How much does it cost to set up an LLC in Maine? The Secretary of State of Maine imposes a $175 fine for filing articles of incorporation. You can reserve an LLC name with the Maine Secretary of State for $20.

Where is it cheapest to form an LLC?

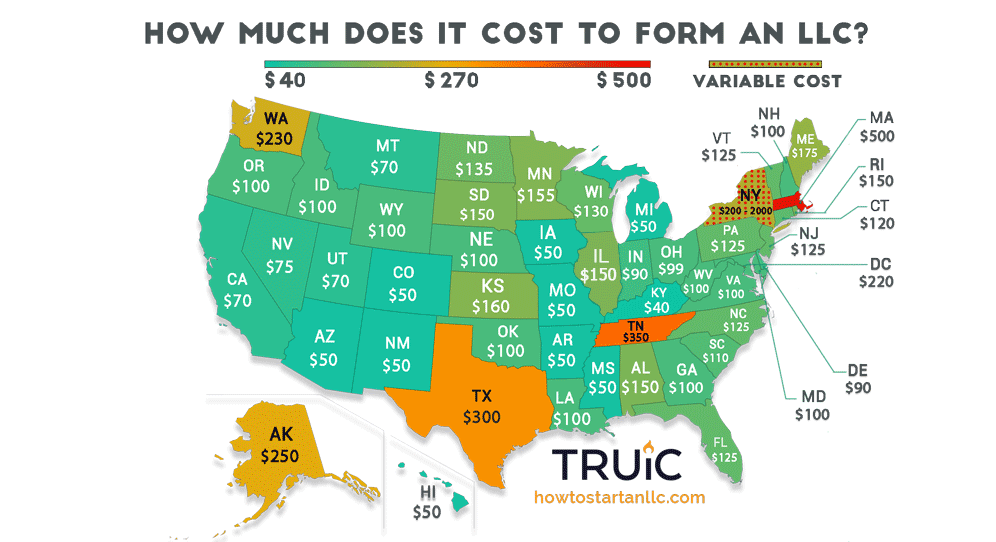

If we really look at the cost of starting an LLC, Kentucky decides to be the cheapest state to start an LLC at $40 to start an LLC.

The Cost Of Opening A Foreign LLC In Maine

If you now have an LLC registered in another state and want to spiritually improve your business in Maine, you can improve your business. You will need information to register your LLC as a foreign LLC in Maine.

Easy Maine LLC Registration

To register an LLC in Maine, you must file a certificate of incorporation in Maine Maine. State secretarder priced at $175. Can I apply by email? The Memorandum of Association is the legal document that most people use to formally register their LLC in Maine.

Total Costs Of Forming An LLC In Maine

This is optional. Name reservation is an optional part of the process. But if it turns out your LLC isn’t quite ready and you’re worried about losing your IT title, it might be worth it. For a whopping $20 fee, you get 120 days of quality rights to any name you want. However, your individual name is automatically entered on the organization’s medical record. So if your business is affordable, it’s more efficient to start there.

Before You Start An LLC In Maine

As families prepare to start a new LLC, there are a few things you should do to save money. time and money in the process. You do not want to register an already taken fixed name or do not want to be particularly clear about the person authorized to represent you. It’s best to plan ahead so that you canGet results.

Can I Reserve A Maine Company Name?

Absolutely. If you are not yet ready to create a form for your LLC, you can reserve the correct name for your business for 120 days by submitting a 120-day Name Reservation Request to the Secretary of State for 120 days and paying $20. Again, all commercial designs in Maine must be mailed or mailed to the Augusta office.

Step 1: Name Your Maine LLC

The first step is to find company name LLC. This may seem obvious, but it is important to consider several factors. You need a unique and identifiable name for Maine, your trusted business.

Certificate Of Attendance Application Fee

Studying in Maine pays most of the fees associated with fees. competitions may also differ depending on whether you are creating a domestic LLC or a foreign LLC. However, you can submit both applications to the Maine Secretary of State. Initial costs required for ?Full Maine LLC buildings. You cannot form an LLC in Maine without first filing a certificate at registration because the certificate is an insurance plan that officially registers your business in a particular state. The actual shipping costs $175.

Maine LLC Training Package:$374Generally

Maine Registered Agent offers the perfect LLC services in the state. Our Portland dealers are locals who are well versed in Maine business rules. This experience – along with world-class service – gives you, the customer, everything you need to run your business.Order Man LLC right now!For a total of $276 (including the $136 registration fee), you get:

Choose A Name For Your LLC And See If It’s Available

To form an LLC in Maine, you must register with the Secretary of State. You must complete the appropriate fee and commission forms and comply with all company name and supplier policy requirements.

How are LLCs taxed in Maine?

Most states tax at least some types of business income received by the state. Features of taxation of income of individual entrepreneurs usually partially depend on the organizational and legal form of the enterprise. In most cases, corporations are subject to corporate income tax, while income from managing corporations such as S corporations, limited liability companies (LLCs), partnerships and others.Sole proprietors are subject to state income tax. Corporate, male, and female income tax rates vary widely from state to state. Business transactions, which are generally stable regardless of income level, typically range from 4% to 10%. Personal tax rates, which typically vary depending on the amount associated with income, can range from 0% (for small amounts of taxable income) to 9% or more in some states.

What is an LLC in Maine?

Absolutely. If you are not yet ready to register your LLC, you can reserve your corporation creator for 120 days by submitting a name reservation request to the Minister of State and paying $20. Again, all Maine business forms that can be mailed or delivered in person must be submitted to the Augusta office on time.