![]()

How much does it cost to open an LLC in Maryland?

Maryland might be a great idea to start an LLC. Learn how to form an LLC in Maryland with this easy and helpful guide. We will guide you through the specific process step by step, highlighting the really important points.

It Is Very Easy To Register An LLC In Maryland

A LLC in Maryland. In all cases, to form an LLC in Maryland, you must file the articles of incorporation with the Maryland Department of Appraisal and then with the Department of Appraisal. taxes, which is the cost of 100 US dollars. You can startYou can use it online, by mail, or in person. The Memorandum of Association is the legal document that usually formally registers your Maryland LLC. Your

Maryland LLC Name

Choosing a business name is an amazing first step in starting a Maryland LLC. Don’t rush the process. You want to get it right the first time. Changing the company name later can mean updating everything from your website to branding, legal and administrative documents.

What Is A Limited Liability Company (LLC)?

LLC is different from other types of corporations. In Maryland, detailed requirements for establishing or forming an LLC are usually contained in the Maryland LLC Law (Maryland Article of Corporations and Associations, Limited Liability Companies Act, Section 4A). An LLC may conduct business in connection with any lawful business, purpose, enterprise or activity, whether for profit or not, with the exception of the business of entities acting as insurers. The law also included certainThese requirements apply to an existing LLC operating in Maryland. However, the law allows flexibility regarding the powers of an LLC, that is, it can take certain actions. An LLC can easily be registered indefinitely to cease operations after a perfectly safe period of time, and it can enter into or enter into other relationships with its members. LLC members generally have a great deal of freedom to form corporations in a manner that is best suited to that type of corporation.

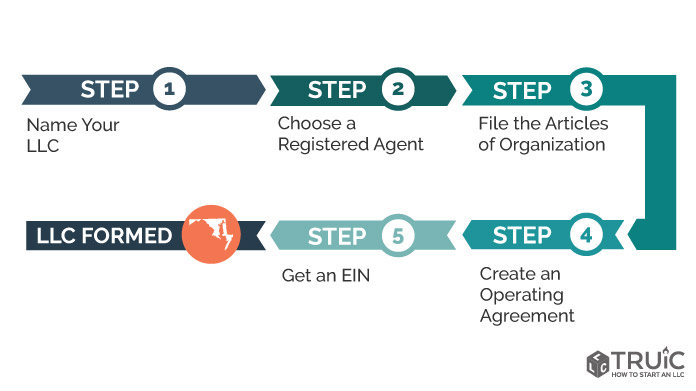

Here Are The Steps To Form A Limited Liability Company (LLC) In Maryland.

Here are the steps to form an LLC in Maryland. For more information on strategies for starting an LLC at any mention, check out Nolo’s article on how to form an LLC. incorporation into the Department of Maryland under assessments and taxation. You can usually submit articles online (requires a Maryland Business Express account) or by mail. The application fee is $100, although there is a fee for online application as a bonus?A service fee of 3%.

7. Review Current LLC Legal Fees, Especially Annual Financial Statements.

LLCs in Maryland are subject to personal property recovery (PPR), which itself generates a similar annual income. The PPR must be filed with the Department of Taxation and Valuation by April 15 of each year. Typically, you should submit the following forms:

Can I Reserve Corporate Status In Maryland?

Yes. Maryland allows an LLC if you want to reserve a company name for 30 days. Simply fill out and submit a business name reservation application and pay the $25 fee (plus $20 for expedited service).

LLC Benefits In Many Maryland States

H2> States Such As Maryland, LLCs Are Quite Attractive Businesses. Small Business Owners Are Constantly Trying To Adopt This Model. LLCs Are Popular In All States Due To Their Limited Financial Obligations, Tax Flexibility, And Flexible Management Structure. As A Small Business Ownernesa, These Benefits Are Likely To Be Important To You. Here Are Some Of The Benefits A Maryland LLC Can Provide For Your Business:

What Is An LLC?

A Limited Liability Company (LLC) is a corporation made up of one or more owners (i.e. members) able to control the dormant corporation, the board of the organization. If you are a major member, your corporation will be treated as a single member LLC. Otherwise, it is a multi-member LLC.

After You Create An LLC

Open a business provider account and maintain a business credit card balance before you begin transactions. from all the important things to do and maintain your LLC’s liability protection. sometimes called the corporate veil.

Is there a yearly fee for LLC in Maryland?

At BizFilings, we clearly state our fees, as well as Maryland’s fees. When you look at our LLC formation fees, a person will clearly see:

How long does it take to set up an LLC in Maryland?

LLC in Maryland. To form an LLC in Maryland, you must register the articles of incorporation with the Maryland Department of Grades in addition to taxes, which cost $100. You can start using it online, by mail, or in person. The Articles of Association is the legal document that formally registers your Maryland limited liability company.