The law contains what appears to be a general statement that Indiana’s policy is “designed to help maximize the impact of an LLC’s approach to freedom of contract and enforcement of operating agreements around the world.” This gives LLC members the right to enter into binding business agreements even in their operating agreements.

LLC Benefits:

Any new (out-of-state) LLC wishing to do business in Indiana must register with the Secretary of State to receive a Certificate of Ownership. This is done through OneStop, the company registration page, as described below.

Website Transmission Security Check

casetext.com must first check the security of your connection Continue.

Chapter 5

Chapter Five covers the general financial rules and procedures of an LLC, including the rules governing capital distribution, profit and loss sharing, illegal distributions, and rights appropriate to members that may be divided.

What are the benefits of an LLC in Indiana?

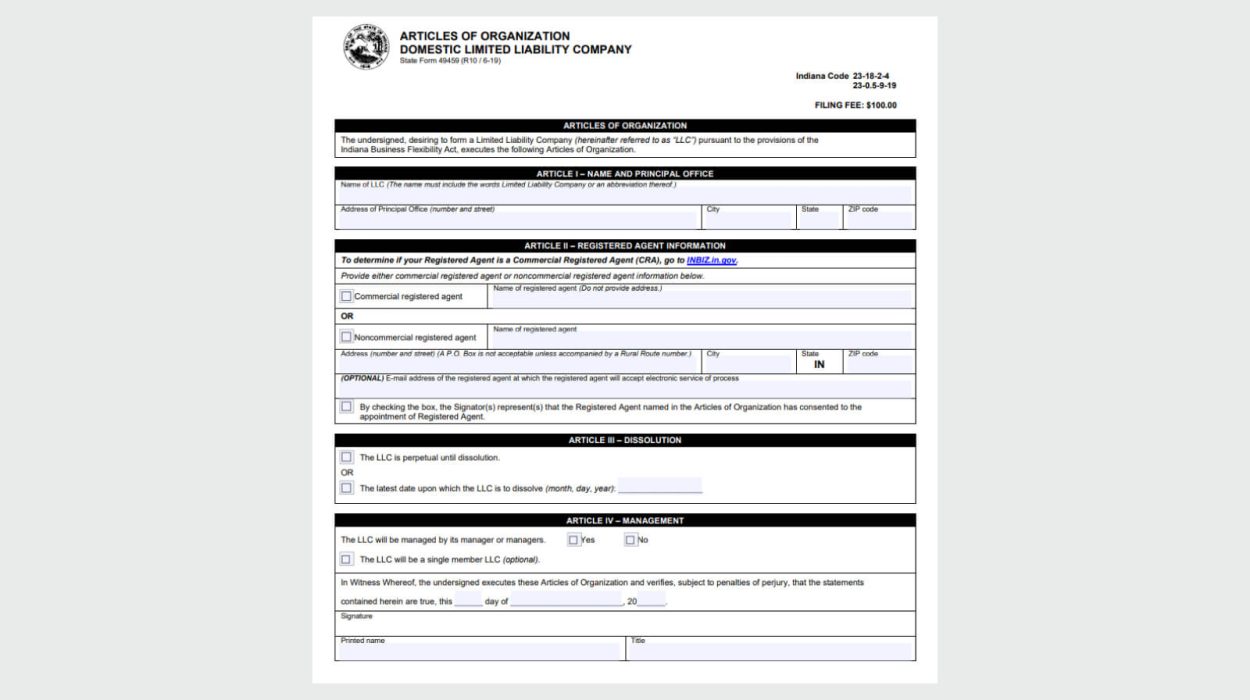

Why form an LLC in Indiana?The state offers several ways for businesses to succeed, such as business tax credits, corporate tax credits, and business development programs. The Indiana career tax structure will also be redesigned in 2021 to better serve Indiana institutions. Indiana’s corporate income tax rate will be cut to 4.9%. The state also offers a variety of programs to support modern entrepreneurship, business expansion, and financial growth. Forming an Indiana Limited Liability Company (LLC) is generally the quickest and easiest way for entrepreneurs to incorporate an Indiana related company. An LLC is the ideal organization for startups and SMBs, providing you with the benefitsThe benefits and protections that Indiana Big Business enjoys, as well as simplified rules and regulations.Benefits of Forming an LLC in IndianaEasily file your taxes and learn about the potential benefits of tax treatmentEasy to set up, manage, regulate, administer and complyProtect your assets from your professional liability in addition to your debtsLow cost offer ($100)Discover the undeniable advantages of an LLC business structure. Check out Incfile’s step-by-step guide on how to call an LLC, get a registered agent, all the fees you need to pay, Indiana venture capital taxes, and more. We will also cover applying for your Indiana LLC, the circumstances of your incorporation, and how you will interact with the Indiana Secretary of State (SOS), Business Services Division.Checklist for Starting a Business in IndianaTo help you, use our specific business start checklist to keep track of what you need to get done.b to run your entire business.

Here Are The Main Options You Need To Choose To Register A Full Indiana Limited Liability Company (LLC).

A Limited Liability Company (abbreviated LLC) is another way to legally set up a business. It combines the limited liability of a corporation with the flexibility and freedom from procedures offered by a partnership or corporation.?ation. Any business owner wishing to limit their personal liability for labor debts and lawsuits should consider any LLC.

Profits, Losses AndBreakdown

3.1BWIN LOSE. For financial and tax purposes business purposeNet gains or losses must be determined and calculated annually.distributed among members in proportion to the relative capital of each memberInterest in the Company as set out in Schedule 2, as amended from time to time.in accordance with the Regulation of the Ministry of Finance 1.704-1. Information

By continuing to

Purchase On This Site, You Agree To The Monitoring And Verification Of Assets. For Security Reasons And To Ensure The Availability Of Public Services To Users, This Government Computer Suite Uses Network Traffic Monitoring Programs To Detect Genuine Unauthorized Attempts To Download Or Deny Information Or Cause Damage, Including Attempts To Disrupt The Service By Refusing Users.

The Cost Of Registering An LLC In Indiana

At BizFilings, we clearly state our fees and explain Indiana’s fees. See fees for registering a specific LLC in Indiana. If you look at our prices for the registration of an LLC, you will see in simple terms:

Incorporating An LLC In Indiana (5 Steps)

The State of Indiana requires that the name of a Limited Liability Company (LLC) be different from the name of a Limited Liability Company (LLC). distinguish between other types of business that operate in the state. To ensure that the name you choose is usually available, you can search for the company in the records of the Secretary of State.

Call Us On The Phone (800) 773-0888

Monday to Friday: 5:00 AM to 7:00 PM Pacific Time. Weekends: 7:00 AM to 4:00 PM Pacific Time.

Why Does An Indiana Limited Company Need An Agreement?

An Indiana limited company must have a business agreement because the corporation cannot trade when it comes to itself. To work LLC aboutexpect real people (and other organizations) to consider running our business.

What is an LLC in Indiana?

Check out this handy guide to setting up an LLC in Indiana.

What are the business laws in Indiana for corporations?

Section 1 of the Uniform Law on Commercial Organizations. Indiana Business Corporations Act Section 1.3. Retirement plans1.5. Professional societies Article 2. Securities and franchises Article 2.5. Credit intermediaries Article 3. Commercial companies: ? General provisions repealed Article 4. Partnerships Article 5.

What is a limited liability company in India?

Limited Liability Company A limited liability company is another category referring to companies incorporated under the New Companies Act of India 2013. There are a number of service providers in India, including several private and public limited companies, but the limited company is a brand new last in line.

What are the Articles of series limited liability company (domestic)?

Charter of the Serial (Domestic) Limited Liability Company 56269 ONLINE FILE Amendment to section 56268 ONLINE FILE The section is similar to Decree 56270