Brief

If you are definitely preparing for integration, keep in mind the following specific requirements in Kansas.

How do I find information about a business in Kansas?

Business Object Database (view information about a business registered with your current secretary of state, order a certificate of good standing for business) Name Availability (check if the company name is available) Charities (always display information about registered charities in Kansas)

Open A Business Account

The use of a bank account and a bank loan is necessary to protect the corporate veil of your business. Your assets (your houses, car and other valuables) are likely to be sued against your LLC.

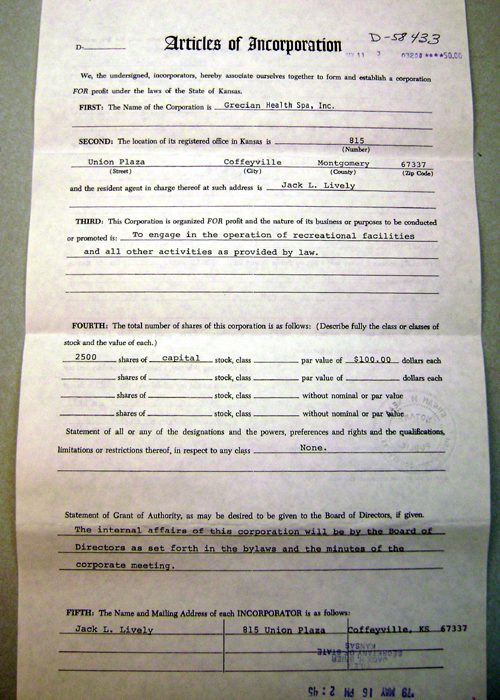

How To Fill Out The Registration Form

You can send your articles of association when it arrives at the Kansas Secretary of State’s office: by mail, fax, in person, possibly online. Online filing is an easy way to file, and filing costs less than other methods.

How To Order A Certified Copy Of The Articles Of Incorporation Or A Certified Copy Of The Relevant Articles Of Association In The State Of Kansas Incorporation

A certified copy of your articles of incorporation or certificates of incorporation can be ordered by fax, mail, telephone or in person, but facsimile is the preferred option. Normal processing takes up to 3 days plus additional shipping time and costs $15 plus $1 per page. Expedited Service is not available.

Company Documents:

Copies of charters and charter amendments filed by the Secretary of State prior to 1939 are available on microfilm, usually in government archives, and are indexed by individual names. The original business unit records (also known as “dead vests”) for businesses seized prior to 2000 are also kept.? in every state archive. These corporate records date from around 1868. Dead Jacket records may include: Offer of Incorporation, Definitive Memorandum, Efficiency, Change of Permanent Agent, Lists of Associated Shareholders and Dissolution Documents, but not the biological imperative of real estate or any particular company. For assistance with supplier historical records, please contact kshs staff.

What Is A Kansas Corporation?

A Kansas Corporation may be a separate legal entity founded by the owners or shareholders of the Company. The shareholders of the corporation decide to merge, creating a separate corporation that exists independently of each of the shareholders personally.

LLC Name

The web design on the next page is a bit confusing. and tries to find out if you reserved the name in advance (which is optional, by the way).

Registering in Kansas Each state has its own rules for registered companies. there. If you choose to register Kansas, mate.com is a must.? will take care of all the details. We will review the availability of your business name and help you prepare and file the appropriate articles of incorporation with the Secretary of State of Kansas. We can also help you with many of your follow-up requirements, such as filing amendments, court orders and consents, annual status, which you will learn during preparation and filing.

Getting information about a business object< /h2>After families do this After you click on the relevant business unit of your choice, you will be taken to the business unit summary page where customers can find more information about the respective organization.

Creating a Kansas Corporation is Easy

h2>Creating a Kansas Corporation is a simple process that can be accomplished by filing a valid charter with the Secretary of State. In the following instructions, we will show you step by step how to create a new corporation in Kansas.

How do I get articles of organization in Kansas?

In this unique tutorial, we’ll walk you through applying your status to state status. This is the document that officially identifies your LLC in Kansas.

How much does it cost to incorporate in Kansas?

Yes, if you are doing business in Kansas, you must register with the Kansas Department of the Treasury. You can o?Open an account through the Kansas Department of Revenue Customer Service Center or by completing the Kansas Business Tax Return Form (CR-16). You must provide your EIN before you can register.

How do I form an S Corp in Kansas?

Before forming this S corporation, you should consider the following factors:

How do I file business taxes in Kansas?

The Kansas Business Center provides access to Kansas Secretary of State’s online services through KanAccess. Registering with KanAccess allows companies to place their deposits directly online and access their documents from the Secretary of State.

Is there a database of sole proprietorships in Kansas?

Note. The State of Kansas does not register title, d/b/a, fictitious names, trade names, or fictitious names. Therefore, this Secretary of State cannot provide a repository for looking up these entity types.

How do I change a business name in Kansas?

Make a deal in Kansas with the Secretary of State. NOTE. Other agencies may require additional documents. Search the secretary of state’s database to determine if a company name is available for use. Submit an amendment to change the absolute company name. Reserve the company name.