How do I pay the $800 franchise tax?

Below, we describe Form 411 related to California franchise taxes for your business. Please note that the deadlines we provide are valid for calendar year taxpayers and may not apply to you if your business tax year does not end on December 31st. Also, the answers below only applydeductible or taxable value and do not include any registration fees or other regulatory fees that may be due from your company. A lot of information about franchise taxes can be found in the following [blog].

Total Number Of Tax Exemptions For The First Year

For tax periods beginning on or shortly after January 1, 2021 and up to January 5, 2024, LLCs will be organized, registered or registered with Corporate Secretary. California is exempt from the $800 annual tax for the first corporate tax year.

OOO Overview

. Limited liability companies (LLCs) combine the formation of a traditional partnership and a corporation. The California Revised Uniform Limited Liability Company Law (sections 17701.01 of the California Corporations Code based on 17713.13) permits the formation of an LLC in California. It also recognizes out-of-state LLCs doing business in California.

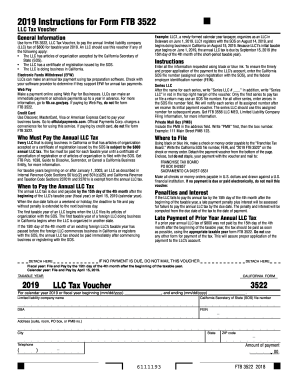

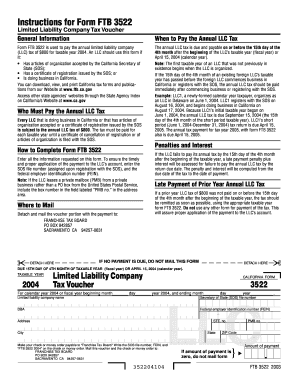

What Is Form 3522?

Form 3522 is the form used by California LLCs to payannual gross corporate tax. from 800 dollars. All SARLs as a whole must pay this tax each year in order to qualify and be in good standing. When a new limited liability company registers in California, it has four months from the date of incorporation to pay these fees.

When Is California’s Annual Franchise Tax Due?

First payment in the amount of 800 dollars will be earned in “15. Day of the 5th month”, earned after the approval of your LLC. Approval of your final LLC, but it’s actually 3.5 months. For example, if your California LLC is approved in November, November is usually considered “month 1”, which is 4 “months” immediately after February. The fifteenth day will be February 15.

California LLC Franchise Tax Exemption

In 2020, the California Legislature passed a unique law. which exempts certain businesses from paying California franchise tax in the first year after tax California LLCs, LPs, and LLPs incorporated between January 1, 2021 and December 31, 2021do not have to pay California franchise tax for the first post-tax year. These companies begin paying California franchise tax in their second tax year. See California Assembly Prop 85 for more information.

California Annual Fee For LLCs

Disclaimer. Our lawyer wanted you to know that many of them do not provide financial, tax, legal or professional advice. advice is given in this post. All media provided are general in nature and are unlikely to apply to your particular situation and are for informational and educational purposes only. The information is provided “as is” and without warranty of any kind.

LLC FAQ – State

You must still file your LLC’s annual tax with the California Board of Regents. franchise taxes (FTB) for approximately 3.5 years after incorporation. This tax is $800 per year. After the year of registration, a portion of the tax is due by April 15 of each year, provided that ??OO has a planned tax year. This tax must be filed with the Franchise Tax Commission using Form FTB 3522, Limited Liability Company Income Tax Voucher located at http://ftb.ca.gov.

Provide California Declaration Information

You must provide California Declaration or SOI information within 90 days of submitting articles to the organization. This is clearly Form California LLC-12, which must be filed with the Secretary of State of California. Expect a total fee of $20.

What Is The Annual Franchise Tax?

The Annual Franchise Tax is a type of mandatory business tax in the state of California, as well as dozens other states. The term itself is a little misleading because it doesn’t matter if your business is franchised or not, it applies to LLCs doing business in California.

Business Information

Activity Information

Activity Information

h2>This section displays information about the activity?These are a pre-loaded legal entity in a limited liability company. The “Activities Included in LLC Declaration” dialog box lists many of the federal activities included in an LLC. If there is no data in the history dialog, the LLC is only a civil action and no federal data is ever transferred to the LLC.

Do you have to pay the $800 California LLC fee the first year 2022?

Individuals establishing a California LLC or solid partnership are not required to pay the $800 annual minimum tax levied in the first year under Gov. Gavin Newsom’s Budget Act, but generally only those who fully established between 2021 and 2023.

Can you pay California state taxes online?

The state sales tax is the tax multiplied by the state on your personal income based on what you earned in the excess tax year. State income tax, which varies by state, is a percentage of the money you pay to the state government based on your income. In California, current state taxes also include taxes on goods, services, and merchandise.