How long does it take to set up an LLC in MS?

What is the payment term for an LLC? This is the time it takes for the state of Mississippi to verify your LLC registration and place it in its system. Once your LLC is approved, the state will electronically send the approved studies back to you.

Mississippi LLC Processing Time

What is the LLC processing time? This is the time it usually takes for the state of Mississippi to verify and enter your LLC registration into its system. Once your LLC has been granted, the approved state will electronically return your files.

Creating An LLC In Mississippi Is Easy

Mississippi LLC. To form an LLC in Mississippi, you must submit a Certificate of Incorporation to the Mississippi Secretary of State, where it costs $50. You can apply online. The Certificate of Incorporation is a legal journal that officially registers the state of Mississippi as a limited liability company.?venity.

Can I Reserve A Business Name In Mississippi?

Yes. If you are not yet ready to file your personal certificate of incorporation, you can reserve your coveted company name up to 180 by submitting an online name reservation request and paying a $25 registration fee.

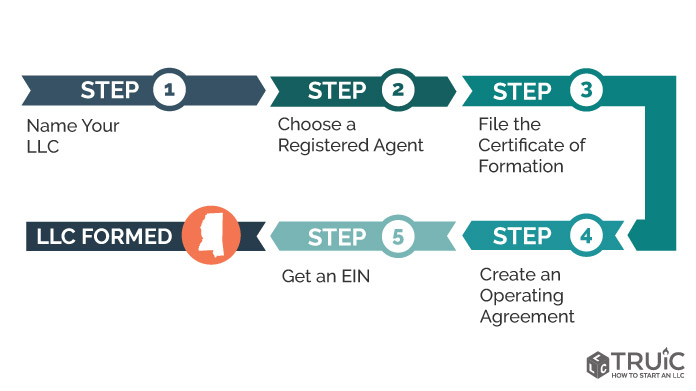

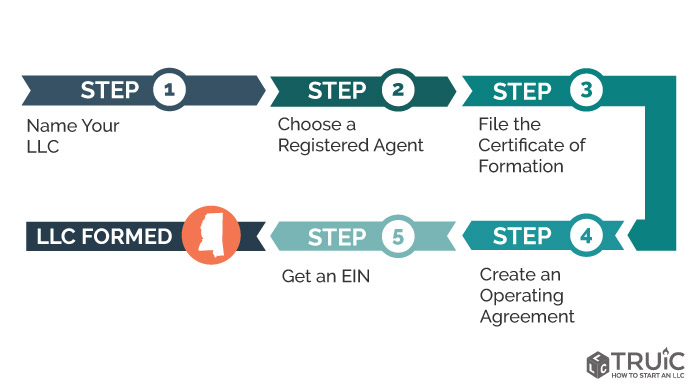

Here’s Everything A Person Needs To Know To Form An LLC In Mississippi.

Here are the steps your business needs to take to form an LLC in Mississippi. Read more about the unique way to create an LLC in any country in the Nolo article. How to form a CLL type Depending on the state, the practice of processing takes 4-6 weeks, possibly even longer in slower states. Prioritization will reduce this time. We will be able to prioritize your processing over non-priority revisions and send your documents as specified by electronic or overnight delivery. We will also use the next day delivery service to send you the documents. If your time is of the essence, you should use Expedited, otherwise Process Haste.

How To Form An LLC In Mississippi

An LLC or Limited Liability Company is a hybrid business unit that a company has that combines components with a specific partnership or business. It separates your personal wealth from the wealth of your sector, providing you with a personal wealth program.

Incorporating An LLC In Mississippi

To form an LLC anywhere in Mississippi, you must file a Certificate of Incorporation with the Minister of State of Mississippi. You must also choose the ideal agent to register your LLC in Mississippi. A registered agent files a lawsuit on behalf of your LLC.

Before Filing An LLC

While the process of forming an LLC is simple, owners must complete a few steps prior to the registration stage. . The following are things to consider before proceeding with registering your LLC in Mississippi.

How Much Does It Cost To Register A Qualifying Corporation In Mississippi?

Initial State LLC State Fee Mississippi State Registration Express RegistrationOffer Time $50 3 weeks 1 business day So how do you start a business in Mississippi? How to start a business in Mississippi Choose a business idea. Take a moment to explore research and ideas for your business. Select the legal form. Choose a name. Create your business object. Apply for licenses as well as permits. Find a commercial space and check the zoning. Declaring and declaring taxes. Get insurance.

Include Certificate Of Incorporation

A LLC is incorporated in the State of Mississippi by filing a Certificate of Incorporation with the Minister of State of Mississippi. Applying for a title in Mississippi requires you to create one using their online registration system. Once registered, you can submit the certificates online or print a copy and then send it to the SOS office. The filing fee is $50.

How much does it cost to set up an LLC in Mississippi?

The initial cost of forming an LLC is a $50 fee to file your LLC Certificate of Incorporation online with this Secretary of State of Mississippi.

How long does it take for an LLC to be approved by the state?

When opening a limited liability company, the first question many people ask is how long it will take. Fortunately, this is a convenient process.

How do I form an LLC in Mississippi?

Mississippi LLC. To register a Mississippi LLC, you must register a Certificate of Incorporation with the Secretary of State of Mississippi, which costs $50. You can apply online. The Certificate of Incorporation is the legal document that officially represents your Mississippi Limited Liability Company.

How do I start an LLC in Mississippi?

Submit your Articles of Association to the Secretary of State of Mississippi and wait for your entire LLC to be approved. You can apply for an LLC by mail (approval within 3-5 business days) or online (approval is instant). In any case, the fee for filing a condition is $50.

How long does it take to create an LLC?

The time it takes to form an LLC varies by state. Depending on how quickly the government processes business documents, an idea can usually take anywhere from a week to 10 business days. ?? In some states, once your admission information is received, the resume writing authority will often grant limited liability company approval in as little as three business days.

What is a Mississippi limited liability company?

A Mississippi Limited Liability Company (LLC) is a legal structure used to protect your personal income (home, car, bank account) in the event of a lawsuit against your self-employed person. An LLC could potentially be used to run a business, or a great LLC could be used to hold money (such as real estate, vehicles, boats, or perhaps even aircraft). Setting up an LLC in Mississippi will be easy.

What happens if you don’t file an LLC in Mississippi?

Mississippi requires an LLC to file an annual return with the Mississippi Secretary of State. Late Filing: The State of Mississippi never charges late fees if you miss a type of filing deadline, but will dissolve your LLC after 4 months. LLCs can be held liable and even automatically dissolved if they neglect one or more of the documents filed by the state.