Does Kansas require a business license?

If you want to do business directly in Kansas, you may need to obtain a business license, usually from the city where you work. Some cities do not require a municipal business permit. An example is the city’s Overland Park. It is best to check with your preferred city/county to see if most people need a business license. This can be done in person, by appointment by phone, or on your city’s website. You can also find out right away if any other licenses or permits are required in your city, especially if you work from home.

Register For Kansas Corporate Taxes.

Kansas receives 12 types of taxes. Review your Business Taxes (PDF) to make sure clients are registering to pay all dues.?dim taxes and requirements, then use the Business Tax Return (PDF) to submit the perfect form.

Choose A Business Idea

Spend time looking for ideas for your business that will help you. Consider at this stage that you have interests, skills, resources, availability, and factors that you want to get started on. You should also consider the likelihood and success based on your personal interests and the needs of your community. Our reading article for more tips on evaluating trading ideas.

Overview Of Business Licensing And Registration

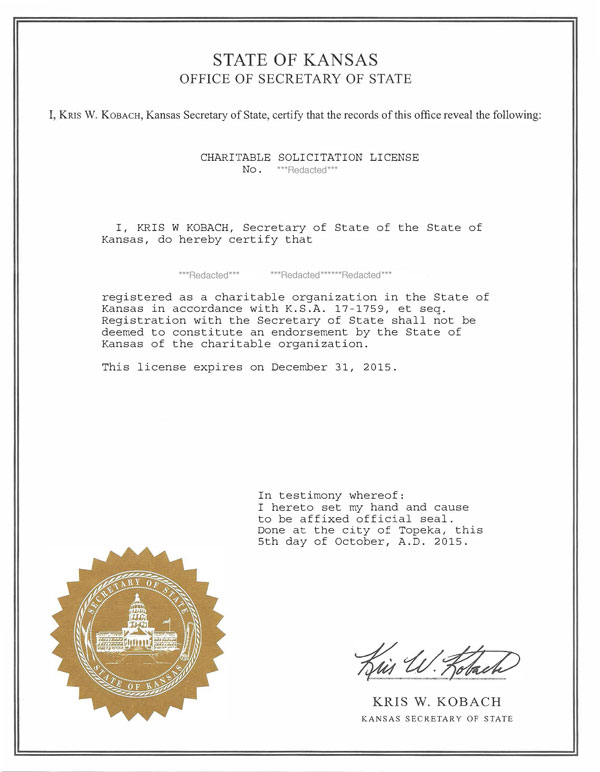

Businesses must be registered and licensed however, doing business in Kansas City, Missouri has an exemption under state law. License.

Choose The Right Business Idea

The decisive step towards starting your own business is deciding what kind of business you want to start. Look for 1 idea that matches your interests, your personal goals, your natural abilities. This, ve?It will probably help you stay motivated when things go wrong and greatly increase your chances of marital success. We have compiled a comprehensive and suitable list of small business ideas to help you get started. Need some inspiration? Here are the best ideas for all our visitors to Kansas in 2020:

Is There A State License To Operate A Business In Kansas?

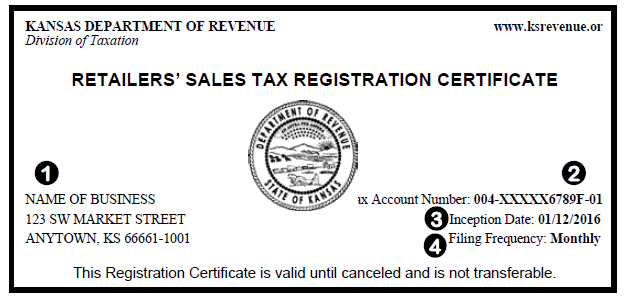

If you are considering running your business in Kansas, you can do so You need to register your business first. There is no “general business license” in Kansas. However, a corporation must register with the Kansas tax office, not to mention filing a tax return for very specific types of corporations. For example, if you are in sales, you will need a sales tax certificate from the Kansas Department of the Treasury, which can often be obtained by filing the Kansas Business Tax Application (CR-16).

Write A Business Plan

It’s time to write your business plan. A good business plan should chart the path to success from the very beginning.?your business, as well as attract investors to finance.

How To Create Any Limited Liability Company In Kansas

The basics that you form an LLC by project, naming your business. And not just in terms of branding: without a unique name, your online business doesn’t exist in the eyes of the Kansas state government. As a result, you must decide how to call your agency before proceeding with registering an LLC in Kansas.

What Is A Business Property Search In Kansas?

Business property search in Kansas can help you research existing business names before making your own decision. Before forming an LLC in Kansas, it is important to research the company you want to make sure it is free. Your preferred name for your Kansas LLC must comply with certain state regulations and automatically be unique.

Ready To Register Your Business In Kansas?

Social media is becoming the preferred alternative company to connect with. their new clients, colleagues and clients. We encourage you to share the fieldKnow the information and tools to help you grow your business.

How much does it cost to register a company in Kansas?

For an overview of LLC racing in each state, check out our other guides on the cost of starting an LLC and how to start an LLC.

How do I get a Kansas tax ID number?

You will receive your company tax identification number as soon as you complete your online registration.