Illinois LLC Annual Return Filing. Once an Illinois-wide LLC is formed, you must file an annual return and pay a $75 fee every August. You must file an annual return in order for your Illinois LLC to qualify and be in good standing with the Secretary of State of Illinois.

How much is Illinois corporate annual report?

The Illinois Annual Return must be filed each year to ensure the proper operation and compliance of the LLC if you are an LLC in Illinois. 3 minutes of reading

What Is An Illinois Annual Return?

An Illinois Annual Return must be filed annually to maintain continued LLC compliance and qualify if you operate an Illinois limited liability company. LLCs have the option to file an individual’s annual return online or by mail. Submitting an online application is more expensive, but it only takes one to two business days to process the report. Sending by mail is undoubtedly cheaper, but processing time can vary from 10 to 20 business days.

As DefinedDo Illinois Franchise Tax?

The State of Illinois offers two ways to do this. this calculates your additional franchise tax. and encourage companies to help you use the process that results in the least amount of debt. Here is a summary of the two options:

Illinois Annual Registration Instructions And Registration Fees

To comply with the law, any business that has always been registered to do business must be required by the State of Illinois to submit annual report to the Illinois Department of Business Services. Costs vary depending on the type of business entity. The focus is on an overview of the main filing requirements and fees:

What Is The Annual Return In Illinois?

Like other states, Illinois requires companies to file periodic returns to prove this them or them? ?re as long as the rules of supervisory jurisdiction are followed. The Material Safety Data Sheet demonstrates that you are “playing by the rules” by signaling reliability, legality and.

RequiredName Of Illinois LLC LLC

The name must end with “Limited Liability Company”, “LLC”, or “LLC”. Its use with hyphens in the name is often discouraged by the state. The name must be different from the name of any group, or from a name that is then exclusively authorized for the transaction, or from a name that is reserved for exclusive rights. Words such as “bank” or “trust” and other variations of them require the approval of the Department of Banking and Trusts.

What Is Illinois In This Annual Report? Why Is It Important? Consider The Powerful Annual State Review Of Your LLC. Is This Like A Class Whose Purpose Is To Collect The Necessary Contact And Organizational Information For Every Corporation In Illinois?

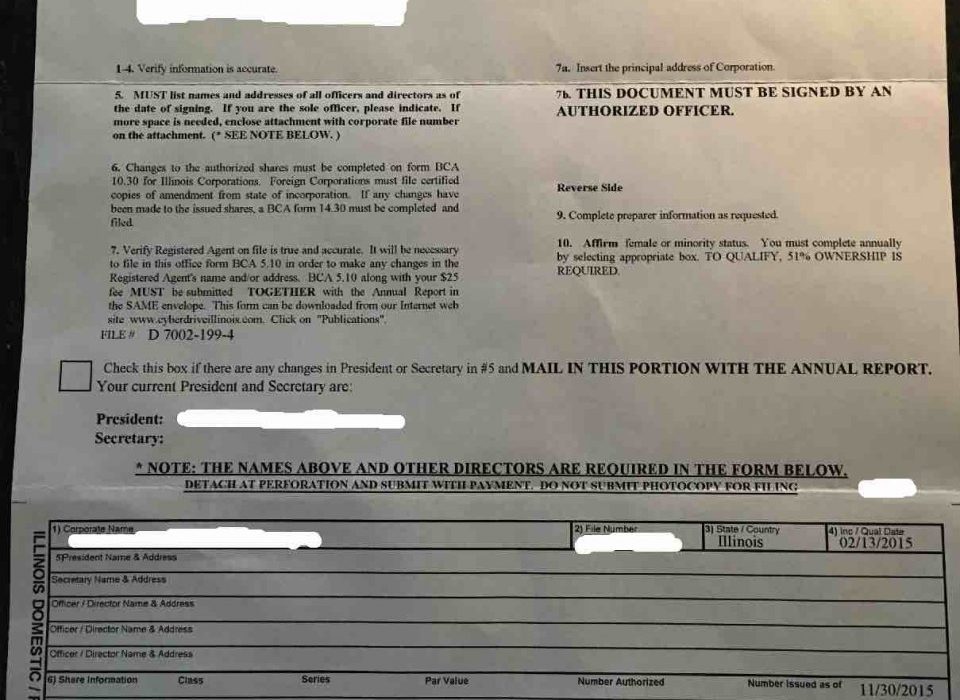

Are you amending your Illinois corporation’s bylaws by submitting a duplicate of Form BCA 10.30, Bylaws of Amendment by email or in person to the Secretary of State Illinois with payment of the registration fee. As a result, how do I reconnect in Illinois? To revive the businessthe customer must file BCA 12.45, Application for Restoration, in duplicate, to the appropriate office of the Secretary of State. You must also file annual returns for years, not just file. For more information, call 217-785-5782.

Annual Return

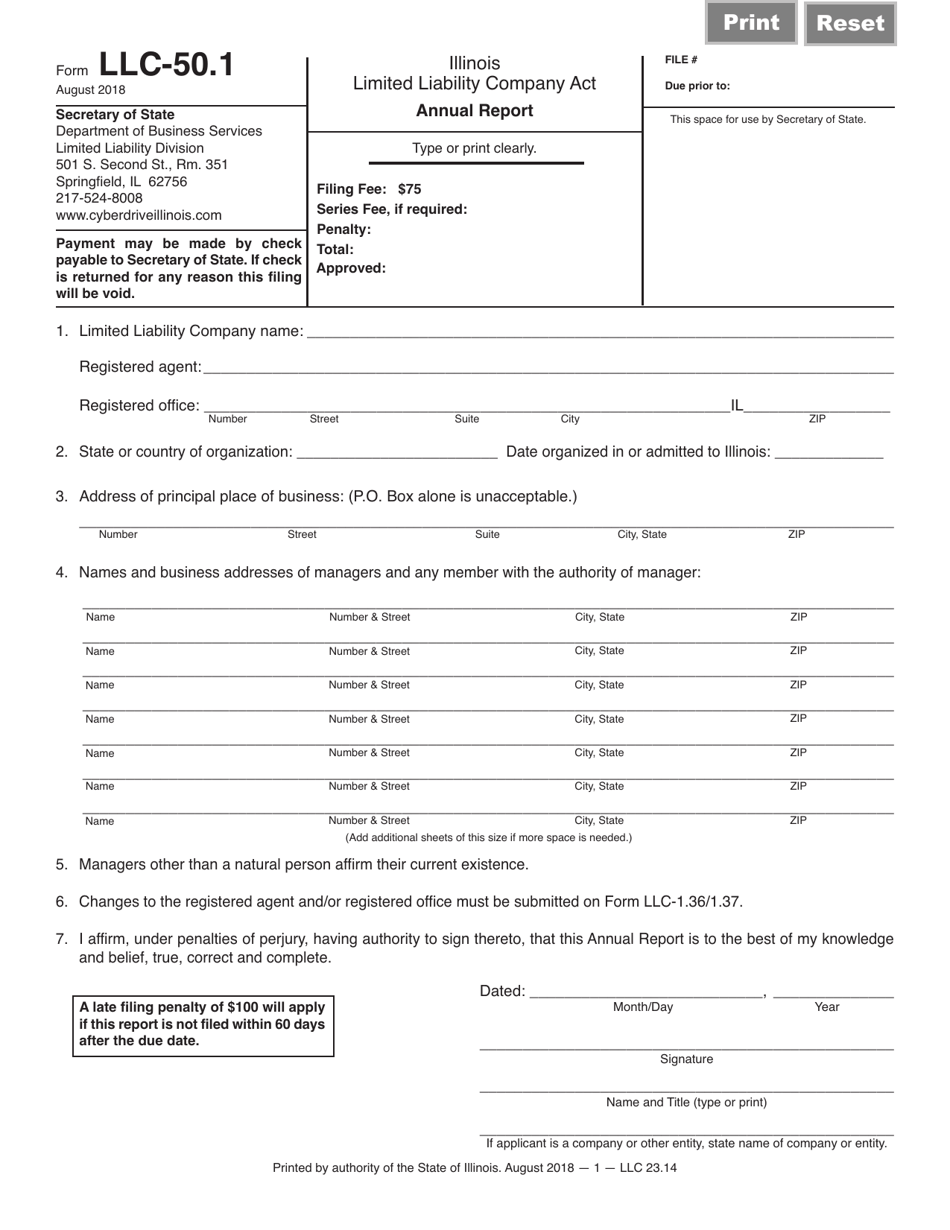

The State of Illinois requires you to file an annual return for your LLC. You can submit your annual return online through the SOS website or by mail using Form OOO-50.1. The report contains almost the same information as the organizational manuals. The report is due annually no later than the first day of any month spent in your LLC. For example, if your LLC was created on July 1st, July 5th, your report may be submitted before July 1st. The new fee is $75. Late filing (more than 60 days after the date of receipt of the results) will result in an additional $300 penalty. day anniversary of the incorporation of the LLC Corporation or incorporation. You can find the registration date by searching for dateCompany name and searching by organization/approval date.

Specify If Applicable. Submit Your Annual Return

Each state has its own annual return requirements. Some provinces require them for all types of organizations. No others require annual reports of all. Some reports are required for actual business unit types but not for others.