Georgia does not require an LLC as a means of concluding operational agreements, but it is highly recommended to have one. A business clause helps protect your limited liability status, avoids financial and operational misunderstandings, and ensures that you choose the rules that govern your business in case of failure, not state law.

What is a Georgia LLC operating agreement?

An LLC in Georgia must contain an operating agreement because a corporation cannot act on its own behalf. Running an LLC requires real people (and some legal entities) to carry out the operations of the business.

Why Should The Best LLC In Georgia Have An Operating Agreement?

An LLC in Georgia must have an operating agreement, since a corporation cannot act on its own behalf. An LLC needs real people (and other legal entities) to carry out the operations initiated by the company.

Name The First LLC

The most important step in starting an LLC is the willingness to help with the name of the LLC. A study should be preparedto make sure the name accurately matches the nature of the business. It should also be available for prospecting. Should include the following words:

What Happened To The LLC Operating Agreement In Georgia?

The operating agreement is a legally binding document that contains specific information about the business owner and, therefore, how affairs. When setting up your own LLC in Georgia, an operating agreement is an important important item on your to-do list. The Operating Agreement helps to protect its owners from legal liability in the event of prosecution of the business and gives legal legitimacy to the business as a whole.

Operating Agreement With Georgia LLC

Operating Agreement The agreement is a legal document, which describes in detail the organizational system and operation of the LLC. Topics covered will not be limited to LLCs with one or more members. Although these provisions do not even affect day-to-day operations, they must be added for legal reasons.

AmongDo They Need To Be Notarized By The Georgian Operating Agency?

Members It is recommended that everyone read and review the agreements carefully to ensure that all members know the language of the document. The necessary signatures must be affixed while all colleagues are in the presence of a notary public for the document to take effect. Is an operating agreement required for an LLC with a sole participant in Georgia? Georgia does not require SMLLC to acquire an operating agreement. Even if a strong SMLLC has only one member, a permanent agreement is highly recommended. An operating agreement does not need to be registered in the state.

Elements Of An Operating Agreement In Georgia

An operating agreement is an approved agreement used to spin off an LLC as a separate entity. from its members. Limited liability companies can use these contracts in the marketplace to determine the rights, duties and responsibilities of the members of the company and to determine the shares of ownership of that company. A typical operating solution includes the followingdew like:

Creating A Large Local LLC

While an operating agreement is undoubtedly required by law to set up a limited liability company in Georgia, it is definitely recommended. An operating agreement is a necessary piece of equipment that sets out the company’s business policy and specifies the owners and managers.

Is An Operating Agreement Required With An LLC In Georgia?

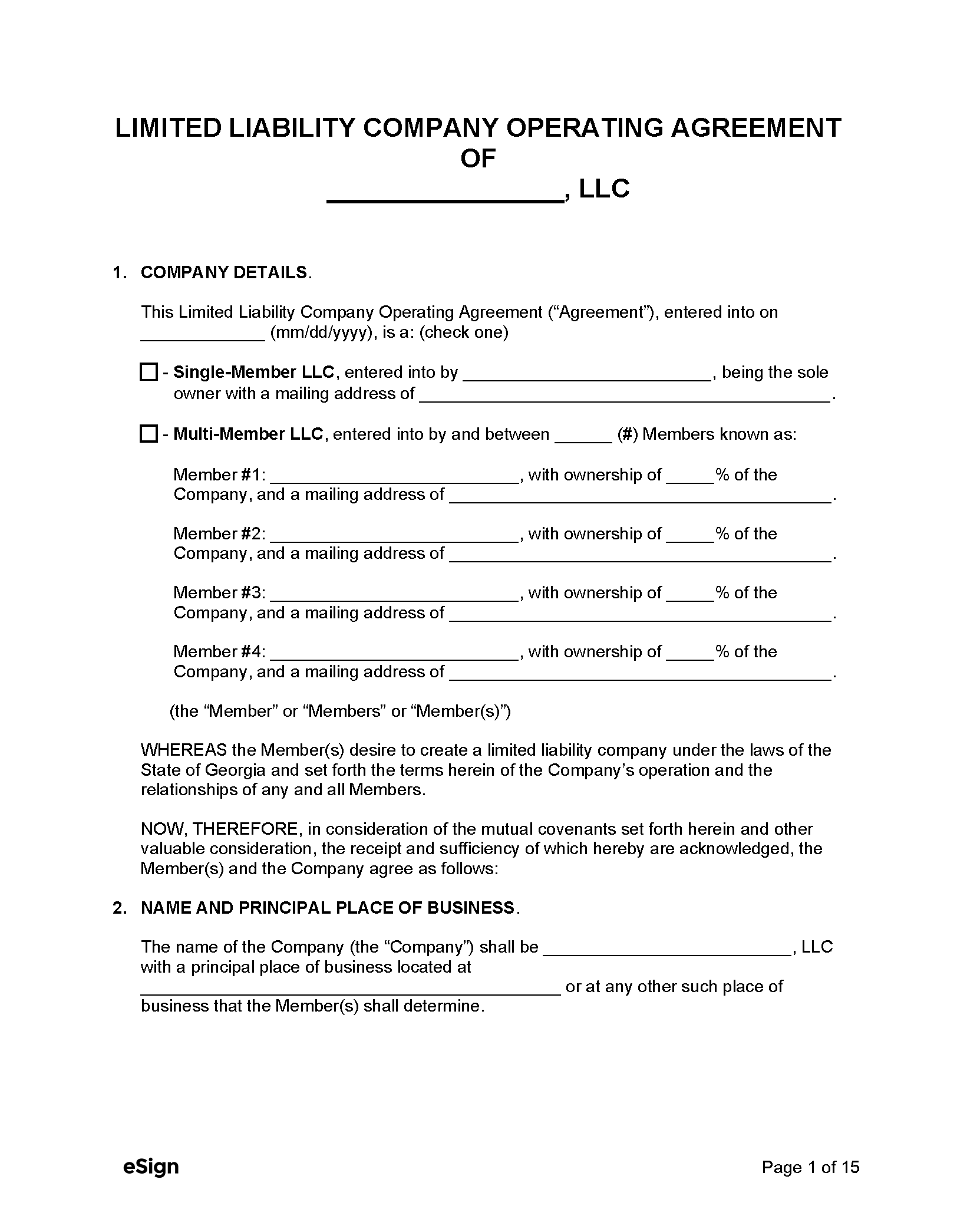

No, this Field is not required to create an LLC Operating Agreement (OA) in Georgia. However, there are many benefits of creating just one, such as helping to define the specific roles and responsibilities of participants. You

Choose The LLC Name

. The first thing you need to know is if this name is right for your business. To create an LLC in Georgia, your company name must be different from the names of existing companies in Georgia. Your LLC name must also include the words “Limited Liability Company” or simply “Limited Liability Company” or the abbreviations “LLC”, “LC”, “?? like â??ltd.â?, and “corporate” like â??co.â?.

Steps To Set Up An LLC In Georgia?and

If you haven’t started thinking yet, use some energy to sit down and make a list of business names you like. The names you come up with should be unique and meaningful. The name of the LLC is critical to marketing and marketing, but there are also legal issues.

How do I set up an operating agreement for an LLC in Georgia?

An operating agreement with an LLC in Georgia is a legal document that regulates the operating procedures and other important aspects of the company’s activities.Portions. The agreement acts as a memorandum of association and partnership agreement between specific owners (participants), defining the share of ownership, obligations of participants, appointment of officers and ownership of the business. An operating agreement enters into force when all parties agree to it and must be observed by almost all participants. He is not represented in the plenary session of the Secretary of State.

Do you have to register your LLC in Georgia?

All partnerships, organizations, and LLCs registered in my division must register as a new corporation through the Georgia Tax Center (GTC). Individual entrepreneurs have a different registration procedure.

Does the IRS require operating agreement for LLC?

The IRS has introduced new audit protocols that require any LLC operating agreement in conjunction with a limited liability partnership (LP) agreement to be voided. While we have never seen such an abrupt request, it is important that changes to the document be made by December 31, 2017. The IRS will gladly punish non-compliance.