What Information Do I Need SEND A REPORT BY E-MAIL?

Business entity reports must be submitted at the end of each year. very little time to create the entity. If you want to know exactly When your Internet business report should be ready, search for a specific company.

Welcome To INBiz!

INBiz is an Indiana-affiliated one-stop business registration, organization, and compliance with state laws and regulations. We use state of the art security features so you can be sure to put your personal and professional know-how into our system.

Do you have to file a business entity report in Indiana?

Once an absolute business entity is incorporated or licensed to do business in Indiana, it has an ongoing obligation to file periodic business reports.and. These reports must be completed annually by non-profit organizations and every two years by for-profit corporations only.

How To File A Company Formation Report?

To submit your business report entity, log in to your INBiz account and select “Business Report Entity” from the “Online Service” menu.sy.” For more information on entity reporting, please visit the INBiz website: https://inbiz.in.gov/business-filings/business-entityreport

Get Indiana Business Today’s Entity Reporting Service!

START

What Is The Indiana Business Unit Report?

The Indiana Business Unit Report must be submitted to the Indiana Secretary of State every two years. The purpose of the report is to provide important information such as contact information that you may provide.

Indiana Annual Report Information

Businesses and non-profit organizations are required to complete annual returns in order to track good growth. Regional Secretary. Annual reports are required in most regions. Deadlines and fees vary by state and object type.

Business Report Fees

The cost of the Biennial Indiana Business Report depends on the type of business. For Limited Liability Companies, the email filing fee is $50 or $31 for online filing, whilewhile corporations pay $20 by mail or $31 to submit online data.

>

What Is An Exclusive Business Entity Report? Why Is This Important?

Consider the corporate report on this semi-annual review of your LLC. It is similar to a census in that its importance lies in gathering the necessary contacts in addition to structural information about any Indiana corporation.

Indiana LLC Name Requirements.

Finding a legal entity in Indiana can help ensure that the company name you want is available, which is the first and foremost requirement for registering your LLC. All LLCs must carry the LLC designation, whether it be an LLC and/or possibly an LLC.

Indiana Annual Return Fees And Instructions

Indiana is a bit unique when it comes to filing biennial returns because their flat fee structure varies significantly depending on whether you submit them manually online or by mail. If you continue to operate as a corporation or LLC, the boat deposit is $30 and the online depositum – $22.40. If it is a non-profit organization, they will be charged $10 for materials submitted by mail or $7.14 for online applications. There is no late decision in Indiana with proper filing. However, state that if you apply more than 120 days after the deadline, it could end your business.

How do I file a business entity report in Indiana?

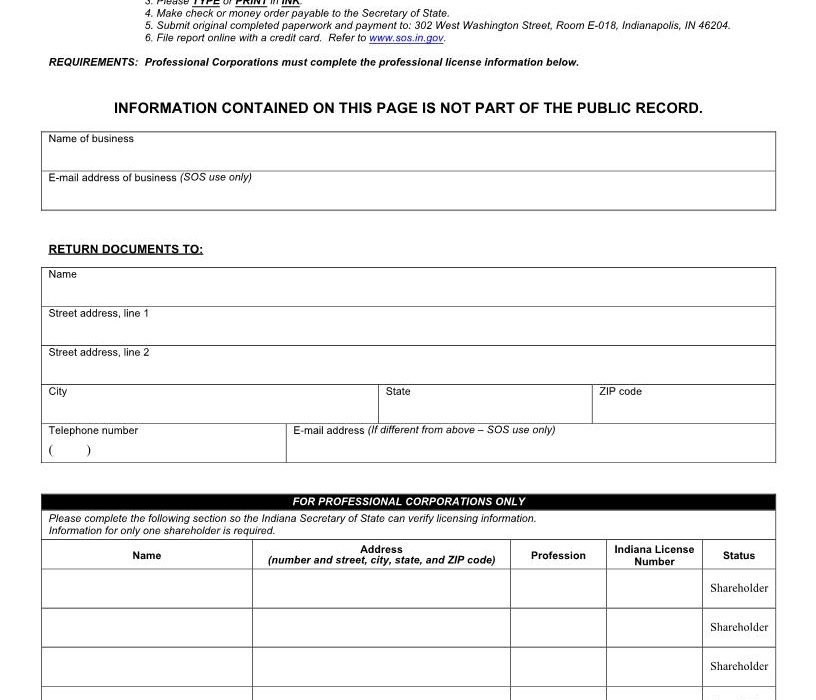

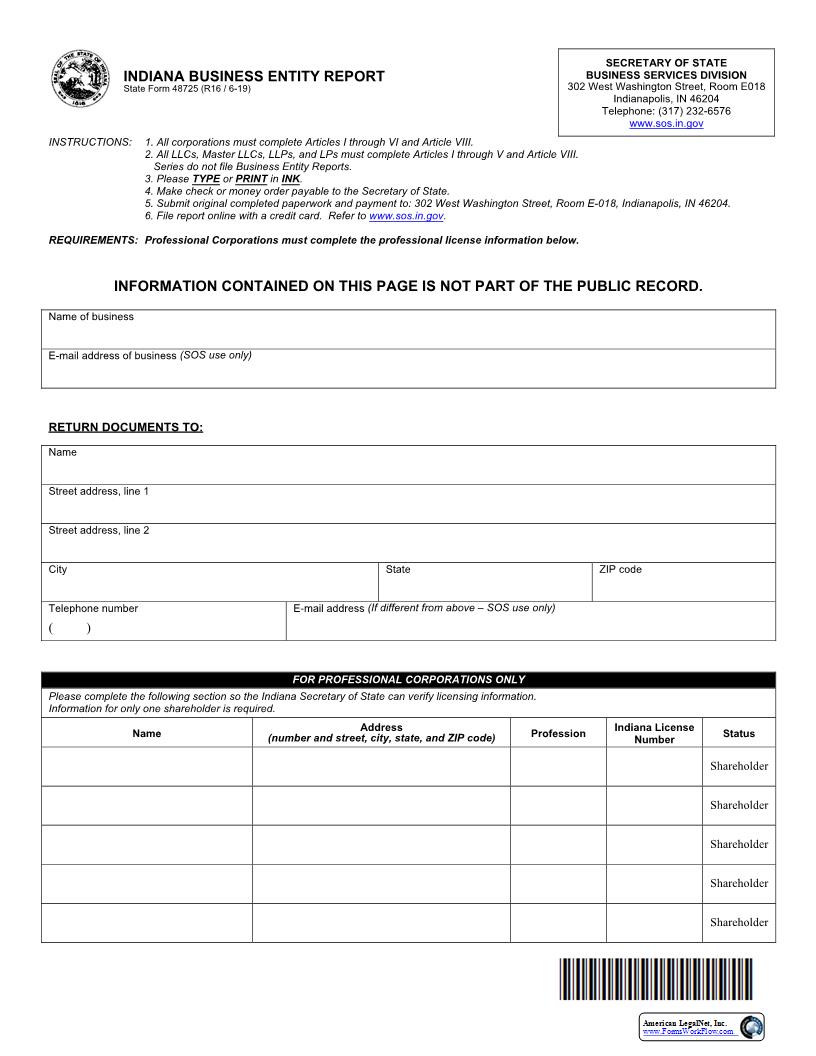

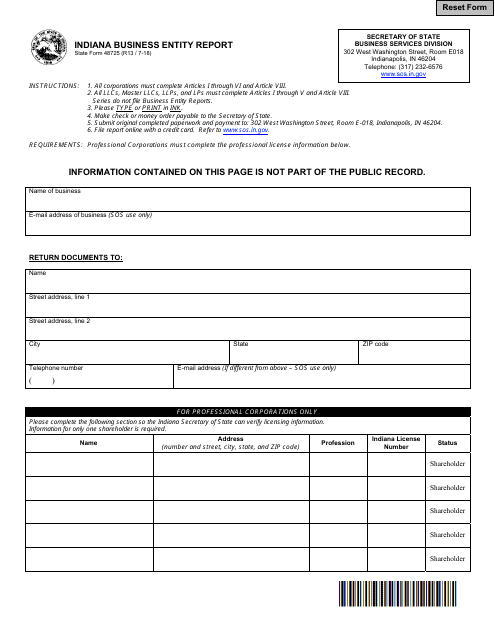

Complete the following steps to properly submit an Indiana Business Enterprise Report:

What are Indiana business entity reports?

Once a large business entity is established or authorized to do business in the Indiana stage, it must file periodic business activity reports on an ongoing basis. These reports must be submitted annually by non-profit organizations and every two years by for-profit corporations.

How much is an Indiana business entity report?

Limited liability companies (LLCs) and registered owners are required to file a report with the Indiana Business Corporation every two years. The same is true for financial statements filed in other states, but the filing frequency is only about two years, not every year.

Does Indiana require an annual report?

Corporations and non-profit organizations are required to file annual returns to help you maintain a good reputation. Ministerforeign affairs. Annual returns are generally required in most states. Deadlines and additional fees vary by state and object type.

How do I file a business entity report?

– IN.gov How do I reset my password? To view the Business Object Report, log in to your INBiz account and select “Business Object Report” from the online services menu. Additional information on business object reports is available at INBiz:

How often do I need to file business entity reports?

Each company has important new responsibilities and continues to submit regular company reports to the secretary of state to notify the office if certain changes to your company remain in effect. Submit a report on my business unit These reports are submitted every two years for non-profit and commercial organizations.

How do I find out when my business entity is due?

If you want to know exactly when your legal entity is due to report, search by company. Find your company in the search results and hence click on the “Company ID” link to finally go to the “Company Details” page where the ad for the due date report is listed.