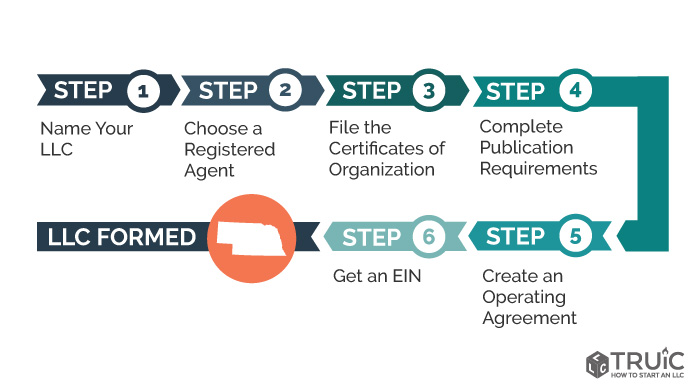

Choose an absolute name for your LLC.Designate a registered agent.Provide proof of organization.Prepare an operating agreement.Release requirements.Get a current EIN.Submit biennial reports.

How much does it cost to have an LLC in Nebraska?

The main cost of setting up a great LLC is the $100 fee to register your LLC organization certificate online with the Secretary of State of Nebraska.

The Cost Of Setting Up A Foreign LLC In Nebraska

If you have an LLC registered only in another state and you want to open your business in Nebraska, you need to register the LLC as a foreign LLC in Nebraska.

Registration Of An LLC In Nebraska Is Often Simple

OOO Nebraska. To form an LLC in Nebraska, you must present your certificate of organization to the Secretary of State of Nebraska. A state that costs 100 dollars. You can register online. CertificateAn Incorporation Code is a legal document that allows your Nebraska to formally register a Limited Liability Company.

Here Are The Steps You Need To Follow To Register An Limited Liability Company (LLC) With Incorporate. Nebraska.

A Limited Liability Company (LLC) is the legal form of a corporation. It combines the limited liability of a corporation with the particular flexibility and informality of a partnership or sole proprietorship. Any business owner wishing to limit their personal liability for business debts and/or litigation should consider forming an LLC.

Initial Costs Required To Form An LLC In Nebraska

Leta? Let’s start by covering the absolute essentials. You cannot form an LLC in Nebraska without filing a Certificate of Organization or my document that officially registers your business in certain states. This deposit costs $100 for online deposits and $110 for office deposits. You can’t proOne hundred choose any name and stick to it. First, you need to make sure that the name you want isn’t already considered a term, or too similar to another company’s name. We can show you how to make it our Nebraska business name search fansite. You can also check the availability of the name that is listed on the Nebraska Secretary of State website.

The Cost Is Similar To Filing Certificates Of Education

The Nebraska Certificate of Education is for the most responsible price, which may also directly depend on whether you are creating a domestic LLC or sometimes a foreign LLC. However, you can also apply to the Nebraska Secretary of State.

Total Costs Of Forming An LLC In Nebraska

You may have reserved your company name by writing to the LLC. However, the name, reservation is completely optional, so you should really apply for this if you are not yet ready to start your business. If you are still waiting for documents or other delays andIf you expect someone to accept your approval, apply for $15 by mail or in person. Otherwise, the organization’s certificate will permanently register your name for as long as you want, and going directly to that application will save you time and money.

What Is The Big Difference Between The Official Name Of My LLC And The Meaningful Name Of The Company?

The legal name of your LLC is listed on your certificate of organization. A business name (sometimes called a DBA) is any other name under which your LLC does business. Commercial titles must be registered with the Nebraska Minister. To register a full business name in Nebraska, you must complete a Business Name Application and submit it to the Secretary of State online ($100) or by returning a paper form ($110). After submitting one of our requests, you must publish a legal notice in the local newspaper with the name of the company. The newspaper then publishes an affidavit of the publication, which you submitReport to the Nebraska Secretary of State. You have 45 days from the date you registered your commercial domain name to complete the registration requirements.

Nebraska LLC Application Fee

To form an LLC, you must provide this certificate of organization by the Secretary of State of Nebraska. The fee for filing an Organization Certificate is $100 online or $110 by mail. These are commonly referred to as “State Fees” or even “State Registration Fees”. to register a new LLC. When you form an LLC, you submit an Absolute Organization Certificate, a document that you can write. This document must include the registration and address of the LLC, the name and address of the registered agent, and a list of any professional services that the individual is authorized to perform under Nebraska law. The Society may provide professional services to its members. Employee? or certificate. The participant must document the evidence.

How long does it take to make an LLC in Nebraska?

How to Start an LLC in Nebraska – You’re Around This quick guide provides a quick overview of how to set up an LLC in Nebraska.

How do you create a LLC in Nebraska?

How do you start a business in Nebraska?

How to start a small business in Nebraska?

How to create a LLC in Nebraska?