Do Sole proprietors need a business license in Hawaii?

When it comes to becoming a sole trader in the affiliated state of Hawaii, there is no formal registration step required. There are also no fees to set up or run this type of business. If you want to run a simple business in Hawaii, all you have to do is get started.

It Is Very Easy To Register An LLC In Hawaii

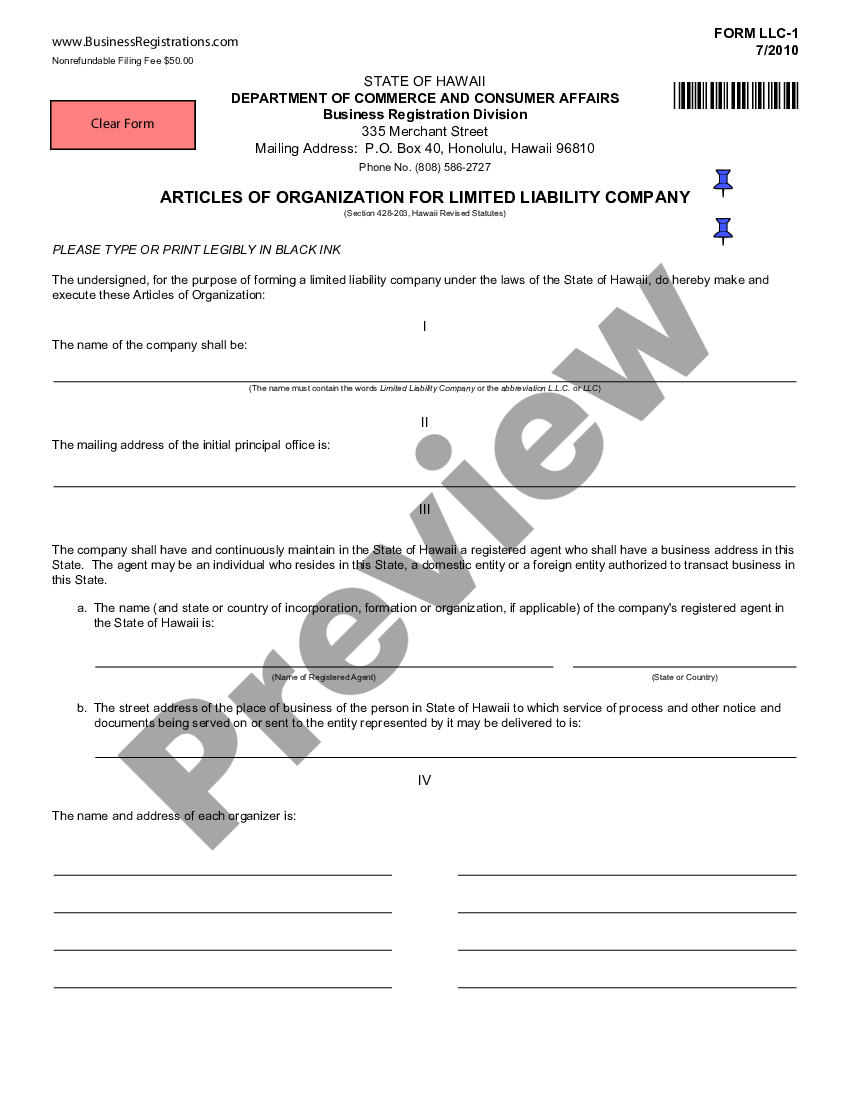

LLC Hawaii. To register an LLC in Hawaii, you must file a Certificate of Incorporation with the Department of Commerce and Consumer Affairs, which costs $50. You can apply by mail, fax, email or in person. The Memorandum of Association can be the legal document that officially registers your new LLC in Hawaii.

Here Are The Basic Steps You Need To Take To Form An LLC (LLC) In Hawaii.

A Limited Liability Company (LLC) Can Be A Way To Legally Structure An Organization. It Combines The Limited Liability Of A Corporation With The Flexibility And Formality Of Partnerships.or A Pure Corporation. Any Business Owner Wishing To Limit Their Personal Liability For Business Debts And Lawsuits Should Consider Forming An LLC.How To Start An LLC In Hawaii

A LLC or LLC is a brand new hybrid commercial a unit that combines the factors of a corporation with a partnership or sole proprietorship. It separates your personal wealth from your labor wealth, giving you resistance to personal wealth.

Creating A Corporation In Hawaii Is Easy

Creating a reputable corporation in Hawaii is a simple process that is accomplished by filing a memorandum of association with the Secretary of State. In the following instructions, we will explain step by step how to set up a company registered in Hawaii.

What Is A Certificate Authority In Hawaii?

It is imperative that businesses register with the Hawaiian Ministry of Commerce and Consumer Affairs before attempting to do business. in Hawaii. Out-of-state businesses typically require a certificate from Hawaii?their islands. Authority. This will register the company in question as a foreign company and eliminate the need to set up another company.

How To Get A Hawaiian Authority Certification

The most efficient way to apply for your amazing Hawaiian Authority Certification is to take advantage of the expedited service which includes a $75 fee (fee for $50 registration). and $25 for an expedited audit).

Choose An LLC Form For Federal Income Tax

One of the main advantages of a limited liability company is its unique tax flexibility, suggests CA. If you apply at the time you receive your Employer Identification Number, you will learn how the business is taxed for income tax purposes. While there may be limitations, some LLCs may be split for federal income tax purposes, such as:

How To Complete A Hawaiian Certificate Of Formation For A Local Limited Liability Companyew?

Get easy access to one of the most comprehensive collection of allowed shapes. US Legal Forms is truly a platform where you can identify each state-specific file by some key points such as: There is no reason to spend hours of work looking for forensic evidence. Our experts will make sure you always get the latest free samples.

Need A Certified Copy For Your Business In Hawaii?

Social media is increasingly becoming the preferred way for entrepreneurs to communicate with clients, colleagues, and even customers. We are committed to sharing important information and tools to help you grow your business.

Limited Liability Company

LLC offers the same benefits as a real corporation, but at no additional cost. and complexity of agreement. Companies whose owners are looking for personal liability protection, tax flexibility and modern management options may find that forming an LLC is the ideal choice for these companies.