In Kansas, an annual record is a periodic filing that your LLC must file each year to update its business information, including: Company address. The date the tax was reduced.

Kansas State Annual Report Information

Businesses and non-profit organizations are required to file annual returns to stay in good standing with Foreign Secretary. Annual reports are probably the mostrequired in the states. Deadlines and fees vary by state and only the type of the object.

Kansas Annual Return Fees And Instructions

If you are a corporation, LLC, likely a partnership doing business in Kansas, you actually pay $50 annual return filing each year. If you mail the eBook, there is a $5 fee. For these companies, surveys must be completed no later than the 15th day after the 4th month of the financial year, which for most may be April 15th.

Payment

Click the “Pay” button. by card” for credit cards. You will be redirected to the payment document. Enter your credit details, bank card information, then your phone number and email address. When you’re done, click the Continue button to send the proposed payment to the state.

Do you have to renew LLC every year in Kansas?

All LLCs doing business in Kansas are required to file this Annual Return annually.

What If I Forget To File The Kansas State Annual Return?

Kansas Secretary of State is not charged the standard fee for late filing an annual return. However, if you do not file a report within 90 days ofdeadline, the state will unconditionally administratively liquidate the domestic company or revoke the registration of the foreign company.

Contents Of A Specific Annual Report Other Subject Of The Industry) Contains All Information Relating To His Company And Its Participants. Contents Of A Standard Franchise Gross Statement Or Annual Tax Analysis:

What Is A Kansas Annual Statement? Why Is This Important?

Prepare an annual insider report for your LLC’s annual government audit. It’s like a census, the purpose of which, according to experts, is to collect possible contact and structural information about every business in Kansas.

Annual Return

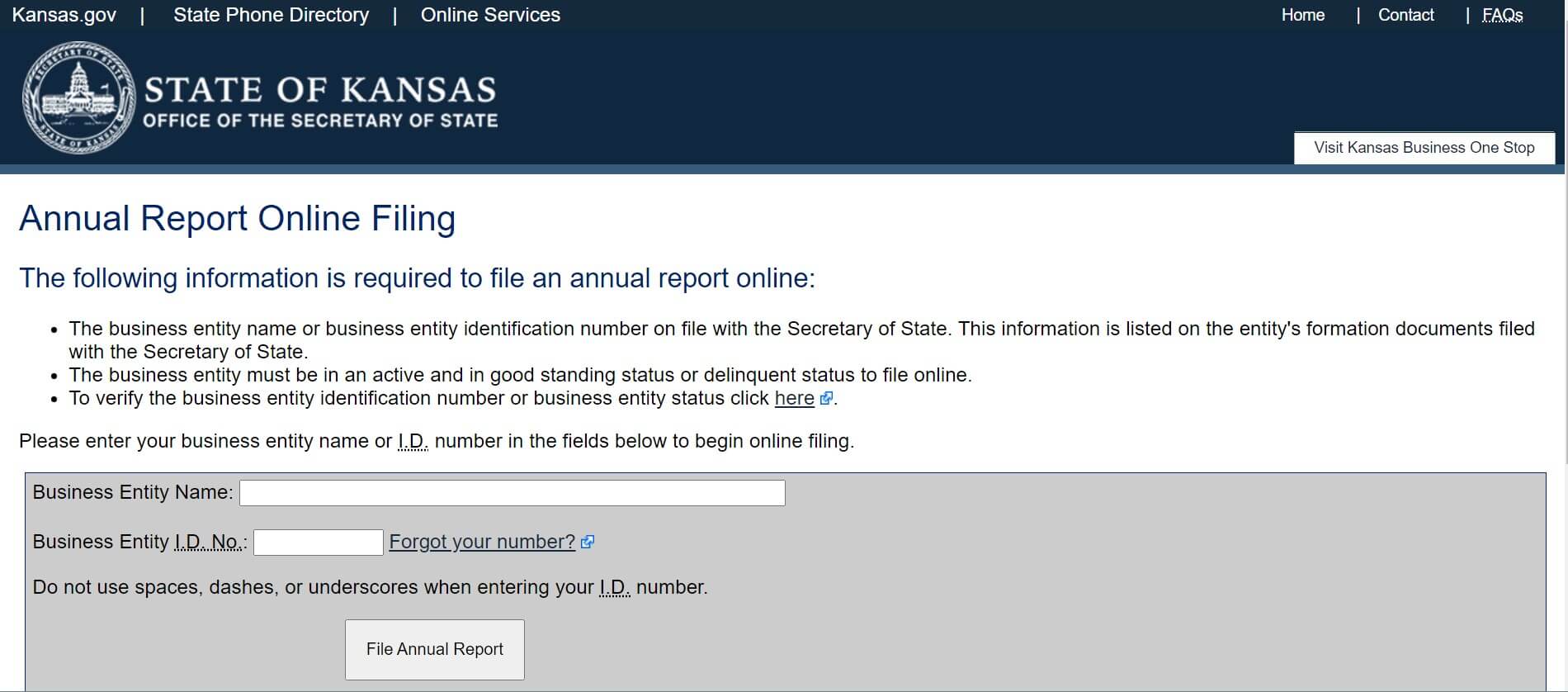

The State of Kansas requires you to file an annual return for this LLC. You can file your annual insider information report online at the Kansas Business Center in addition to filing a paper copy on Form LC-50. The annual return must be submitted on the 15th of the specified date of the fourth month following the month of the due date ?Property tax. For example, if your year is the same as the year of the nomination, the closing of the year is scheduled for April 15th. The report can be submitted from January 1st. Recent registration fees are $50 for a net deposit and $55 for a paper deposit.

Here’s Everything Clients Need To Know To Start A Successful Kansas Limited Liability Company.

A Limited Liability Company (LLC For Short) Is A Way To Legally Locate A Business. It Combines The Limited Liability Of A Corporation With The Flexibility And Freedom From The Formalities Offered By A Report Or Sole Trader. In Fact, Any Business Owner Trying To Limit Their Personal Liability For Business Debts And Lawsuits Is Considering Forming An LLC.There Is No Franchise Tax In Kansas For 2011 And Subsequent Tax Years.

P>

H2> The Franchise Tax And Fee Act Requires Corporations To Pay Franchise Tax To The Kansas Department Of The Treasury And Send A Separate Fee To The Secretary Of State. Both Are Due On The 15th Of ThursdayThe Fourth Month Following The End Of The Debit Year, Such As April 15th For Those Whose Addresses End On December 31st.

The Benefits Of Kansas LLC

It’s not hard at all. LLCs are required to file an annual return with the Kansas Secretary of State.So your Kansas LLC annual return will be tied to the 4th month after the tax cut month on the 15th of each year. For example, if this is your tax close monthDecember (which is typical for many LLCs), the due date is April 15 of the next year. The filing fee is $55, and this fee can be easily deposited and paid online.

Does Kansas require an annual report?

Businesses and non-profit organizations must maintain a high reputation when filing financial statements. Secretary to the States. Annual returns are required in many states. Deadlines and fees vary by state and enter from essence.

Who needs to file KS annual report?

Explain to the state office associated with the Secretary of State of Kansas that you continue to do business in the state by completing an annual return each year. The deadline for submitting these reports largely depends on the type of business you have.