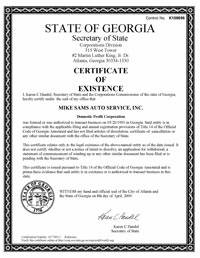

You can obtain a certificate of existence for the State of Georgia directly from the Secretary of State. This document confirms that your company is a registered manufacturer that complies with all applicable municipal laws. We recommend that you verify that your organization is eligible before submitting.

Make Sure The Connection To The Site Is Still Secure

ecorp.sos.ga.gov must be checked in advance to secure your own connection Continue.

How do I get a certificate of authority in Georgia?

Companies are expected to register with the Secretary of Georgia, who is associated with the state, before doing business in Georgia. Company which are registered when another state usually requests a certificate of authorization from Georgia. Included registers the company as its own foreign entity and eliminates the need to register a new legal entity.

What Is A Georgian Certificate Associated With An Authority?

Companies must help you register with the Secretary of State of Georgia before starting a business in Georgia. Company registered in an additional state will generally require a Georgia Certificate of Authority. Included registers the company as an unusual legal entityA natural person and eliminates the need to register a new legal entity.

Doing Business In Georgia

Under Georgia LLC law, if you plan to do business through the state, you must eventually register your foreign corporation with the Secretary of State. As with most states, this approach does not explicitly define what transactions are actually dealing with. However, you can learn more about what constitutes a business in a lawsuit by reviewing Georgia law’s guidelines on whether you must pay state sales tax. If you operate your service provider in such a way that you must pay sales tax in the state of Georgia, you may need to obtain professional certification before engaging in such activities. Some instances where you are believed to be doing business in the state include:

Instructions For Completing The Macon Bibb County Vacancy Form And Foreclosure Registration Form.

Macon Bibb County Bylaws, Chapter 6, Article IV, Sec. At points with6-70 through 6-80 set out the purpose and requirements for completing the Forfeited and Unoccupied Property Register. The following is a brief summary: Chap. 6-73 requires each owner or agent of foreclosed property OR unoccupied property to open an account within 30 days of foreclosure or release of the property, and art. 6-76 uses a single sign-up and, effective September 3, 2018, a one hundred dollar ($100 per $00) administration fee to structure your mailing. Effective January 1, 2014, the law extends to the new jurisdiction of Macon Bibb County, Georgia, which includes both many of Macon’s municipalities and the former governments of Bibb County. Please complete the emotional connection form (found HERE) with implementation information:

Business Applications:

All businesses operating in Alpharetta associated with the city must have a valid tax certificate (also known as a business license) on the first day of daily work. Businesses that operate within Alpharetta city limits and do not have a valid taxfor a professional certification will be subject to fines and penalties as required by law.

Is This My National Manufacturer Number (NPN)?

Want to know what your National Manufacturer Number (NPN) is? A unique identification number is issued to licensed persons by the NAIC (National Association of Insurance Commissioners) and most provinces are starting to use it for various licensing purposes. If you have a Georgian driver’s license, use a free Vertafore license number/request a national manufacturer number to find this NPN today.

Enter The Website From The Secretary Of State

The only way to get a good solid certificate of existence in Georgia is now available online. You need to go to the portal of the minister among the states. Before registering, clear your browser cache and open the site in only one tab, otherwise your data may be corrupted or processed incorrectly.

Who Needs A Business License?

Any individual, firm, partnership or corporation, se?Seriously engaged in business, trade, profession or livelihood in the city of Valdosta, it is recommended to have an annual license License License Certificate of Professional Fees. This tax certificate is based on a commercial function and is also calculated on the company’s gross income or on an actual lump sum.

The Boat Is Registered In Georgia

The seller must issue a signed certificate and detailed conditions of sale to the buyer, as well as a boat request card. The contract of sale must contain enough information to identify the boat, such as hull identification number, year, brand, product, boat registration number in Georgia, etc. The seller must report the sold boat to the DPR within 15 days. p>

What is a letter of authority from the Georgia Corporations Division?

1. Doing business in Georgia2. How to get a power of attorney inside Georgia

How do I obtain a Georgia Secretary of State Certificate of authority?

All non-public colleges authorized or seeking blessings in Georgia must annually submit a Certificate of Credibility and Annual Registration issued by the Secretary of State of Georgia. Minimum Standard Criteria Form (GNPEC document to be completed and uploaded)program for each offered service (web form).

What is a Georgia Certificate of good standing for corporations?

The Secretary of State of Georgia as well as the LLC will provide you with Certificates of Goodwill. Statement of when the company is authorized to conduct business in Georgia.

How do I obtain a business license in Georgia?

Although the application is simple, you have the opportunity to provide evidence that your supplier complies with the rules and laws of Georgia, as well as attach a certificate of good standing from the state in which your company is registered.