The Annual Report is now a document containing comprehensive financial information and facts about public companies, small and large companies, not-for-profit organizations, partnerships and other businesses. It covers their financial performance and activities during the previous financial year.

Who has to file an annual report in Kentucky?

The Kentucky Choice Report is a comprehensive report that may include details of the company’s performance for the previous year. 3 minutes of reading

Can Anyone With Proper Authority File A Kentucky Annual Return?

Yes! After starting a business in Kentucky, your Kentucky Annual Return may be filed by an officer, director, member, director, or anyone employed (such as an attorney) on your behalf. Or you can hire a registered North West agent to complete and also file the annual return for you! good records. However, if an unfortunate circumstance arisesthat it will deteriorate, there are methods to return the state to high quality.

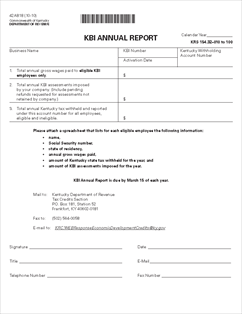

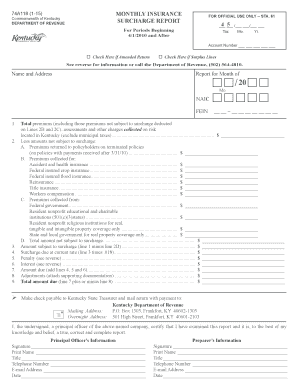

Kentucky Annual Report Information

Businesses and nonprofits must file annual returns to stay in good standing. Secretary of State to do. Annual returns are required in all states. On the other hand, specify deadlines and fees and enter with essence.

Processing Time

When mailed, processing times can vary from 1 day to 1 week (or more) depending on whether the Secretary of State n is incompetent. Kentucky does not officially run mail-in annual return processing sessions.

Kentucky Annual Return Instructions And Fees

Regardless of the type of text your business has, the pricing structure to apply is presented on the annual return should be simple. All corporations, from corporations to weddings, must pay a $15 fee to successfully file an annual return with Secretary of State Ke’s office.ntukki. Returns must be submitted by June 30 of each year.

What Is A Typical Kentucky Annual Return?

Kentucky’s Annual Report is a document that provides an update on changes in your organization. Whether nothing has changed, or something has really changed, circumstances force companies to submit this report every year.

Kentucky Annual Report Review

In Message 14A.6-010 of the Revised Kentucky Charter, which requires all companies doing business on the Internet in the States to: maintain an annual report . You must do this every year. Submitting a report keeps the business online and keeps a good reputation. You can submit the report online or, if desired, by mail. Submitting online is easier if you; Turnaround times are also reduced.

Plan, Start, Manage Or Grow A Business

Kentucky One-stop Business Portal is designed to create an easy-to-use environment for Kentucky businesses to do business, find requirements and the tools you need to own and manage a business in Kentucky??.

Annual Return

The State requires the State of Kentucky to file an annual return that is available to your LLC. Notices of activity reports should generally be sent to your LLC. When you file your first annual return for medical reasons, you must publish the names and addresses of the members and officers of your LLC, certify the director and legal address/representative, and sign and date that particular report. For subsequent annual reports, the same information must be confirmed. Reports can be submitted online at the SOS website, or you can complete and return a card that SOS will send to you. The annual report must be submitted between January 1 and June 30. The current shipping fee is $15.