Without further possession of any real or personal property; Make an isolated investment that is realized within thirty days, but which is also not in the school of romantic repeat transactions; as well as. Conduct transactions in interstate commerce.

How do I close my corporation in Hawaii?

To unblock your Hawaiian corporation, submit Form DC-13, Hawaiian Articles of Resolution, to the Hawaii Department of Commerce and Consumer Affairs, Business Registration Office (BREG) by mail, fax, or in person here. The dissolution article cannot be submitted online. Our fax documents must contain legible signatures, fee amount, creditworthiness of the sender, contact information, and show general or expedited verification.

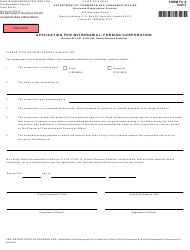

Requirements And Instructions For Cancellation Of A Hawaii Department Of State Certificate

To revoke or revoke your foreign Hawaiian LLC in respect of Hawaii, complete the Certificate of Cancellation () and bring it along with the registration fee by mail, by by fax or in person to the Ministry of Commerce, Direction de l’Immatriculation des Entreprises (BREG). Cancellation certificate not available in online check-in. Our upDocuments to be faxed must contain legible signatures, amount of fees, creditworthiness of the sender, contact information, and indicate whether to continue or expedited processing.

Remove Your Company From Hawaii

H2>Withdrawal Process Complete Business Registration Abroad. According The Current State Of Your Business Or Organization, Our Process Varies. See The Table Below For Details. Withdrawal Strategies And Information In Hawaii.

Hawaii Annual Registration Fee And Instructions

The cost of filing an annual return in Hawaii depends on the type of business you have. Corporations, LLCs and LLPs must pay $15 to prepare an annual return. Nonprofits, partnerships, LPs and LLPs must pay $5 to submit their report. If you do not file your report on time, the applicable state of Hawaii will charge a late fee of $10 each, unless you are an accomplice. Non-profit organizations in Hawaii are not subject to late fees.

Check If The Side Of The Connection Is Secure

casetext.com standards preselect the security of your working relationship Continue.

Description

REVOCATION OF A FOREIGN CERTIFICATE (CORPORATE OR NON-PROFIT) FROM THE STATE OF ALABAM Exit of foreign corporation – 1/2019 Page 1 out of 2 businesses in Alabama the Corporation may present to the Secretary of State upon filing a Certificate of Exit accompanied by a Certificate of Compliance obtained from the Alabama Department of Revenue (ADOR) – see Section 7 and Sample Application or pursuant to Section 10A-1-7.11 of the Alabama Code 1974 GUIDELINES: Submit two (2) completed Certification Revocation Forms, a Certificate of Compliance, and the applicable registration fee. $100 for standard processing or $200 for expedited processing (within 24 hours of notification) to ADOR. Applications are only accepted by mail or courier and will not be accepted by e-mail. Submit your credit card, check or money order to the Secretary of State, Business Services, PO 5616, Box Montgomery, Alabama 36103. Withdrawals cannot be processed if the credit card is not authorized and the shipment will most likely be removed from the index if your unpaid check is not cashed ($30 fee). All processing instructions are completed on this form along with the payment options sheet; Cover letters are indeed required and will not be reviewed. If you are using a good credit card and our website, you can submit a withdrawal request online because this time it takes time to enter the request here. The information required to complete this form may be required or the submission will be invalid without validation. Applications sent by e-mail are not always confirmed, considered, processed or returned. 1. Alabama Legal Entity Identification Number (format: 000-000): – INSTRUCTIONS FOR OBTAINING YOUR ID NUMBER TO COMPLETE THE FORM: If you do not currently have this mobile phone number available (it is listed on the front of your original registration application)walkie-talkie), you? It can only be accessed on our website at www.sos.alabama.gov

What Does It Mean To Liquidate An LLC?

Liquidation of a corporation is the official instrument associated with the final closing of your business. While filing the basic dissolution papers with the State of Hawaii is certainly an important part of the overall process, it is not just a step. You must also liquidate your business assets, pay off all debts, and send legal notices to anyone who was interested in your core business.

How do I register my out of state business in Hawaii?

In order to register a foreign limited liability company in Hawaii, you must file a distinct Application for Foreign Limited Liability Company Power of Attorney Certification (FLLC-1 form) along with the appropriate registration fee with the Ministry of Foreign Affairs.Department of Commerce and Consumer Affairs (DCCA). ), Department of Registration of Enterprises. Applications may be submitted via e-commerce or by e-mail, mail or fax.

How do I withdraw a foreign corporation in California?

To remove or remove a foreign entity, you must file the appropriate form with the California Department of State (SOS). Include a stamped envelope with your address and a real letter with the name and number of the person, combined with the name, address and phone numbers of the sender. Withdrawal forms are available on the dedicated SOS website and can be completed online. You can print or write in black or blue ink on online forms. Checks must be paid to the Secretary of State.