What is the Illinois Annual Report? An Illinois Annual Return must be filed each year to maintain the good standing of an LLC if you own an LLC in the entire state of Illinois. SARLs may submit their annual return online or by mail.

Do I need to file an annual report for my LLC in Illinois?

Note. Illinois LLC fees have been reduced. If you see higher government fees on a secondary website, this information is out of date. For more information about the new fees, see Illinois LLC Registration Fees Reduced.

What Will My Spouse And I Get From The State?

If you send your annual return by standard mail, the Secretary of State of Illinois will not send you confirmation orand confirmation of receipt. But maybe if you send 2 copies of your annual return to the state with their address and stamped envelopes, they will send you back an important notice of receipt.

What Is The Illinois Annual Report?< /p>

What Is An Illinois Annual Return?

H2> An Illinois Annual Return Must Be Filed Annually To Keep An LLC In Good Standing And Meet The Requirements If You Own LLC In Illinois. LLCs Have The Option To File Their Annual Return Online Or By Mail. Submitting An Online Application Is More Expensive, But It Takes One To Two Business Days To Process The Report. Sending By Mail Is Cheaper, But Processing Time May Take 10-20 Business Days.

How Our Illinois Annual Return Service Works

For $100 for a positive federal return, we will file your annual return. Nationally, this adds up to a total of $175 for most LLCs. If you have a business in Illinois, we will send you a completed report of your choice so you can add your sales tax information and thensend the report to you by mail.

What Is An Illinois Directory? ? Report?

As with other promises, the State of Illinois requires companies to provide regular feedback to demonstrate compliance with applicable jurisdiction rules. A certificate of no objection confirms that you are “playing by the rules” and signals your status and legitimacy.

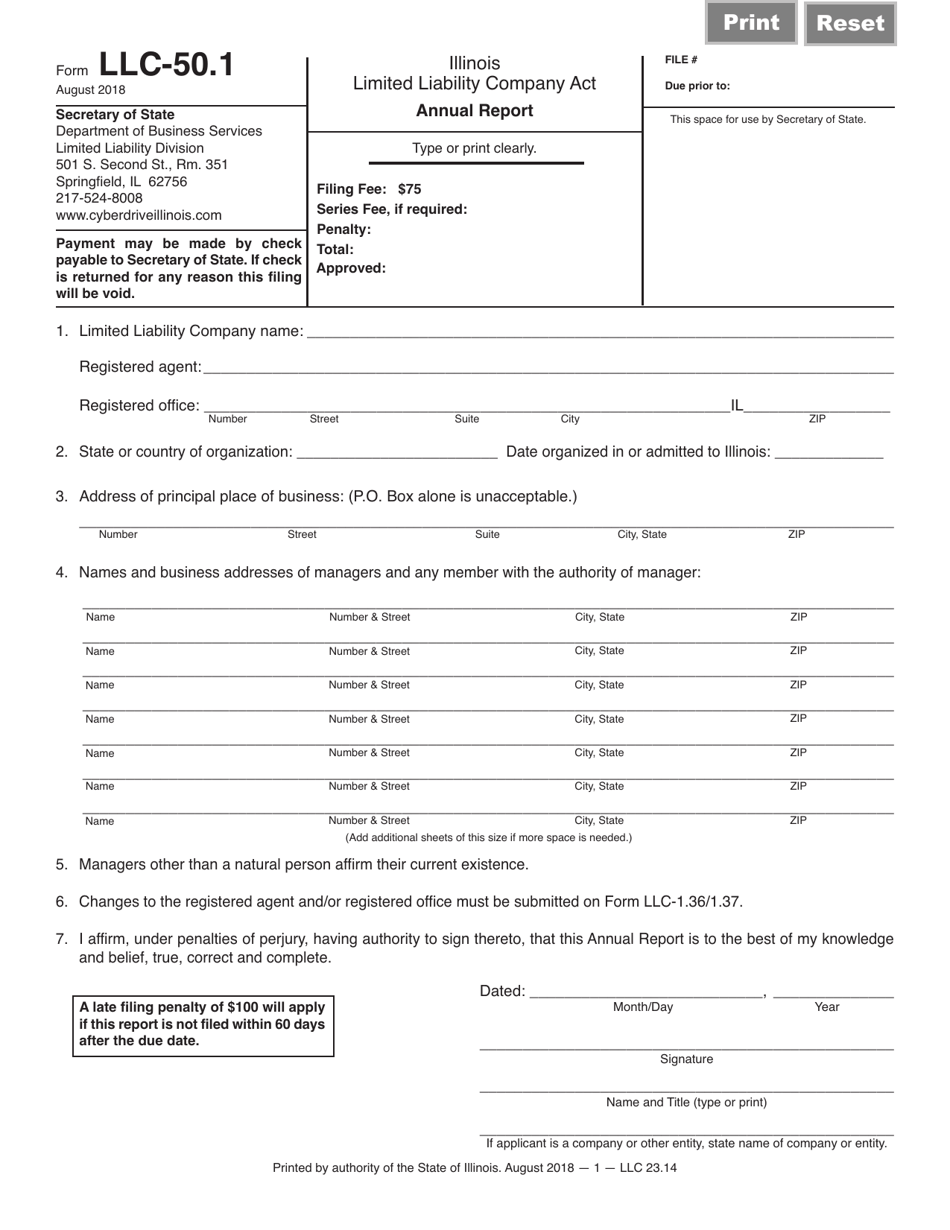

Annual Report Contents

Typically, an annual report is published by LLC of Illinois ( or other relevant commercial organization) and includes all guidelines related to its activities and membership. The contents of the standard annual return in addition to the franchise tax annual return remain

Illinois Annual Registration Instructions And Application Fees

To ensure compliance with each business’s laws for the registered state in Illinois, it is important to file an annual return with the Illinois Department of Business Services. Responsibilities vary depending on the type of business entity. Here is a summary of fees and basic filing requirements:

Annual Return

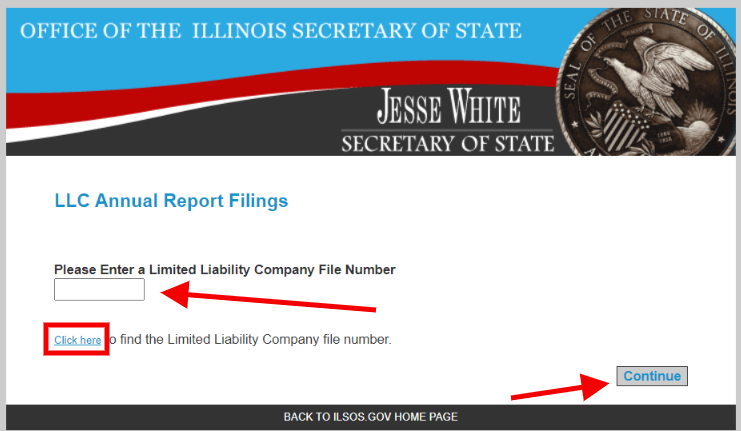

The State of Illinois requires you to file an annual return for your LLC. You can submit your annual return online on the SOS website or by mail using Form OOO-50.1. The report mainly contains information about the content of the organization’s article. The report is prepared annually on the first day of the specific month in which your LLC is formed. For example, if your LLC was specifically drafted on July 1st, July 5th, your report probably needs to be filed by July 1st. The entry fee for electricity is $75. Late submissions (more than 60 days after the due date) will incur an additional $300 penalty.

What Is The Illinois Annual Report? Why Is This Important?

Consider an annual review of your LLC. It is similar to a census in that its purpose is to collect the necessary information and contact information for every business in Illinois. LLC

Call Request From Illinois

The name of an LLC must end with “Limited Liability Company”, “LLC”, or “LLC”. Using hyphens in names?ni often constantly approved by the state. The name must be different from the name of any local or foreign limited liability company authorized to support your business, or a name for which a professional right is reserved at the time in addition to registration. Words such as “bank” as well as “trust” and variations thereof require the approval of the Department of Banking Trusts.

How Do I Amend The Illinois Annual Return?

You are amending your Illinois corporation’s articles of association to reflect the BCA 10.30 Amendment System, by mail or in person, by paying registration fee in Illinois. Secretary of State. As a result, how do I bill my Illinois company? To restore any type of corporation, you must file BCA 12.45, Application for Reinstatement, in duplicate, with the Office of the Secretary of State. You must also submit annual returns for years not submitted. For more information call 217-785-5782.

What is the filing fee for an LLC in Illinois?

The name of your LLC must be significantly different from the names of some other business entities already registered with the Secretary of State of Illinois. You can verify that a name has been provided by searching the Secretary of Commerce’s name database. You can reserve a meaningful name for up to 90 days by simply submitting a Name Reservation Request (LLC Form-1.15). The application fee is often $25.