What’s New?

Another loan forgiveness? ? For tax periods startingOn or about January 1, 2019, California law allows for a broad gross income exemption for borrowers pursuant to the debt relief described in Section 1109(d)(2)(D), Coronavirus Relief, Relief, and Economic Security » (CARES) pursuant to section 278, section N of the 2021 Federal Consolidated Appropriations Act (CAA). California is harmonizing the legal provisions of this federal regulation as amended. For California purposes, these deductions generally do not apply only to ineligible entities. “Non-Qualifying Entity” means a taxpayer that is either a public entity or does not comply with this 25% reduction in gross revenue requirement under Section 311 of the 2021 CAA. See specific instructions, also known as ftb.ca, for more information. .gov and search for AB 80.

General Information

Limited Liability Companies (LLCs) have traditional corporations.Explicit and partnership characteristics. The California Revised Uniform Liability Limited Liability Company Act (sections 17701.01–17713.13 of the California Corporations Code) permits the formation of an LLC in California. It also recognizes out-of-state LLCs doing business in California.

Underpayment

If you don’t pay your LLC’s estimated fees by your scheduled return date, you’re worried about penalties and interest. . For more information, visit the Earned Data for Business website.

General Information

In Caudillo, for tax periods beginning January 1, 2015, California law is in effect based on the Internal Revenue Code (IRC). as of January 1, 2015. However, differences remain between California and state law. Where California complies with federal tax laws, we may not always make every change to federal credentials. For more information, go to ftb.ca.gov and then search for eligibility. For more information see Pab FTB in general. 1001, Additional Advice on California Adjustments, California CA Schedule Regulations (540 or 540NR) and current Corporate Tax Returns.

General General Information

about tax years beginning with or after As of January 1, 2015, California law complies with the new IRC effective January 1, 2015. However, differences between California law and later state law remain. When California submits to the government. Tax changes, which we do not want, must necessarily approve any changes made at the federal level. For more information, go to ftb.ca.gov and search for a match. Visit the FTB pub for more information. 1001, Guidelines supplementing the California Adjustments, these specific instructions for the California CA Schedule (540 and/or 540NR) and accounting for corporate property taxes.

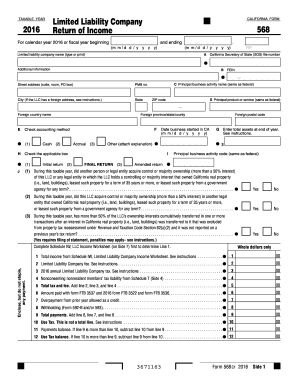

Schedule Iw, Limited Liability Company (LLC) Worksheet For Income

Schedule iw limited company worksheet can be usedUse to calculate LLC’s “California Total Income” to determine the amount of our own LLC fees. For the purposes of the article worksheet, “California total income” means total income derived almost exclusively from sources located in or attributable to that state, and not worldwide income. This includes income from all sources such as business profits, interest, rent, and dividends.

How do I file FTB 568?

Generally, for tax periods beginning on or immediately after January 1, 2015, California law complies with the Internal Revenue Code (IRC) combined as of January 1, 2015. However, there are differences between California law and federal law. As California adapts to changes in federal tax law, we don’t always make every change at the federal level. Visit ftb.ca.gov for more information in conjunction with compliance studies. Visit the FTB pub for more information. 1001, Additional Advice on California Adjustments, California Adjustment Instructions (540), California Adjustments â?? Residents or Schedule CA (540NR), California regulates specific ?? Non-residents or part-time residents and corporate tax books.

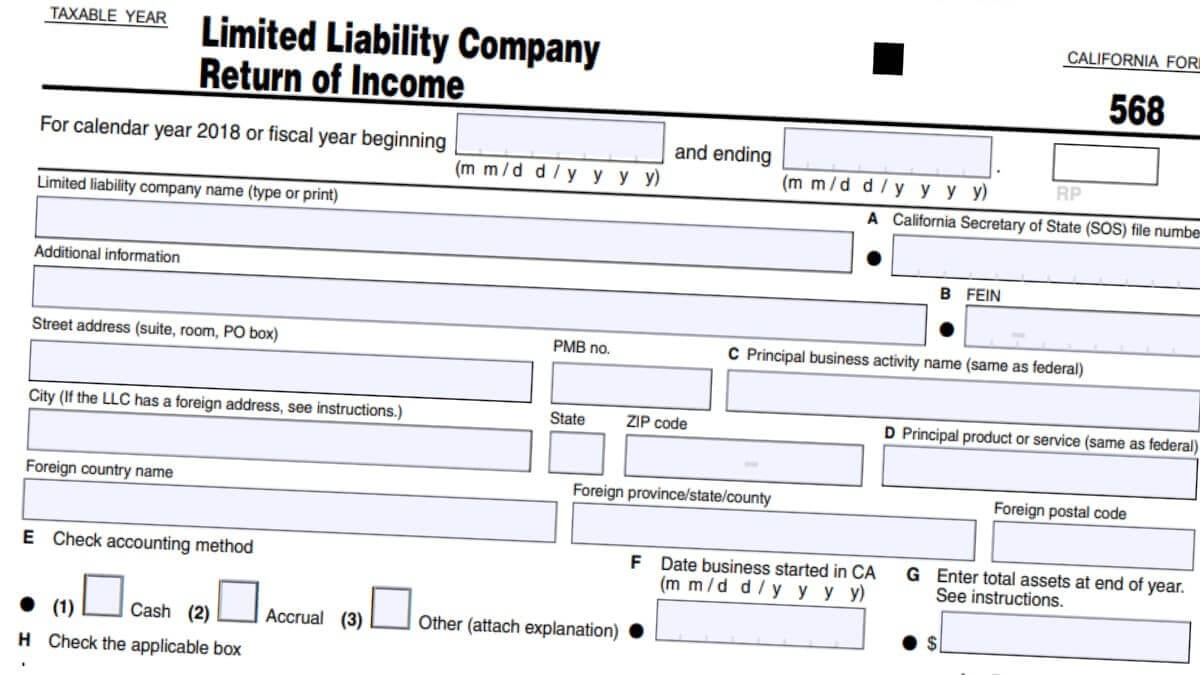

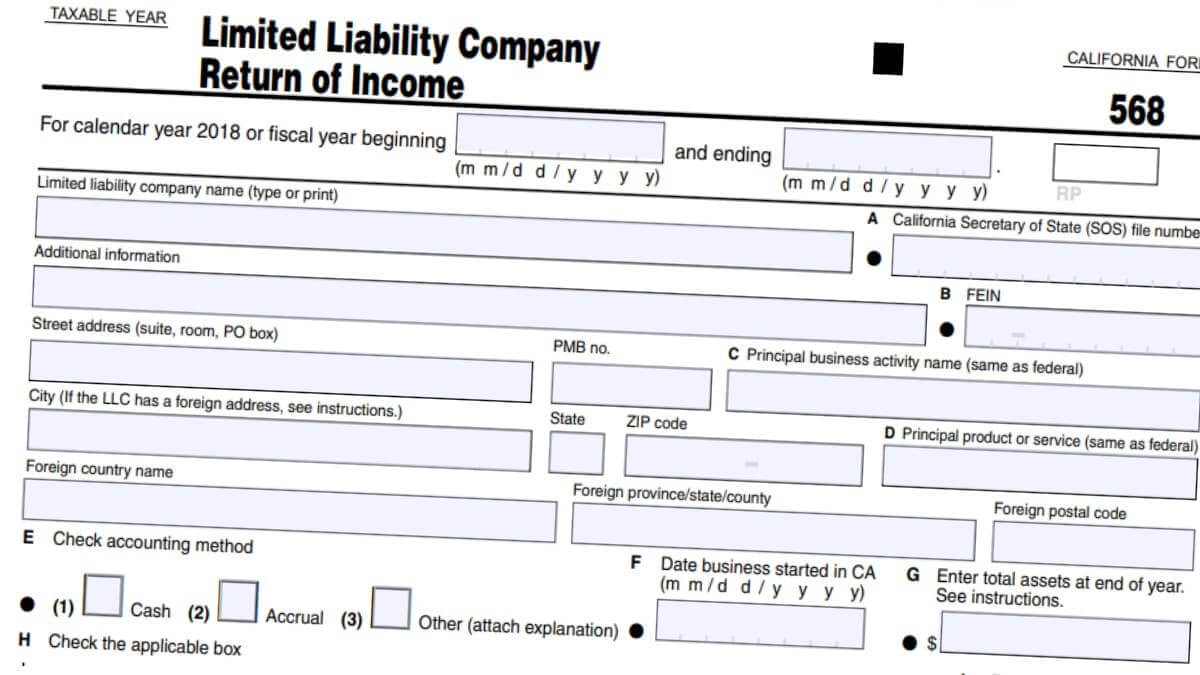

What Is Form CA 568?

The version of CA 568 is a document tax. This is perhaps the most serious tax document for any LLC. All other commercial bank documents and additional tax documents must match and even match what ends up on the CA 568 form. You can think of the CA 568 form as the “basic tax document” for your LLC. /p>

What Is Form 568?

Form 568 is often requested by business owners interested in forming an LLC who often have questions. Form 568 is an income statement that many California limited liability companies (LLCs) must file. Companies withLimited liability that are classified as disregarded friendly corporations or must file Form 568 with the California Franchise Tax Board along with Form 3522.

Who Must File Form 568 California?

In general, California law requirements for tax periods beginning January 1, 2015 or later comply with the Internal Revenue Code (IRC) dated January 1, 2015. However, differences remain between California law and US federal law. While California is adapting to changes to mandatory federal laws, we don’t always implement all of the changes made at my federal level. For more information, visit ftb.ca.gov on the marketplace and search for eligibility. See the FTB pub for details. 1001, Additional recommendations for adjustmentm of the state of California, support for the California CA schedule (540 or 540NR) and corporate tax books.

Does a single member LLC need to file Form 568?

We are required to file Form SMLLC 568 from time to time, although they do not count for tax purposes. You are subject to annual tax, LLC fees and credit limits.

Do I need to file Form 568 if no income?

From the Form 1065 Revision Instructions (2020): Unless otherwise noted below, each domestic partnership must file a Form 1065 unless they receive income or expenses that count as deductions plus credits for federal income tax purposes.