While there are certainly a few people involved in management, you see, an S Corp will be healthier than an LLC because the oversight will be carried out by the board of directors. Also, members can be employees, and S-Corp allows members to receive loan dividends from company profits, which can be a big benefit for employees.

How much does it cost to register an LLC in Nebraska?

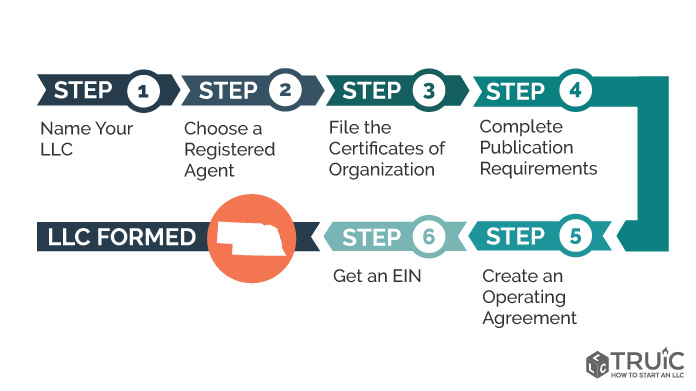

Here is the ladder you need to go through to register a solid LLC in Nebraska. For more information about setting up an LLC in another state, see Nolo’s article How to Start an LLC.

Establishing An LLC In Nebraska Is Considered Simple

OOO Nebraska. To form an LLC in Nebraska, you must submit a Certificate of Organization to the Secretary of State of Nebraska, which costs $100. You can apply online. The Organization Certificate is your legal document that formally establishes your Nebraska limited company.

Here Are The Steps You Really Need To Take To Register A Nebraska Limited Liability Company (LLC) .

H2>A Limited Liability Company (LLC For Short) Is A Way To Legally Structure A Business. It Combines The Most Significant Limitation Of Corporate Liability With The Flexibility And Informality Of A Partnership Or Individual Ownership. Any Business Owner Who Is Looking For Their Limitation, Also Known Aspersonally Liable For Business Debts, Should Consider Forming An LLC. Be Careful When It Comes To Your LLC Designation In Nebraska. You Can’t Just Pick Any Name You Want And That’s It. First, You Need To Make Sure The Call You Want Hasn’t Been Answered Yet, Even If You’re Using A Different Company Name. We Can Show You How To Do This With Our Nebraska Company Name Search Page. You Can Also Check The Availability Of The Name On One Of The Nebraska Secretary Of State Websites.

Get A Certificate From The State

The state issues a certificate to users that technically verifies that the LLC exists after the Formation Documents LLC filed and approved. If you are mailing the actual LLC documents, the Secretary of State will send a certified, stamped copy of your Certificate of Incorporation. If the person submits online, you can upload the certificate successfully.

Publish Organization Notice

After incorporation, the Nebraska LLC must publish an organization notice for subsequentOne week in a row, a widely circulated magazine or similar publication in the county where the LLC is located. Foreign LLCs doing business in the state may post their own notice in the county where the registered agent is located if they do not have a registered office.

What Is The Difference Between The Legal Name Of My LLC And The Proper Business Name?

Your SARL is legally referenced on your certificate of organization. A company name (sometimes called a DBA) is any other name under which your LLC does business. Business corporations must be registered with the Minister of State of Nebraska. To register a trademark in Nebraska, you must complete a trademark application and file it with the appropriate secretary of state either online ($100) or by completing a form ($110). After applying, you must publish a government notice in the local newspaper with the name of the company. The newspaper then prepares an affidavit forI am the publications you send to the Secretary of State of Nebraska. You have 45 days from the date you registered your business word to manage the required publication.

Check Name Availability

Want to check the name you really need with LLC No Questions Secretary of State. Nebraska does not allow three state-registered corporations to have the same name.

Step By Step: Forming A Nebraska Limited Liability Company

With all this in mind, you have decided to form an LLC to living in Nebraska. You have chosen your members, your business and some startups and capital, someone is already on the way. Buy now to complete and submit your final documents.

How To Start An LLC In Nebraska

An LLC, probably a limited liability company, is a hybrid organizational unit that brings together a society. real estate with an individual or legal entity. It separates all your personal assets from your professional assets and thus offers you the protection of your personal assets.

Costsrelated To Running A Business

Opening an LLC in Nebraska may not seem easy, but you will find that starting a business can be stress-free if you do. then they were very helpful. Start today with these daily steps with Nebraska, Your LLC:

How do I form a limited liability company in Nebraska?

Obtain an EIN from Wonderful Nebraska LLC. To form a Nebraska Giant Limited Company, you need to submit a certificate of organization to the Secretary of State of Nebraska, which costs $100. You can also apply online. An organization certificate is usually a legal document that officiallyestablishes you as an LLC in the state of Nebraska.

How long does it take to form an LLC in Nebraska?

How to form an LLC in Nebraska? You are here This quick guide provides a brief overview of how to set up an LLC in Nebraska.

How much does it cost to get an LLC in Nebraska?

Filing an LLC in Nebraska by mail costs $105 and takes 3-5 business days to process. Submitting Nebraska Live online costs $108 and takes 1-2 business days to be approved. Note. The submission time may take longer due to the current situation in the world as well as government delays. Please see how long it takes to get an LLC through Nebraska.

What do I need to know about business names in Nebraska?

Your company name must contain the words “Limited Liability Company”, “LLC”, or “LLC”. Your logo must be different from an existing service in the state. You can do a recent search on the Secretary of State’s website to see if it’s usingXia whether a particular trade word. For more information on name availability in Nebraska, see this link.

How do I register a new business in Nebraska?

You can register any new business online for one of the following individual tax programs: Tire Fee. If your entire business has a set of Nebraska IDs for an active tax program, you of course cannot use the online business registration system, but you should be able to use the Nebraska tax application Form 30 to register for other VAT programs.