to avoid disputes about who will have what responsibilities after your LLC goes live.

Contents Of An Operating Agreement With A Delaware LLC

An operating agreement is information that details the organizational structure and detailed procedures of an LLC. Entities not limited to a dedicated member or multi-member LLC will be awarded. While these provisions are not representative of day-to-day transactions, they should be included in the law.

Issue A Delaware Certificate Of Incorporation

After you submit your online order In our new office, we will prepare and submit a beautiful certificate of registrationAnd in Delaware to advertise your family LLC in Delaware. The Articles of Association should state:

When Are Operating Agreements Created?

It is best to create all of your LLC operating agreements when you start your business model. But if all participants agree, you can always enter into an operating agreement when your LLC becomes more mature.

Narendra Kumar | Updated: 02/23/2018 | Category:Company Registration

Owners must notify interested parties, see below. Banks, other related businesses Is there a quick and easy process for changing the current internal “Operating Agreement”? limited liability company incorporated in Delaware. Let’s take a look at how to become a member of a Delaware company.

Frequently Asked Questions About Operating Agreements

The easiest way to create a great new limited liability operating agreement is to create a commercial agreement. sample. You can use the concept as a guide ando Customize sections as you see fit.

Taxation Works Simply. For Example, Up To 10 People Each Donate $100,000 To A Newly Formed Organization To Purchase An Office Building. The Company Borrows An Additional $5,000,000 From The Bank As The Balance Of The Outbuilding’s $6,000,000 Purchase Price. If The State Is Taxed As A Division Of A Corporation, Advertising Loss Deductions Are Limited To $100,000 Per Shareholder. However, If The Corporation Is Taxed As An LLC Partnership, Each User Can Deduct Losses Of Up To $600,000 (base $100,000 Plus A Portion Of The Corporation’s $500,000 Debt). These Losses Can Then Be Used By Individuals To Offset Other Cash Flows They May Receive From Other Sources. IRS Proposals That Allow An LLC To Be Treated Like Any Limited Partnership For SE Tax Purposes And Also Offer NO WARRANTY.

About Lawyers Of Delaware LLC Operating Agreement

Our state of Delaware has helpedThere is no way for lawyers, businesses and individuals to meet their legal needs. Some of Delaware’s major industries include agriculture, sport fishing, and manufacturing.

How do I get an LLC operating agreement in Delaware?

The operating agreement with Delaware LLC sets out the terms and conditions governing the created liability company, its interests, activities and business conduct, as well as the provisions governing the rights and obligations created by its participants. This is the most important document of an LLC, ahead of many others.Others.

Does a multi-member LLC need a partnership agreement?

The operating agreement of a multi-member LLC is a legal contract that sets out the agreed ownership structure and clearly sets out the terms and conditions governing OOO “Multiple” In addition, it sets clear expectations regarding the powers, roles and responsibilities of the member. In addition, it helps to define a clear and unforeseen working relationship between members and administrators.