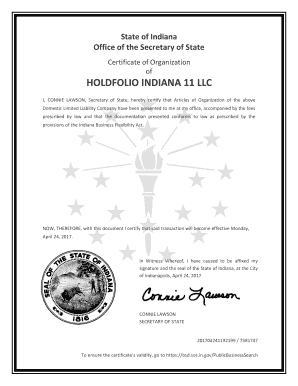

An Indiana Certificate of Existence means your business is in “good standing” in the state of Indiana. A good reputation means that your business is actually legally registered and operating in Indiana. The Indiana Secretary of State satisfies requirements based on evidence of existence.

Opening An Account In A Commercial Bank

Using special bank accountscommercial bank and cash accounts is an important protection for your company’s corporate veil. When your personal and business web accounts are mixed up, your personal assets (your car and other valuables) are at absolute risk if your LLC is also sued.

How do I get a copy of my Articles of Organization in Indiana?

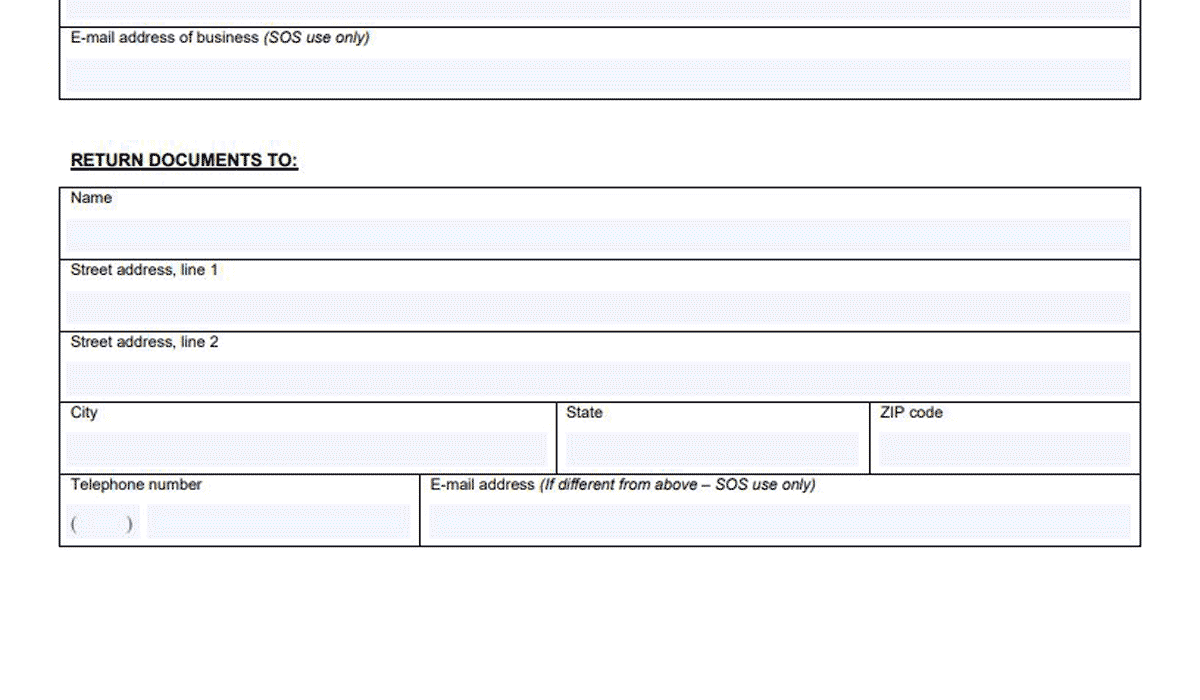

There are various situations in which a company needs a certified copy of the founding documents. For example, some banks require a certified copy of the charter or organization to open a business account. Similarly, some United States of America would like to certify these files (including any other material such as edits, etc.) before allowing a business to operate in that state as a “foreign entity” (a process known as foreign qualification). ).

Here Are The Steps You Need To Get Started A Limited Liability Company (LLC) In Indiana.

A Limited Liability Company (abbreviated LLC) is a way to finally legally structure a business. It combines my limited corporate liability with your current flexibility and lack of formality through a simple partnership or sole proprietorship. Any agency owner who is seeking their own limits, or perhaps even personal liability for litigation-related business debts, should consider forming an LLC.

How Can I Help You? Certified Copy Of Indiana State Incorporation

A certified copy of the Incorporation or Articles of Incorporation can be obtained online free of charge. Normal processingbut takes up to 5 days plus shipping time and costs $15 plus $1 per page.

What Is An Indiana Certificate Of Existence?

An Indiana Certificate of Existence means your business in good standing in Indiana. Authentic status means that your business is legally established and operated in Indiana.

The Cost Of Submitting A Powerful Organizational Article

It is better to send an organizational article than by mail. The cost of filing for an LLC in Indiana is slightly higher when filing offline than online. Here is the cost of filing a Certificate of Incorporation in Indiana,

Indiana LLC Training Package:$247Generally

What is included in the Indiana LLC package?A registered agent in Indiana offers the best LLC service in the state. Our agents in Fort Wayne are locals who also seem to know Indiana business rules inside and out. This experience, along with world-class customer service, gives you everything you need to keep your business going strong.Order LLC “Indiana” right now!For $247 (including registration)$98 fee) you must receive:

Spend Time Starting An LLC In Indiana

At BizFilings, we clearly state our and Indiana fees. Check out our rates for a high performance LLC in Indiana. If you look at our prices for the registration of an LLC, then a person clearly sees:

Developing An LLC Operating Agreement

The Formation Agreement should be one of your most important tasks once you have successfully formed your LLC. Although this document is not required by law, it is still important because it explains how a particular LLC manages the rights and obligations of its owners or members. For example, an operating agreement explains the basic financial obligations of each LLC member, how decisions are made and distribution of sales, profits and losses, the roles end users will play, and how you will interact with new members or buy out members.

Need A Certified Copy Of Your Business Documents In Indiana?

Social media is increasingly being used by companies to communicate with their visitorsand colleagues and clients. We want you to share useful information and tools to grow your business.

LLC Benefits:

Any foreign (out-of-state) LLC that wishes to actually do business in Indiana must register with the Secretary of State for a Power of Attorney. This is done on the OneStop Registration business page as shown below.

How much does it cost to file Articles of Organization in Indiana?

An LLC in Indiana is formed by filing a Memorandum of Association with the Business Services Division of the Secretary of State of Indiana. Articles must contain: