Are you getting

The Same As Me From The State?

By default, when you mail your annual return, the Illinois Secretary of State does not send you any proof or confirmation. However, if you then mail 2 copies of your annual return to the state in a self-addressed envelope, they will mail you a confirmation.

What If I Don’t File My Illinois Annual Return?

P>

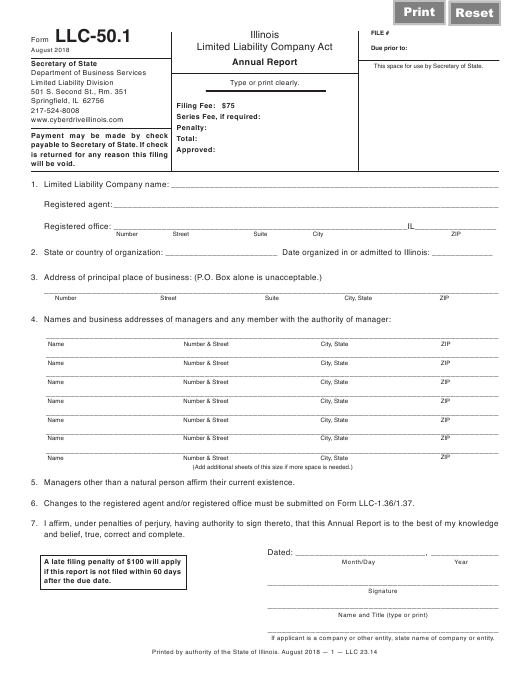

H2> The Penalty For Failing To File An Illinois Annual Return Depends On The Type Of Business.Companies Will, Of Course, Be Charged 10% Of The Total Tax Due Per Film. Non-Profit Organizations Are Charged An Additional $3 And Limited Liability Companies Are Charged $100. There Are No Late Fees For LPs; However, Some Transactions May Be Resolved Administratively Or Simply If The Report Is Not Filed Within Two Months Of The Due Date. Online Annual Report Form:

SignNow’s full range of services allows you to make significant changes to the IL Secretary. State Annual Report Forms Create your personalized TV signature in just a few steps and thus streamline your workflow without leaving your browser.

BUSINESS TAX SERVICE FORMS

E-mail: SDAT. [email protected]. Because the laws governing the establishment and operation of organizations that provide an opportunity, and the effectiveness of a UCC funding application, require more than just submitting documents to our office. We recommend that you consult withPersonal lawyer, accountant or other professional. Our employees cannot act as consultants.

How do I file an annual report for an LLC in Illinois?

Complete the following steps to successfully submit your Illinois Annual Return:

Do I need to file an annual report for my LLC in Illinois?

Note. Illinois LLC fees have been reduced. If you see higher government fees on another website, that information is often out of date. For details on the new rate, please click here: Illinois LLC Reduces Additional Registration Fees

How do I get a copy of my annual report in Illinois?

For information about the company’s financial statements and changing your official representative, contact the Secretary of State of Illinois at 1-217-782-6961 or visit the separate website at https://www.ilsos.gov.