The Indiana Secretary of State charges a $100 law enforcement fee. You can reserve an LLC name at Indiana SOS for $20. It is also considered that LLCs in Indiana are required to file biennial returns every two years during the year following the registration of the LLC. The fee for this report is $50 if sent by mail or $32 if sent online.

Choosing Incorporation And Your Corporation

The following is a summary of the many different forms in which a corporation can be incorporated in Indiana. Caveat: formalStarting a business brings both great benefits and acceptable consequences. Care should be taken regarding the form of business that will be used in the conduct of the business. The Corporate Department is happy to help, but does not offer legal advice. It is highly recommended to consult a lawyer for further advice and guidance.

How long does it take for an LLC to be approved in Indiana?

If you are thinking about starting your amazing business, you might be wondering how you can help set up an LLC in Indiana. This content will guide you step by step through the entire process. Although setting up your first LLC can be a little tricky, with proper planning and preparation, setting up an LLC can be done without a really good lawyer.

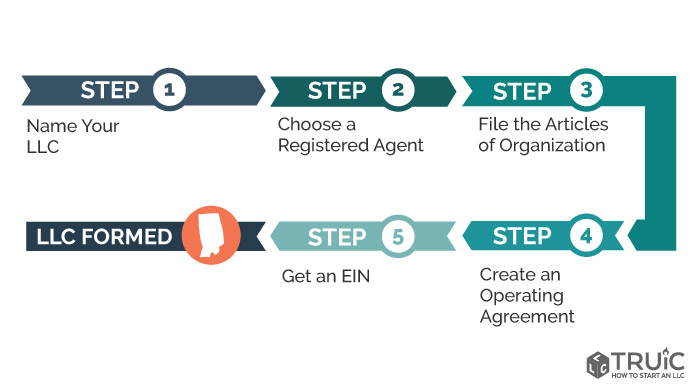

Here Are The Basic Steps You Need To Take To Form A Limited Liability Company (LLC) In Indiana.

A limited liability company (LLC) is a way to legally structure a business. It combines the sort of limited liability of a corporation with the new flexibility and informality offered by partnership or individual ownership. Any professional owner who also wants to limit their personal liability for business debts should consider forming an LLC.

Creating An Amazing LLC In Indiana Is Easy

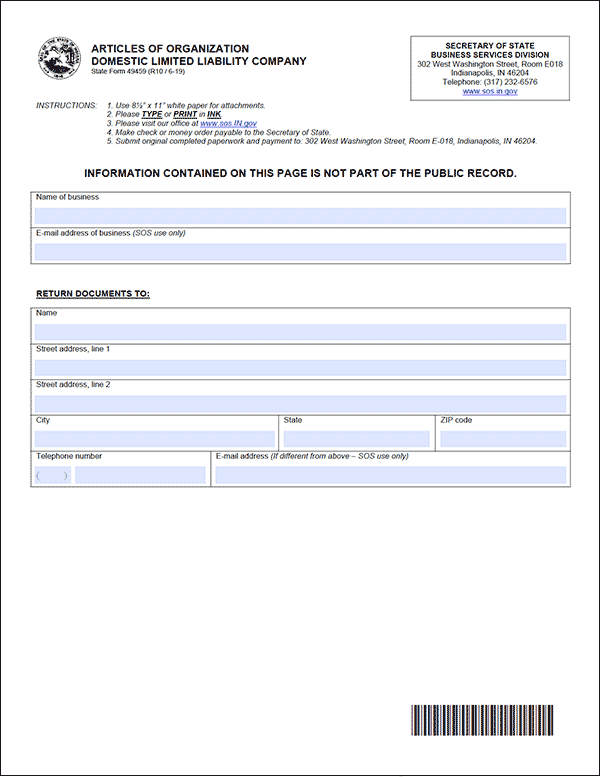

Indiana LLC – Create an LLC Indiana, you need time to file the Articles of Incorporation with the Indiana Secretary of State’s Department of Business Services, which costs between $95 and $100. You can apply for or by email. The Memorandum of Association is the legal document that formally establishes your limited liability company in Indiana.

Developing An LLC Agreement

Drawing an Operating Agreementshould be your only first task after completing GMBH. While this document is not legally required, it is still important as it relates to the operation of your LLC and the rights and obligations of its officers or members. The Operating Agreement explains the financial obligations of each LLC member for a specific period of time, how decisions will be made and profits and losses shared, what role all members will play, and how we will deal with new members or avoid the associated risks.

Can I Reserve A Company Name In Indiana?

Yes. If you’ve been thinking about the perfect company name but aren’t ready to register your LLC, you can reserve your awesome company name for up to 120 days by creating an account on the INBiz web portal and selecting “Government Business Services Secretary” and then “Reserve name.” You must pay a $10 fee. There is no name reservation disclosure form in Indiana.

RegisterRegister With The Indiana Department Of Revenue

Many LLCs, including sales tax collectors and employees, must register with the Indiana Department of the Treasury. Registration can be done online or by submitting a prepared paper application by mail or in person at the office.

LLC Benefits

A Minimum Liability Company (LLC) is a type of corporation that allows its owners to (called “participants” in an LLC) enjoy the protection of an appropriate self-employed corporation by taking advantage of the tax benefits and flexibility of that partnership or sole proprietorship.

LLC Benefits:

Any Hawaiian (out-of-state) LLC wishing to do business in Indiana must register with the Secretary of State in order to receive board certification. . This is done on the OneStop Business registration page, as described below.

Indiana LLC Training Package:$247GenerallyWhat Is Included In Our Indiana LLC Package?A Registered Agent In Indiana Offers The Best LLC Service In The State. Our Agents In Fort Wayne Are Locals Who Knowcoma With Indiana’s Business Restrictions. This Experience And World-class Customer Service Gives You Everything You Need To Keep Your Business Running Smoothly.Order LLC “Indiana” Right Now!For A Total Of $247 (including A $98 Processing Fee), You Get:

Choose The Federal Income Tax LLC Form

One of the main advantages of a limited liability company is the tax flexibility it offers. It’s about federal income tax. While there have always been some restrictions, for federal income tax purposes an LLC can be treated as follows:

What are the benefits of an LLC in Indiana?

Why form an LLC in Indiana?The government offers several ways for businesses to succeed, such as corporate tax credits, corporate tax credits, and market development programs. Indiana’s corporate tax structure will also change in 2021 to finally better serve Indiana corporations. Corporate income tax in Indiana will fall to 4.9%. The state also offers various programs to support new businesses and to expand and grow businesses. Forming a Limited Liability Company (LLC) in Indiana is generally the quickest and easiest way to start a business.Owners help you start a business in Indiana. An LLC is the perfect organization for online businesses and small and medium businesses, providing your needs with the benefits and protection of big business in Indiana with simplified policies and regulations.Benefits of Forming an LLC in IndianaEasily file your taxes and find potential tax processorsEasy to create, manage, regulate, use and complyProtect your personal wealth from liability and incredible business debtLow billing cost ($100)Learn more about the benefits of a conventional LLC business structure. Check out Incfile’s step-by-step guide for more information on how to name your LLC, how to get a registered agent, collect fees including payroll, Indiana business taxes, and more. We will also cover applying for your Indiana LLC, your registration requirements, and how to interact with the Indiana Secretary of State (SOS), Business Services Division.Checklist open?I am a business in IndianaTo help you on your way, use our business start-up checklist to keep track of everything you need to do to start your business.