One of the fastest ways to get a great EIN for your business is to email the IRS and simply apply over the phone. Call 800-829-4933. You can call from Monday to Friday from 7:00 to 19:00. If you are calling from outside the US, use the international toll-free number: 267-941-1099.

Explanation Of Employer Tax Liabilities (Publications 15, 15-A And 15B)

Publication 15PDF contains information about the obligationEmployer claims to pay property tax on taxable wages, excess tax withholdings, and filed tax returns. More advanced topics are covered in Publication 15-APDF, and taxation of various employee benefits can be found in Publication 15. We encourage employers to download these audiobooks from IRS.gov and Publications) or 1-800-TAX-. FORM.

Does Florida require an EIN?

If you are a corporation or LLC in Florida with a dual or If you have more members, you must apply for an EIN. Likewise, if your the company has any number of technicians, you need an EIN. This tax classification Your company can report whether you need it or not. If you have a partnership, LLC or corporation taxed as a partnership or corporation, then EIN is necessary.

What Is An EIN?

A Federal Employer Identification Number (FEIN or EIN) is a table assigned by the IRS to certain entities for federal tax purposes. An EIN is primarily the equivalent of a Social Security number for your business, and you can find an EIN by completing Form SS-4 with the IRS.

Steps To Get Your Social Security Number Florida Taxpayer Identification (TIN) Number:

If you’re trying to complete the process as quickly and easily as possible, it’s a good idea to collect some of the information you’ll need to apply for your ID beforehand. Basically, depending on the specificFor your business, this should take a few minutes, but the product will help you complete your application faster (and all in one session).

Business Registration

In order to register with the Department of State, most professions must register with the Department of Commercial and Occupational Regulation. Florida franchises may need to be registered with the local county. County business licenses are, of course, obtained from the local government of the county.

How Do Florida EINs Work?

If you are a business owner in Florida and want to find your own EIN, you will be asked to provide yours. Find old tax returns and business bank account information. These documents may contain your EIN.

Wait For Your Florida LLC To Be Approved

Wait for your Florida LLC to be approved by the Department of State before applying. Otherwise, if your LLC.- application is rejected, you will have an EIN attached to each non-existing LLC.

Remote TaxationOption Sale

Depending on the type of business, you will need to provide certain information and in addition the taxes for which you create e.g. companies Types of activities, location of business and date of opening. you can buy those departments Registering your business (form DR-1N ) to help you with the details you need to register the legal entity type of your amazing business. Addresses used for delivery time applied in accordance with United States Postal Service Web site.

What Is An Employer Identification Number (EIN)?

EIN stands for Employer Identification Number for both men and women and is sometimes even referred to as the Federal Employer Identification Number, FEIN, federal tax identification number. or Federal Tax Identification Number. This is a special, unique nine-digit number that looks like a social security number for an individual, but rather identifies an organization.?.

Does My Company Need An EIN?

If you are a Florida corporation or LLC with two or more members, you must apply via EIN. Likewise, if your A business can have any number of employees, you must obtain an EIN. This control group Your web business can also indicate if it needs your organization or not. For example, if you have a bond, LLC or corporation which is taxed as a joint venture or corporation, then EIN is necessary.

Finding The Federal Taxpayer Identification Number On Federal Documents

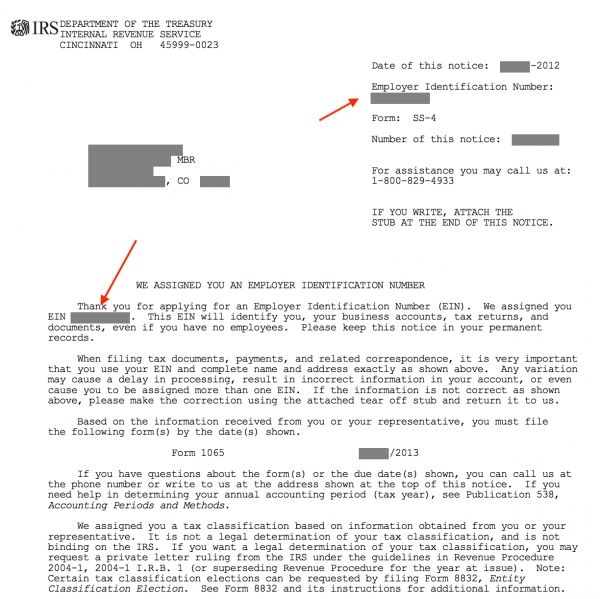

One way is to view the EIN Verification Notice. Typically, when the IRS online application was used to practice EIN, a thank you message was generated immediately upon completion. Applicants may be asked to download, save and print a specific confirmation notice that includes an EIN.

How do I get my EIN number?

We cannot process your application online if the responsible party is a legal entity, since the TIN was previously obtained via the Internet. Please use one of our other easy steps to apply. See Applying for an EIN. We apologize for any inconvenience.

Is Florida sales tax number the same as EIN?

If you are considering registering a business in Florida, you must register the business with the relevant offices. A State Tax Identification Number is a unique number that is assigned by the state to a business, corporation, or manufacturer to track their tax returns and job applicants. This number, also known as the corresponding state employer identifier or state EIN, is separate from the federal employer achievement number. Even if you appliedFor the latest state EIN, most states will require you to apply for a state EIN if you are feeling well.

How do I apply for an EIN in Florida?

If you run a large business in Florida, there are several ways to justify an EIN. All businesses in the US are required to register and obtain an Employer Identification Number (EIN). This number is used to register the legal address and tax returns.

What is an Employer Identification Number (EIN)?

All businesses in the US owe the dawnregister and obtain an Employer Identification Number (EIN). This number is used to register the legal address and tax returns. The IRS and other government agencies use EIN to permanently identify a particular business.

How do I Find my Employer Identification Number in Florida?

Employer identification number in Florida. This includes bank accounts and other local and national licensed applications. You can call any IRS at 800-829-4933 if you are unable to purchase your records with an EIN associated with your business. They have to provide some information, but with the right details, they can actually provide you with your EIN.

What is a Fei number in the state of Florida?

Probably register a limited liability company in the entire state of Florida. The Federal Employer Identification Number, or FEI, is a large number issued by the Internal Revenue Service (IRS). The FEI number is also referred to as this EIN number. This number is used to identify the legal entity for federal purposes.