Who is literally obligated to obey? Almost everyone will want to file an Iowa tax return, including: residents with an extremely high net income of $9,000 for individuals and $13,500 for married taxpayers. Partial year residents (during the part of the year they currently reside in Iowa)

Biennial Return

The State of Iowa requires individuals to file a biennial return for your LLC. You can file a report online at the SOS website orDownload the respective pre-filled form from the same website. The report is due on March 31 after an odd number of years. You must receive notice from the Secretary of State before the deadline for submitting a credit report. Current filing fees have always been $30 for online filing and $45 for mail-in filings.

Learn About Local Iowa Taxes.

You will be required to pay the provider each times for submitting the completed form. exemption certificate. You are purchasing goods and services for resale or other free purposes. Similarly, in the marketplace, you must obtain tax exemption certificates from your customers whenever they purchase goods or services from customers for resale or other tax-free purposes. Keep them in your records.

Biennial Reports Requires Iowa LLC To File Reports With The Secretary Of State Every Two Years. Although You Can Always Print The Report, Fill It Out Elsewhere, And Then Mail It To The Secretary Of State.Hello, The Iowa Secretary Of State Now Has An Online Portal That Allows You To Complete And Submit All Information Online. However, Reports Submitted In Odd-numbered Years (2021, 2023, Etc.) Must Also Be Submitted By March 31st. The Secretary Of State Will Send A Letter To The Address Where You Registered Your Branch (if You Provided One) And Send A Notice To The Address Actually Registered. The Currently Available Filing Fee Is $30 If Submitted Online Or $45 If Mailed. At

price Iowa LLC

At BizFilings, describe our and Iowa fees as clearly as possible. Check out our Iowa LLC pricing update. By noting our prices for registration of an LLC, customers clearly see:

How is an LLC taxed in Iowa?

Most states taxWell, at least some of the business income generated by the state. The details of taxation of the income of a particular company, as a rule, depend in part on the legal form of the company. In most states, corporations are subject to corporation tax, while income earned through corporations such as S corporations, limited liability companies (LLCs), partnerships, and sole proprietorships is subject to state income tax. Tax rates on executive and personal income vary greatly from state to state. Corporate rates, which are largely fixed regardless of the level of funding, typically range from 4% to 10%. Personal tax rates, which typically vary by income, can range from 0% (for small amounts after tax) to about 9% or more in some states.

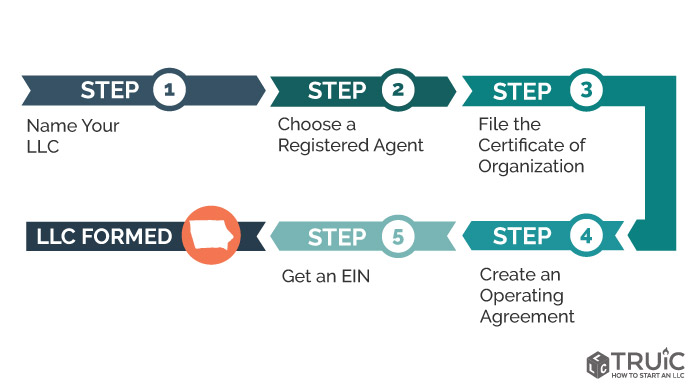

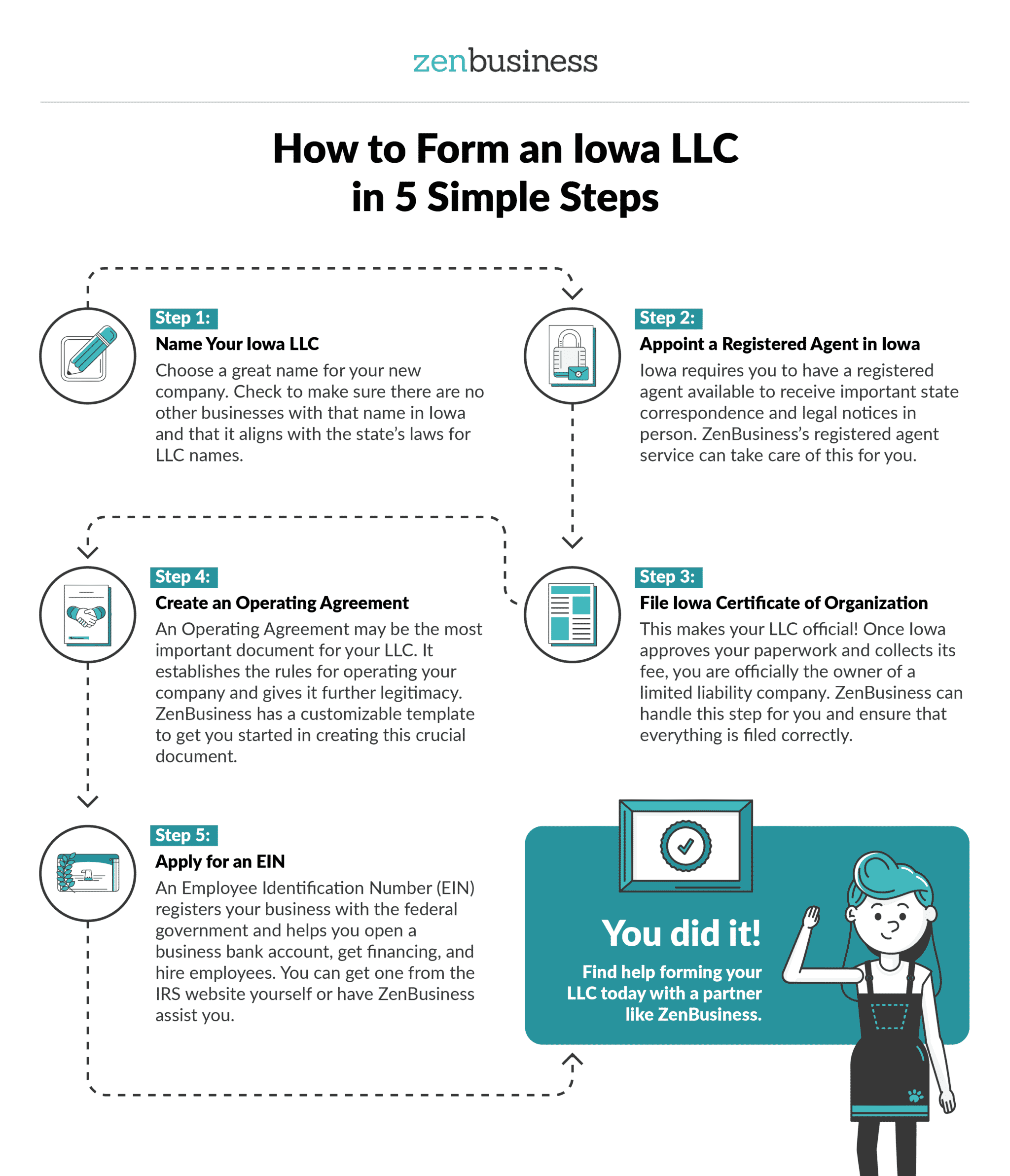

Creating An LLC In Iowa Is Easy

To form an LLC in Iowa, you must apply to the Secretary of State of Iowa for a Certificate of Organization, which costs $50. You can apply online, by mail or fax. An organization certificate is a special legal document that allows you to officiallyto form Iowa LLC.

IA LLC Vs. IA Corporations

Now that we have laid the groundwork for our own shared characteristics between LLCs and agencies. Next, you should consider the features that make an LLC or Iowa Corporation unique and that are best for your business in the long run. Each state also has its own IRS rules and tax laws that govern its businesses, and these unique details should be considered when choosing your legal entity. The information in this section may well provide this data to Iowa LLC and Iowa Corporation.

Check If The Connection To The Site Is Really Secure

casetext.com would like to check the security of our connection beforehand Continue.

How To Register An Iowa LLC

It is very important to choose a unique name for your Iowa LLC. Without a conflicting name, the Iowa Secretary of State will not allow you to register your business. The only result is that you need to finally determine the name of the LLC before registering.Registration of your legal entity and submission of the necessary documents.

Can I Reserve A Field Name In Iowa?

Yes. If you wish to reserve your corporate name and are not yet ready to formally register your LLC, most people can reserve a name for 120 days by submitting an associate name reservation request with the Secretary of State of Iowa and paying the $10 fee.

Iowa Corporation Annual Report Requirements:

See ours for more details Iowa Annual Report Clearinghouse page.

Is there an annual fee for LLC in Iowa?

The main expense that can be incurred when forming an LLC is the $50 fee to submit your LLC’s Certificate of Organization online to the Secretary of State of Iowa.

Does the state of Iowa require you to file a tax return?

f. You were a non-resident, if not a part-time resident, and your Iowa-sourced net income [line 26, IA 126 (pdf)] was likely to be $1,000 or more, unless your income was below the threshold specified above. In the case of employed non-residents, the couple’s combined income is purchased to determine if their income is large enough to require them to file a proper Iowa return. To understand “Iowa income,” read the instructions on lines 1-26 of IA 126.