The Kentucky Certificate of Good Standing certifies that a limited liability company (LLC) or company has been legally registered and is clearly supported.

Open A Business Bank Account

Using dedicated business bank accounts and credit checks is critical to protecting your business. When your personal and businessaccounts are mixed, your personal assets (your house and car, other valuables) are at risk if your LLC is sued.

How do I form a corporation in Kentucky?

Many states are also required to require companies to provide annual guidance on maintaining a good reputation in Deputy State If annual filings are required for companies incorporated in Kentucky, see The table below.

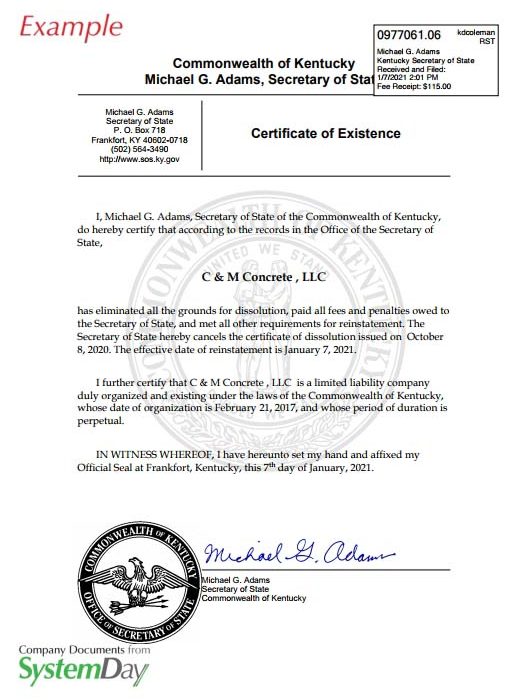

Is This A Certificate From Kentucky? Existence?

The Kentucky Certificate of Existence (COE), also known as the Certificate of Good Standing, was a document showing that a business organization not only exists, but is authorized to help conduct business in the state in order to conduct business in which it operates . flies. The COE also demonstrates that the service meets the parameters required by state law.

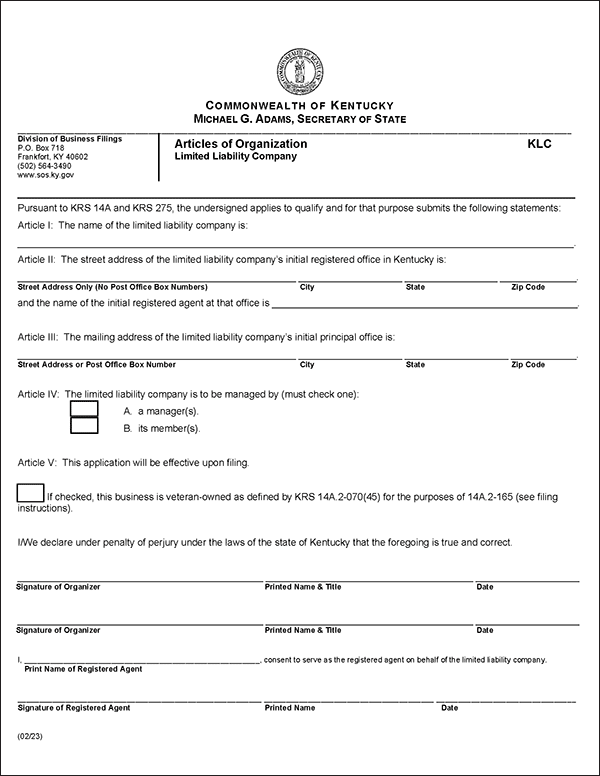

Submit Articles To The Kentucky Organization Via The Internet

If you wish to mail your enrollment degree, you can do so very easily. You can file a Kentucky Certificate of Incorporation by following the process below.

What Is A Kentucky Power Of Attorney?

Corporations are almost always required to register with the Secretary of State of Kentucky before doing business in Kentucky. Companies moving to another state usually use the Kentucky law certificate first. This registers activitiesBeing a foreign company eliminates the need to set up a new company.

Kentucky Annual Requirements

Once you have earned a Kentucky foreign qualification, the Commonwealth of Kentucky requires all LLCs, corporations (for-profit or not-for-profit), and LPs to file a raw report. These reports may be submitted between January 1 and June 30 of each year. The report can be submitted online or by mail.

Plan, Start, Manage, Or Grow A Business

Kentucky’s One Business Portal is designed to provide an easy-to-use environment where Kentucky businesses can find the requirements and procedures they need. they must own and operate a business in Kentucky.

More Information

By using this site for yourself, you consent to security monitoring and testing. For security reasons and to ensure the availability of a public service – users – this government computer system uses network traffic monitoring training to detect unauthorized attemptsto download or modify information or cause damage, including attempts to help you deny service to users.

Creating An LLC Operating Agreement In Kentucky

Creating an LLC Operating Agreement in Kentucky is the best way to legally consolidate the administration and structure of your LLC. Having this document in place will give you positive feedback in the event of a dispute or litigation.

Company Name

The name must contain the words “Incorporated”, “corporation”, “Company”, “Limited” or their abbreviation. Use of the words “engineer” or “surveyor” requires the approval of the Kentucky Licensing Board for Professional Engineers and Land Surveyors. The name must not contain language that would otherwise indicate that the company is formed for purposes other than those provided for by a particular law or articles of association. The name of the business must be different from the subject matter of existing business entities in the history of the secretary of state reporting to that secretary of state. The company may use these names, ifwhether another registered company will give written consent, or in some of the other cases listed.

Kentucky Business Search

We can provide a good Kentucky Business Search report that includes employer registration information, employment status, business, registered agent, registration history, and a copy of the business divisions. submitted final report became Secretary of State for the Commonwealth of Kentucky.

How do I form an LLC in Kentucky?

A limited liability company (LLC) is a way to legally structure a business. It combines the limited legal liability of a corporation with the flexibility and formality of an affiliate or sole trader. Any business owner wishing to limit their personal liability for business debts and lawsuits is advised to consider forming an LLC.