Need a company annual report? The last day of the few weeks leading up to the founding anniversary month. So if you signed up on February 20th, your annual income should be paid on January 30th.

Idaho Annual Report Information

Businesses and non-profit organizations should remain optimistic about filing financial statements. Secretary of State. Annual returns are required in most states. Payment terms and fees by alternative state and type associated?? with essence.

Idaho Annual Report Deadlines And Fees

Can’t remember when you started your business? You can look closely at the due date of the annual return by searching the Idaho Business Database. After repeating your company name in search results, your due date will be listed under the heading “AR Due Date”.

How much does it cost to renew LLC Idaho?

Once you have filed your Idaho LLC Annual Return, you can move on to the next specific lesson: Idaho LLC Business License and Additional Permits.

Is There A Penalty If I Don’t File Every LLC Annual Return?

Yes, if you don’t file your Idaho LLC annual return, the proposal has the right to administratively liquidate your LLC (close) . When this happens, you will need to apply for reinstatement and pay a fee.

Completing The Idaho Annual Return Fees And Instructions

Unlike many other states, Idaho is not required to charge a fee. for filing an annual report with the Office of the Secretary of State. This applies to all companies that do business with the state. Also, there is no fee if you submit your report after the due date.

What Does The Idaho Annual Report Do?

The State Annual ReportIdaho “Idaho is a document that must be presented to the Idaho Secretary of State each year. The report includes a repeat with detailed information about your LLC or supplier, such as address and contact resources for important people.

Annual Return

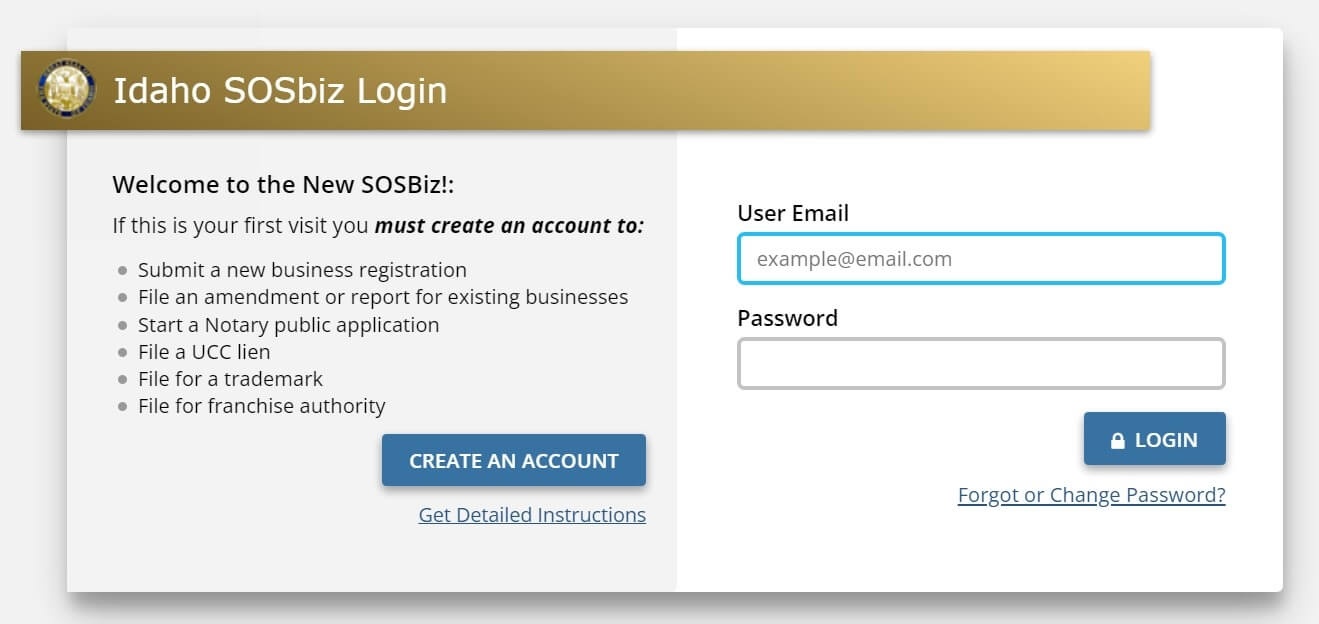

The State of Idaho requires you to file an annual history of your LLC. The Secretary of State will send a reminder to your LLC before the report is ready. You can explain the annual report online on all SOS websites. There is no fee for the Annual Report.

What Is The Idaho Annual Report? Why Is This Important?

Consider the state’s large annual review of your LLC. It is similar to the census in that its purpose is to provide each person with the contact and structural information they need to do business in Idaho.

Annual Report Contents

General has been filed, and Idaho LLC (or any other commercial entity for that matter) will contain all information relating to its business and group. Franchise Annual Report Standard Contente or annual tax return would be:

Idaho LLC Vs. Idaho Corporations

While we have no doubt covered the differences between an LLC and a corporation, we would like to dig a little deeper into the ins and outs of starting another Idaho LLC. Below you will learn what makes LLCs and Idaho entities unique:

Reserve Your LLC Name With The Secretary Of State

Once you have chosen a name for your LLC, you can reserve it with the state to the Secretary of State of Idaho for a few months to ensure that it is unfortunately not being used by another business entity before you are ready to legally incorporate that particular company.

Can I be my own registered agent in Idaho?

NOTE. You may impersonate your own registered agent as an individual if your website has a physical address in Idaho. Or, an individual may use another legal entity, again registered with our office at a fantastic physical address in Idaho, but not your actual entity.