Step one: determine the percentage of ownership.Step two: Determine rights, responsibilities and details of remuneration.Step Three: Determine the conditions for joining or leaving the LLC.Step 4: Create permission conditions.Step five: Insert a severance clause.

What should an operating agreement include?

To make sure everyone in your LLC (including you!) understands their roles and responsibilities, I recommend that you enter into an operating agreement. While most states don’t require you to wear one, you should consider doing so. This serves as proof that your important personaland professional cases are kept separately. And a business agreement can in many cases help clients avoid misunderstandings, disputes and large-scale battles on the part of business partners.

Why You Should Have An Agreement

Some states require conditions for an LLC to operate. Sometimes this is only required if the LLC has more than one member. While not required by law, the operating agreement serves three other key purposes:

Members

When a new member is added to a company, this means that the LLC Operating must be changed, more or less less all existing members must agree to the written consent of that new member. This is in addition to the increase or decrease in ultimate ownership from member to member.

Joining And Leaving An LLC

Any LLC expects to be wise in the face of the unexpected for its members. Your operating agreement should be able to specify what happens when the next member decides to join or leave the LLC.

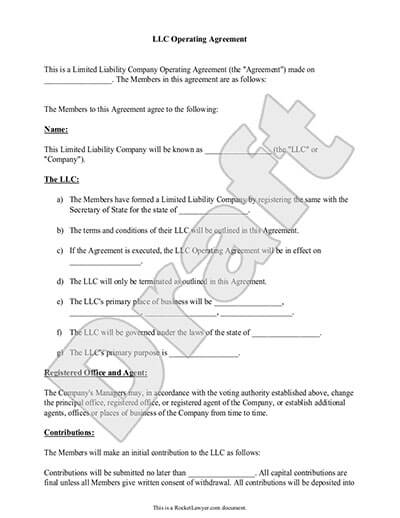

What Is A Limited Liability Operating Agreementy?

The Operating Agreement of a Limited Liability Company (LLC), also known as the Limited Liability Article Naming Agreement, is a functional legal document that sets out the rights associated with defines the responsibilities of each member of an LLC and includes details such as :

What Does The Agreement Cover? Operating Activities?

LLC operating agreements cover many very important issues. Most of the material things covered by the operating agreements disclose the business interests of the members, their rights to conduct business, and how the LLC will be run. No two operating agreements are the same, so you need to effectively choose the one that is right for your business.

What Is A Limited Operating Agreement?

A limited operating agreement allows families to have their financial and business love relationships with your co-owners are structured in a way that works for your business. Under your terms, you and your co-owners (onCalled “participants”) must indicate each owner’s share in the LLC (limited liability company), its share of the profits (or losses), its duration, and the obligations that will happen to the business if you leave completely.

Why It Is Beneficial To Write Down An Operating Agreement

Operating agreements are not always required by law, but they are always worth checking. They create the rules and policies of a large company, separating personal responsibility from corporate responsibility. This is equally important for individual LLCs and multi-partner LLCs.

Article V: Membership Section Changes

This describes the program for adding or removing members. It also specifies whether members can transfer their ownership of the company and when. For example, a company wants to detail what happens if one member dies, one member goes bankrupt, two members get divorced, etc. The operating agreement depends on your business and industry. However, in addition to the above?? agreements, there are several other provisions that you may see (or intend to include) in your agreement.

The benefits of an “operating agreement”

h2> An operating agreement is an insurance policy that helps protect the owner’s personal assets from LLC actions, clearly defines acceptable actions for certain businesses, and creates a succession plan if the owner is likely to go out of business.

Does South Carolina require an operating agreement?

An LLC license is not required in South Carolina, although it is highly recommended. This is an internal surface document that defines how your LLC will actually operate. It is not supplied by the state. It defines the privileges and responsibilities of members and individuals, including how the LLC will be able to do so. It can also help protect your small liability by showing that your LLC will indeed be a separate business entity. In the absence of an operating agreement, LLC state law governs your LLC.